On February 6, the US Securities and Exchange Commission (SEC) introduced strict rules for people involved in providing liquidity. These rules cover not only federal securities laws, but also affect cryptocurrencies and decentralized finance (DeFi).

New rules targeting cryptocurrency liquidity

The rule, which was proposed in March 2022, finally got the green light from the SEC after two years by a 3-2 vote during Tuesday's meeting.

The approved 247-page rule will affect those who deal in crypto assets defined as securities or government securities, excluding those with assets of less than $50 million. It also impacts the decentralized finance (DeFi) sector, as described in the rule.

According to the rule, individuals who trade crypto-asset securities within the DeFi market must register as a “dealer” or “government securities dealer” if their activities meet the criteria of being “part of a regular business.” This includes buying and selling crypto assets on a regular basis, and providing liquidity to others, as outlined in the qualitative standard.

Despite the approval, some commentators argue that the rule is unfair to DeFi products, citing its decentralized nature with no central oversight body, acting merely as software.

Industry voices are voicing concerns

In response to the SEC's decision, the DeFi Education Fund has pushed back aggressively He criticized the moveHe called it “misleading and unworkable.”

CEO Miller Whitehouse Levin believes the SEC has failed to consider the practical difficulties faced by DeFi entities, suggesting that the rules are unfriendly to innovation.

Cody Carbone, vice president of policy at the Chamber of Digital Commerce, shared similar sentiments, criticizing the SEC for its continued unfriendliness toward the digital asset industry. He stated that the SEC did not take into account the industry's point of view.

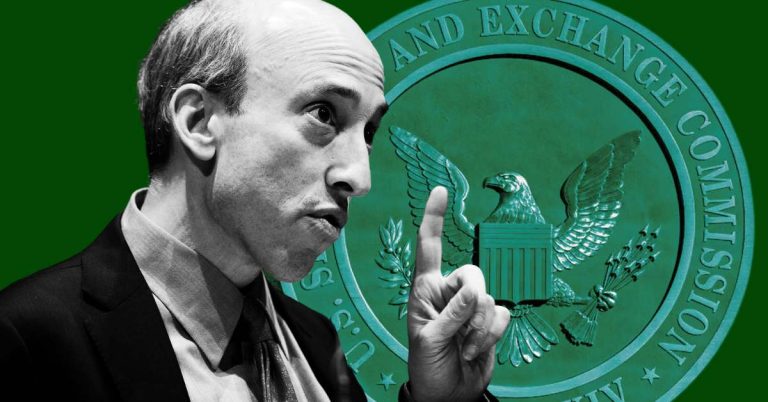

Gensler defends the rules

SEC Chairman Gary Gensler defended the regulatory changes, highlighting the $50 million exception and the importance of protecting investors in both the crypto and non-crypto space. He said these rules are consistent with Congress's intentions regarding fair competition.

During the meeting, Republican Commissioner Hester Peirce, one of the votes against the rules, raised questions about the inclusion of automated market makers (AMMs) in the rules. She wondered whether AMMs, which are often considered software protocols, should register as merchants.

The SEC responded by saying that AMMs are more than just software. However, Pierce expressed concerns about transparency and market participants' understanding of SEC rules.

Countdown to implementation

The final rule will take effect 60 days after its publication in the Federal Register, with a compliance period of one year. While the cryptocurrency industry is bracing for increased regulatory attention, the full impact of the SEC's rules remains uncertain in decentralized finance.