The resilience of the US economy has been a surprise to Wall Street, and the Federal Reserve, for more than a year now, and the latest GDP estimates from the Federal Reserve Bank of Atlanta suggest the first quarter could easily beat Wall Street estimates.

The leading theory as to why the economy has been so strong, even with rising inflation and then sharply rising interest rates, is the strength of fiscal spending. One paper last year suggested that unless the government pays down the debt — and there's no danger of that happening with this Congress — excess savings will continue to “trickle upward,” for five years.

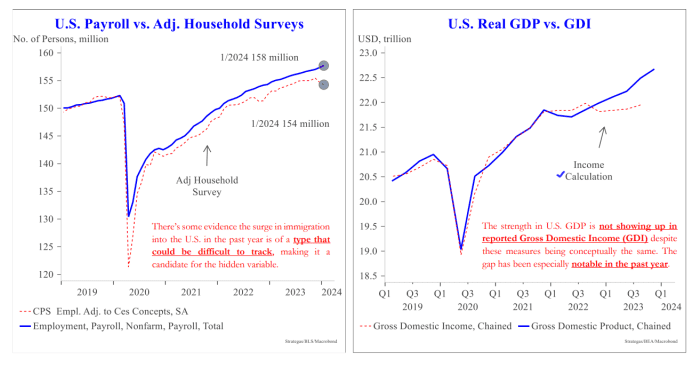

Analysts at institutional brokerage Strategas, led by Don Rissmiller, agree that what they call “big fiscal” — large budget deficits run at a time of full employment — is the main driver of the economy. But they also point to another factor at work: immigration. “There are good reasons to believe that the US has benefited from positive supply effects, namely that there is surprisingly strong real economic growth (~3%) coupled with more moderate inflation (~3%) going into 2024,” they say in a presentation. . The uptrend appears to be specific to the United States and not global.

They say that falling inflation is not just about improving supply chains. They point out that stress metrics suggest the supply chain disruption story is largely over by mid-2023. They also pour cold water on the energy shock abating, noting that it happened by the end of 2022.

This is where immigration plays a role, helping to offset the aging US workforce. “As much as it has been difficult to fully measure migration to the United States in recent years, reported data may underestimate this increase. Policy enacted by some states to move migrants from the southern border to major cities may have had a (likely unintended) effect.” It involves matching individuals to areas where there is capacity to work, even informally. Such an event could help explain other anomalies in the US data (e.g., missing workers in the Household Employment Survey, missing income in the Household Employment Survey). gross domestic income).

Immigration is the source of the discrepancy between the Congressional Budget Office, which estimates the US population rose 0.9% last year, and the Census Bureau, which estimates a 0.5% increase. “It is difficult to know for sure, but if there is uncertainty about the number of people in the country, it would not be a stretch to think that some income is not being reported correctly,” they say.

What are the market implications? “What concerns me most is that if there is a fundamental change in U.S. government policy regarding the border, it could set the stage for a second wave of inflation,” Rissmiller said in a follow-up email. “Given how out of consensus this is versus expectations for (easy) central bank policy this year, that would put pressure on both bonds and stocks.”

Change does not appear to be imminent: A bipartisan border bill collapsed this week amid pressure from former President Donald Trump.

market

The big question for Thursday is whether the S&P 500 SPX will cross the 5,000 mark – early on, there was little movement in ES00 futures,

NQ00,

Related: The S&P 500 looks vulnerable to accidents as it approaches an important milestone

|

Performance of key assets |

last |

5d |

1 m |

YTD |

1y |

|

Standard & Poor's 500 |

4,995.06 |

1.81% |

4.49% |

4.72% |

22.38% |

|

Nasdaq Composite |

15,756.64 |

2.57% |

5.25% |

4.96% |

33.65% |

|

10 year treasury |

4.115 |

23.78 |

14.47 |

23.53 |

45.37 |

|

gold |

2,050.90 |

-1.03% |

0.87% |

-1.01% |

9.48% |

|

oil |

74.45 |

0.72% |

2.20% |

4.37% |

-4.13% |

|

Data: Market Monitor. The change in Treasury yields expressed in basis points |

|||||

Buzz

The US economic calendar was light on Thursday, with unemployment claims in the spotlight, ahead of seasonal adjustment revisions to consumer prices on Friday. There is a $25 billion auction of 30-year bonds at 1 p.m. ET. China's consumer price index saw its largest decline in nearly 15 years.

There are 32 companies included in the S&P 500 index scheduled to announce their results.

walt disney disney stock,

It rose on better-than-expected earnings as share buybacks resumed.

ARM Holdings ARM shares,

It rose as the microchip designer raised its earnings and revenue guidance for the year.

paypal bbl,

It issued a cautious earnings forecast and did not issue full-year revenue guidance.

mattel matte,

Looking to cut costs after the Barbie boom.

The Supreme Court is scheduled to hear arguments on Trump's eligibility to run for president.

Best of the web

Investors are almost always wrong about the Fed.

NVIDIA is close to surpassing Amazon in terms of market value.

Here's what history says about the Great Collapse.

Highest indicators

Below are the most active stock market tickers as of 6 a.m. ET.

|

tape |

Security name |

|

TSLA, |

Tesla |

|

ran out, |

Nvidia |

|

bbl, |

PayPal |

|

Belter, |

Palantir Technologies |

|

Holo, |

Micro Cloud Hologram |

|

arm, |

Holding arm |

|

Dis, |

Walt Disney |

|

Camel, |

apple |

|

New, |

New |

|

Baba, |

Ali Baba |

Chart

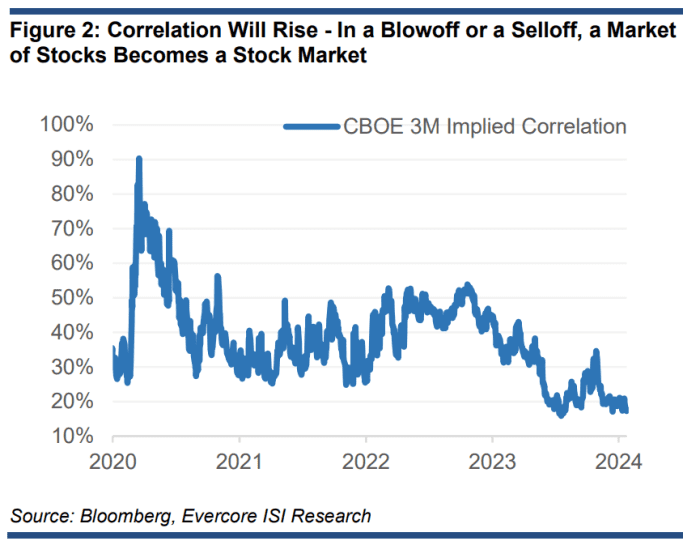

It's a real stock market, as this chart of the low correlation among S&P 500 companies shows. “The earnings reactions from stocks like Snap and Ford show that correlations are low and that it was a stock market. For now,” say Evercore strategists led by Julian Emanuel. He says a move to the 5,000 level on the S&P 500 increases the likelihood of continued volatility in both directions.Since December, stocks and volatility have risen, a rare combination that has happened only twice since 2000, and both times led to selloffs.

Random readings

The land of Ferrari and Lamborghini enforces a 20 mph top speed.

my coca cola,

It launches its first new permanent soda in three years.

This 285-year-old lemon was sold at auction for £1,416 ($1,787).

The Need to Know program starts early and is updated until the opening bell, but sign up here to have it delivered all at once to your email inbox. The copy will be emailed at approximately 7:30 a.m. ET.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we're all watching — and how it affects the economy and your portfolio.