Trading in stock index futures early Friday suggests the S&P 500 will start the session several points above the 5,000 mark.

Breaking through the big round numbers in stock indices – and closing above them – would inevitably encourage optimists to hope that what was seen as resistance could turn into support.

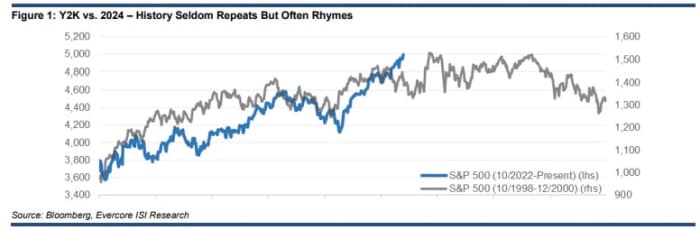

It can also produce reflections on how the past can give insight into what comes next. Julien Emanuel, a strategist at Evercore ISI, sees a parallel between the stock market's 2000 rally in the late 1990s and today's markets, though he acknowledges the usual caveat: history rarely repeats but often rhymes.

“The relentless momentum that carried the S&P 500 to the round number of 5,000 is unparalleled in history,” Emanuel says in a report, “the prime example being the Internet-fueled rally from a market-like bottom in October 1998 versus the pivotal low in October 2022.” A note was sent to customers this week.

Let's remember that the Y2K phenomenon occurred during the nascent dot-com boom, when some technology stocks got an extra boost from expectations that companies would spend millions of dollars to ensure that their computer systems could turn out Y2K when the new millennium began. Do we have a similar craze regarding artificial intelligence?

This is Emanuel's chart showing the S&P 500's path from the October lows he cites. If the rhyme is rich, the market today may struggle to make further progress in this cycle.

Source: Evercore ISI

Emmanuel is quick to notice the differences. Today's valuations may stretch to 22 times trailing-twelve-month earnings, but that's well below the 28 times seen at the top of the Y2K/dot-com bubble.

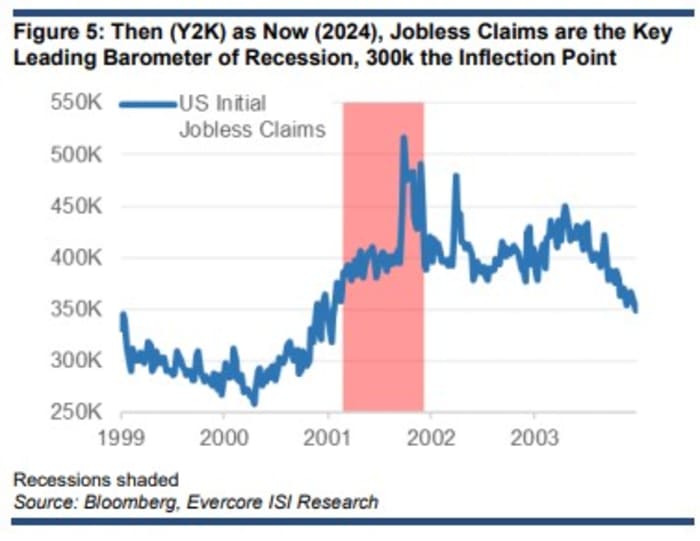

After the 2000/dot-com bubble burst in early 2000, there was a significant spike in initial weekly jobless claims a full year before the 2001 recession. Current unemployment claims of about 210,000 and consumer confidence data suggest little evidence of such pressure Until now.

Source: Evercore ISI

However, he still worries about the similarities every now and then. “The price is aligned with positive sentiment around the long-term potential of generative AI and new investor confidence in the potential to make money in stocks – as was the case in 1999 – despite the 10-year Treasury yield being firmly pegged at 4%+, still… “Exposing stocks to inflation, earnings and Fed policy disappointments,” Emanuel continues.

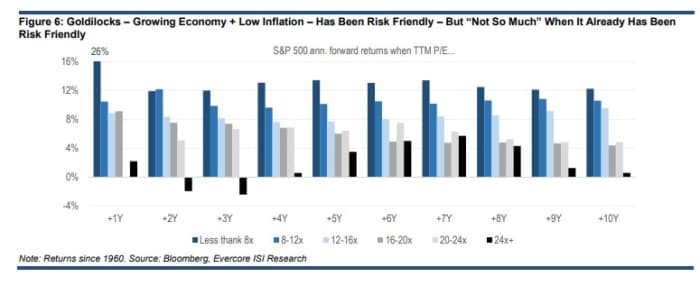

In fact, he believes the market's current “moderate” valuation model is consistent with average futures stock returns of zero percent, regardless of whether a recession is avoided or not.

Source: Evercore ISI

Therefore, he prefers defense. “We maintain our year-end S&P 500 price target of 4,750 and reiterate our preference for telecommunications services, consumer staples, and health care, sectors that have historically outperformed since the Fed's last hike to its first rate cut,” Emanuel says.

Markets

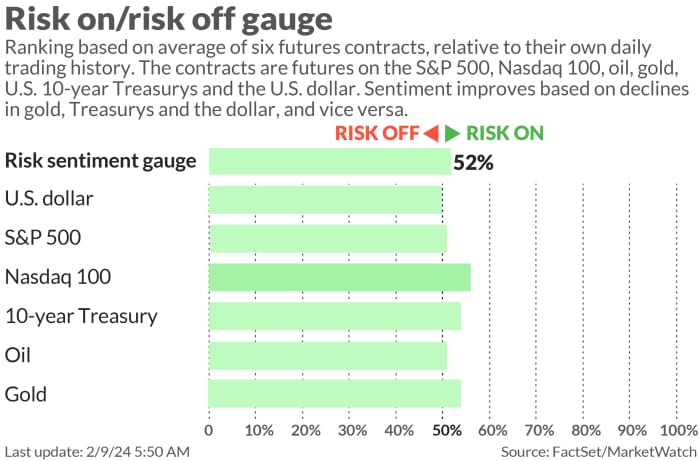

US stock index futures ES00

YM00

NQ00

They were strongest early Friday as benchmark Treasury yields were

He falls. U.S. dollar

There was little change, while CL oil prices rose

Dipped and gold GC00

It traded at around $2,030 an ounce.

|

Performance of key assets |

last |

5d |

1 m |

YTD |

1y |

|

Standard & Poor's 500 |

4,997.91 |

0.79% |

4.48% |

4.78% |

22.18% |

|

Nasdaq Composite |

15,793.71 |

1.05% |

5.48% |

5.21% |

34.78% |

|

10 year treasury |

4.168 |

14.48 |

22.38 |

28.66 |

42.98 |

|

gold |

2,046.60 |

-0.51% |

-0.34% |

-1.22% |

9.07% |

|

oil |

76.32 |

5.41% |

4.89% |

7.00% |

-4.31% |

|

Data: Market Monitor. The change in Treasury yields expressed in basis points |

|||||

For more market updates as well as actionable trading ideas for stocks, options and cryptocurrencies, Subscribe to MarketDiem by Investor's Business Daily.

Buzz

A review of seasonal factors for the US CPI showed that the inflation rate in December reached 0.2% on a monthly basis compared to the previously reported 0.3%. The news pressured bond yields and lifted stock index futures.

Dallas Fed President Lori Logan is scheduled to speak at 1:30 p.m. ET.

There are some big pre-market moves for company stocks announced after Thursday's close. Investors love what Cloudflare NET does

He would say its stock rose 25%. But the numbers and statements are from Expedia EXPE,

Down 14%, AFRM confirmed,

11% off, and Pinterest PINS,

It dropped by 11%, and was poorly received.

Children's Place Evaluation PLCE

They were cut by nearly half early Friday after the children's clothing chain issued a profit warning for the fourth quarter and said it was working with lenders to secure new financing.

Shares of the International Masonic Company DOOR

rose 34% after the door maker agreed to be acquired by building materials company Owens Corning OC

In a cash deal worth $3.9 billion.

China's markets are now closed for a week to celebrate the Lunar New Year.

Best of the web

The stunning collapse of a $30 billion real estate empire.

$3 for one piece from McDonald's? Customers are fed up and are backing off.

Europe's largest fund manager says a Donald Trump win risks bringing back the UK bond crisis for Treasuries.

Chart

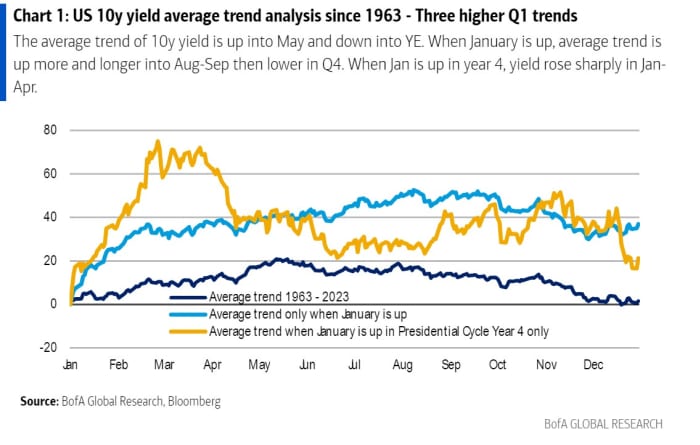

Many investors will have heard about the January effect when it comes to stocks: that a strong first month often means a good year as a whole. Well, according to Paul Scianna, technical strategist at BofA Securities, something similar is happening to the 10-year Treasury yield. He analyzed numbers going back to 1963, and as the chart below shows, when the benchmark yield rose in January, the trend from February to the end of the year was higher 61% of the time by +81 basis points on average.

Highest indicators

Here are the most active stock market tickers on MarketWatch as of 6 a.m. ET.

|

tape |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

Belter |

Palantir Technologies |

|

arm |

Holding arm |

|

Mara |

Digital Marathon |

|

TSM |

Taiwan Semiconductor Manufacturing ADR |

|

Camel |

apple |

|

Your mother |

AMC Entertainment |

|

New |

New ADR |

|

GME |

GameStop |

Random readings

“My AI friend is boring me to death.”

Cancer-resistant mutant Chernobyl wolves.

Turning the air blue. The next stage in football destruction.

American CEOs visiting China cannot escape this problem: they have to dance on stage.

“Need to Know” starts early and is updated until the opening bell, however Register here To be delivered once to your email inbox. The copy will be emailed at approximately 7:30 a.m. ET.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we're all watching. This episode: The beginning of the artificial intelligence boom, and one of the sweetest Super Bowl stars. Earnings season has big tech companies talking about generative AI. But will chatbots become big business? Additionally, we're examining leftover candy whose annual sales have risen from $50 million to $500 million.