Recap of February 7th

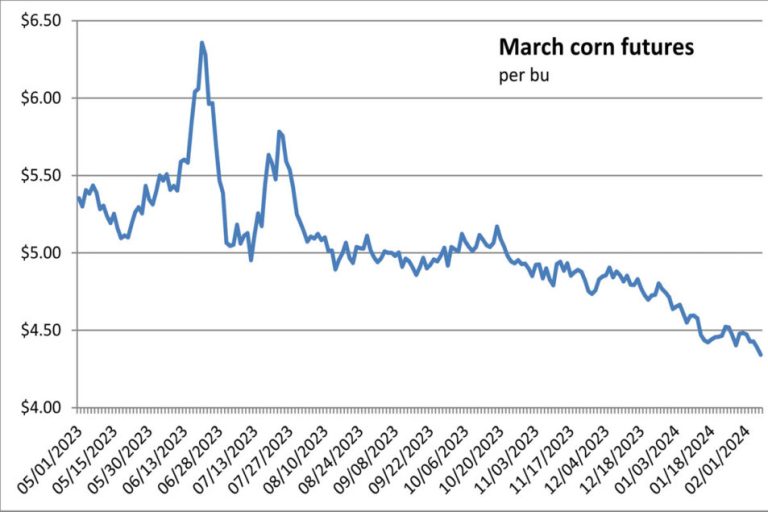

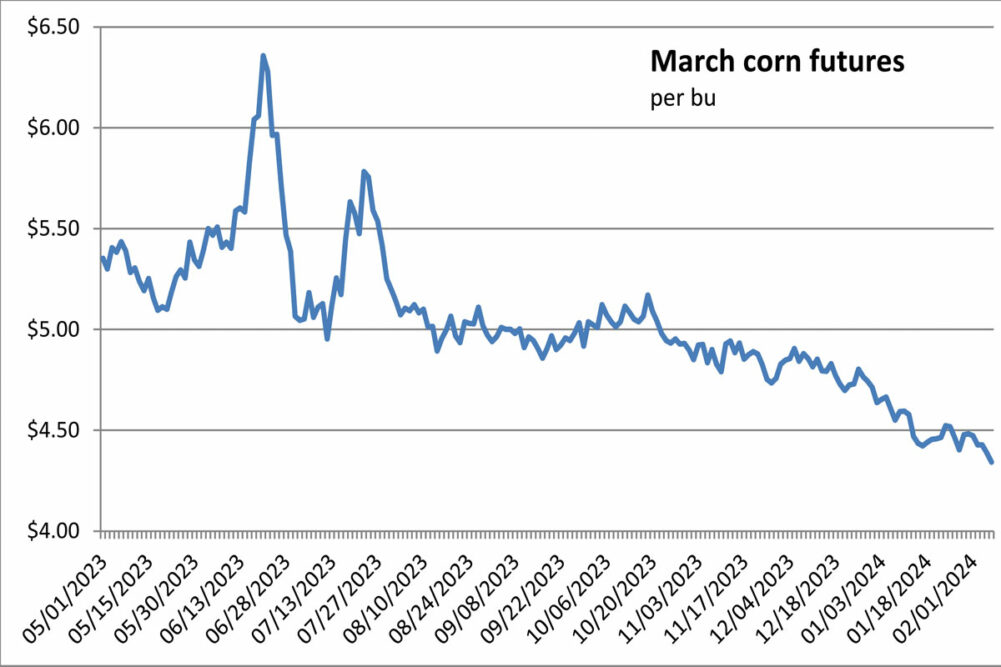

- Corn prices hit a three-year low on Wednesday after weather reports indicated rival Argentina would shift from hot, dry weather to widespread rainfall. Wheat futures were mixed as soft wheat advanced in Chicago. Supply pressure from Russia's surplus and favorable new crop prospects weighed on wheat as traders settled their positions ahead of key supply and demand reports in the US and Canada due out on Thursday. Soybean prices reached their lowest levels since December 15, 2020, as Brazilian growing regions also expected rain. the Corn March Future fell 4½ cents to close at $4.34 per unit. chicago March wheat 7 cents were added, closing at $6.02 per unit. Kansas City March wheat ¼™ fell to close at $6.18 per unit; Subsequent months were little mixed for the second day. Minneapolis He walks wheat Added 3 cents to close at $6.96 per unit; Subsequent months were narrowly mixed. March soybeans It fell 10½ cents to close at $11.89 per unit. March soybean meal It fell $7.60 to close at $351.20 per ton. Soybean oil for March It rose 0.82 cents to close at 46.76 cents per pound.

- US stock markets rose again on Wednesday despite recent news about the pace of interest rate cuts. The DJIA and S&P 500 hit record closing levels. the Dow Jones Industrial Average It rose 156 points, or 0.4%, to close at 38,677.36 points. the Standard & Poor's 500 It rose 40.83 points, or 0.82%, to close at 4,995.06 points, its eighth record close in 2024. Nasdaq Composite It rose 147.65 points, or 0.95%, to close at 15,756.64 points.

- US crude oil Prices rose again on Wednesday. The price of March West Texas Intermediate Light crude rose 55 cents to close at $73.86 a barrel.

- the US dollar index It dropped for a second day on Wednesday.

- American gold Futures Advance on Wednesday as the US dollar weakens. The February contract added 70 cents to close at $2,035.20 an ounce.

Recap of February 6th

- Wheat futures recorded a mixed close on Tuesday. Chicago soft wheat futures rose for the first time in three sessions in short-covering moves, while KC and Minneapolis wheat futures were mixed ahead of key crop reports in the US and Canada due on Thursday. Soybean futures rose for a second day in short covering and technical buying from the previous day's lows. Corn futures fell in the near decade amid rain forecasts in hot and dry Argentina. the Corn March The future fell 4 cents to close at $4.38 ¾ per unit with subsequent months varying in a narrow range. chicago March wheat 4¾¢ was added, closing at $5.95 per unit. Kansas City March wheat Added 4½¢ to close at $6.18 per unit; Subsequent months were narrowly mixed. Minneapolis He walks wheat Added 2¼¢ to close at $6.93 per unit; The subsequent months were mixed. March soybeans It rose 3¼ cents to close at $11.99 per unit. March soybean meal It removed $2.30 to close at $358.80 per ton. Soybean oil for March It rose 0.61 cents to close at 45.94 cents per pound.

- US stocks initially fell modestly on Tuesday, with major indexes flipping between small gains and losses before rising at the closing bells as investors reset their thoughts on the Federal Reserve's interest rate path. the Dow Jones Industrial Average The stock increased 141.24 points, or 0.37%, to close at 38,521.36 points. the Standard & Poor's 500 The stock rose 11.42 points, or 0.23%, to close at 4,954.23 points. the Nasdaq Composite It rose 11.32 points, or 0.07%, to close at 15,609 points. The three major indexes held their gains for 2024, which was a positive sign for some Wall Street traders.

- US crude oil Prices rose again on Tuesday. March West Texas Intermediate Light crude oil rose 53 cents to close at $73.31 a barrel.

- the US dollar index It fell on Tuesday after a two-session rise.

- American gold Futures Tuesday advanced as the US dollar weakened. The February contract added $8.80 to close at $2,034.50 an ounce.

Recap of February 5th

- the US dollar index It rose again on Monday as investors continued to digest Labor Department reports on Friday that showed U.S. employers added more than twice as many jobs as expected in January and that the unemployment rate held steady at 3.7% last month, missing expectations for an increase.

- US wheat futures were under pressure to start the week due to a stronger US dollar and lower Russian wheat prices last week. Soybean futures overcame dollar pressure and rose as traders began to adjust their positions ahead of new supply and demand data released Thursday from the U.S. Department of Agriculture. Corn futures traded mixed and closed mixed ahead of the USDA report on Thursday. the Corn March The future was flat at $4.42 per unit with subsequent months mixing in a narrow range. chicago March wheat It fell 9½¢, closing at $5.90 per unit. Kansas City March wheat It shed 11 cents to close at $6.14 per unit. Minneapolis He walks wheat It fell 8¾¢ to close at $6.91 per unit. March soybeans It rose 7¾¢ to close at $11.96 per unit. March soybean meal It added $4.30 to close at $361.10 per ton. Soybean oil for March It rose 0.6 cents to close at 45.33 cents per pound.

- U.S. stock markets fell on Monday after a Sunday night “60 Minutes” interview in which Federal Reserve Chairman Jerome Powell said, “We feel we can handle the question of when do we start cutting interest rates carefully,” and suggested that rate cuts would be at… March is the perfect solution. It is unlikely. the Dow Jones Industrial Average The stock fell 274.30 points, or 0.71%, to close at 38,380.12 points. the Standard & Poor's 500 The stock fell 15.8 points, or 0.32%, to close at 4,942.81 points. the Nasdaq Composite The stock fell 31.28 points, or 0.2%, to close at 15,597.68 points.

- US crude oil Prices were higher on Monday. March West Texas Intermediate Light crude oil rose 50 cents to close at $72.78 a barrel.

- American gold Futures Its decline continued on Monday after rising for four days last week. The February contract offered $10.40 to close at $2,025.70 an ounce.

Recap for February 2nd

- Huge US technology stocks – led by Meta, which added 20% after it reported its biggest quarterly sales increase in two years and began paying its first-ever dividend – pushed US stock indexes higher on Friday, for the fourth straight week of gains, and to levels… New standard in two cases. Additional support came from the US government's strong jobs report. the Dow Jones Industrial Average It added 134.58 points, or 0.35%, to close at 38,654.42 points, which is its ninth record level in 2024. Standard & Poor's 500 The stock increased 52.42 points, or 1.07%, to close at 4,958.61 points. the Nasdaq Composite It rose 267.31 points, or 1.74%, to close at 15,628.95 points.

- the US dollar index It rose on Friday after a Labor Department report indicated that US employers added 353,000 jobs in January, more than double the expectations of a panel of analysts surveyed by the Labor Department. Wall Street JournalThat the unemployment rate in January remained steady at 3.7% (an increase was expected) and that wages jumped 4.5% in January compared to the same month the previous year.

- A stronger US dollar put pressure on US agricultural futures on Friday. Soybeans closed lower under pressure from weak export demand shown in net export sales in the week ending January 25 at 164,500 tons, representing the smallest weekly volume since May. Complex wheat futures were mixed with KC wheat flat despite improving soil moisture levels in the Plains. Corn futures followed broad weakness today to their seventh weekly decline in the past eight weeks. the Corn March Future fell 4½ cents to close at $4.42 per unit. chicago March wheat It trimmed 1¾¢, closing at $5.99 per unit, and the subsequent two contracts also fell, but futures for September and beyond were mostly higher. Kansas City March wheat It rose 4¼ cents to close at $6.25 per unit. Minneapolis He walks wheat 3¾¢ was added for the second session in a row, closing at $6.99 per unit. March soybeans It fell 14¾¢ to close at $11.88 per unit. March soybean meal It fell $4.90 to close at $356.80 per ton. Soybean oil for March It fell 0.87 cents to close at 44.73 cents per pound.

- US crude oil Prices fell again on Friday. The price of West Texas Intermediate Light crude for March fell by $1.54 to close at $72.28 per barrel.

- American gold Futures It turned lower on Friday after rising for four days. The February contract offered $16.90 to close at $2,036.10 per ounce.

Recap for February 1

- Wheat complex futures posted a mixed close on Thursday with soft red Minneapolis and Chicago winter contracts advancing on technical buying and short covering moves. Hard red winter wheat futures fell in Kansas City on Thursday as the USDA reported net export sales for the week ending January 25 within pre-report expectations but down 29% from the previous week, down 9% from the four-week average and Lowest level in three weeks. Soybean futures were also lower on export sales figures – at 64,500 tonnes in the week ending January 25, this was the lowest weekly figure for 2023-24 since the start of the marketing year on September 1 – as well as concerns about lower prices in rival Brazil coupled with… Economic concerns for the world's largest buyer, China. Corn futures were flagged as soybeans fell with losses limited due to strong export sales of 1.2 million in the last reported week. the Corn March Future minus 1 cent to close at $4.47 per unit. chicago March wheat It added 6¼¢, closing at $6.01½ per unit, with gains tapering through March 2025 and then declining thereafter. Kansas City March wheat It fell 1¼¢ to close at $6.20 per unit. Minneapolis He walks wheat It rose 3¾¢ to close at $6.96 per unit. March soybeans It fell 19 cents to close at $12.03 per unit. March soybean meal It fell $6.60 to close at $361.70 per ton. Soybean oil for March It fell 0.42 cents to close at 45.60 cents per pound.

- Stocks posted a strong rebound Thursday from declines precipitated by thoughts about the pace and starting point of interest rate cuts by the Federal Reserve. the Dow Jones Industrial Average It rose 369.54 points, or 0.97%, to close at 38,519.84 points. the Standard & Poor's 500 The stock increased 60.54 points, or 1.25%, to close at 4,906.19 points. the Nasdaq Composite It rose 197.63 points, or 1.30%, to close at 15,361.64 points.

- US crude oil Prices were lower on Thursday. The price of West Texas Intermediate Light crude for March fell by $2.03 to close at $73.82 per barrel.

- the US dollar index The decline continued for the third day on Thursday.

- American gold Futures advanced. The February contract added $4.60 to close at $2,053 an ounce.

Component markets

| new ideas. Served daily. Sign up for Food Business News' free newsletters to stay up to date on the latest food and drink news. |

Participate |