The following is an excerpt from the latest issue of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these and other online Bitcoin market insights directly into your inbox, subscribe now.

Bitcoin miners have not been operating under normal conditions over the past few months. Bitcoin's blockchain has seen a particularly intense degree of demand over the past few months, and the BRC-20s and, to a lesser extent, engravings, all made possible thanks to the Ordinals Protocol, appear to bear a great deal of responsibility. Essentially, this protocol enables users to register unique data on the smallest denominations of Bitcoin, allowing them to create new “tokens” directly on the Bitcoin blockchain. This means that amounts of Bitcoin that are worth pennies in paper value may be bought and sold multiple times, with each of these transactions having to be processed through the same blockchain, not to mention the high demand seen during the coin's initial minting.

This is where Bitcoin miners come in. Energy usage calculations made by specialized mining hardware are not only intended to generate new bitcoins, but can also be used to verify blockchain transactions and keep the digital economy flowing smoothly. With network usage as high as ever, miners have more than enough opportunities to earn revenue just by processing these transactions, and the actual production of newly issued bitcoins can take something of a backseat. As of February 2024, these conditions have created a situation in which mining difficulty is higher than ever before in Bitcoin's history, yet the industry is generating significant profits. However, one of the most reliable patterns in the Bitcoin market is absolute chaos that results in fees rising and then falling. So, what will happen to miners after these conditions change?

It's this ecosystem that became so turbulent on January 31 when federal regulators announced a new mandate: The Energy Information Administration, a subsidiary of the U.S. Department of Energy (DOE), was to begin a survey of the electricity use of all miners operating in the United States. . Identified miners will be asked to share data on their energy use and other statistics, and EIA Director Joe DeCarolis claimed that this study “will focus specifically on how energy demand for cryptocurrency mining has evolved, identify geographic areas of high growth, and quantify demand for Energy for mining cryptocurrencies. “Electricity sources used to meet demand for cryptocurrency mining.” These goals seem clear enough at first glance, but there are several factors that have given Bitcoin users pause. For one thing, Forbes He claimed that this directive came from the White House, which referred to the action as an “emergency data collection request.” This survey was created explicitly with the aim of examining the potential for “public harm” from the mining industry, and even included an aside that this “emergency” pool may lead to a more routine collection expected from every miner in the near future.

Clearly, such language has left many in the community feeling very uncomfortable, and several prominent miners have already made statements condemning the initiative. The tone coming from regulators seems to be an overwhelming narrative that these companies pose a potential threat, whether by increasing carbon emissions, taxing electrical infrastructure, or being a public nuisance. Some of the more outrageous claims can be easily debunked, but that doesn't change the fact that some aggressive government action can significantly disturb this ecosystem. Furthermore, the mining world is already facing major disruption on the horizon, in the form of the imminent Bitcoin halving. This normal protocol built into Bitcoin's blockchain is set to automatically halve mining rewards sometime in April, at block 840,000, and some pessimists are already claiming that this disruption will be enough to put almost the entire industry out of business. What are the actual worst case scenarios here? What is most likely?

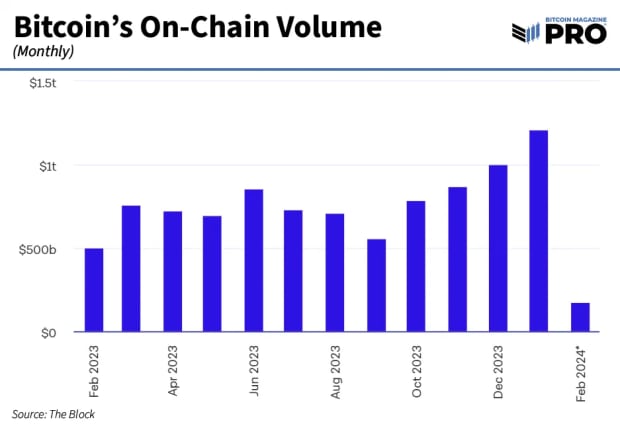

First, it is important to examine some of the factors inherent in Bitcoin that are likely to influence miners, regardless of government pressures. Miners are in a strange position in the market because transaction fees can generate revenues at the same level as actual mining, but the situation may stabilize. New data shows Ordinals sales fell by 61% in January 2024, showing that their impact on demand for block space is likely to diminish. Therefore, if some miners are relying on these tokens to maintain profits, this revenue stream does not seem particularly reliable. However, although network usage from these small transactions may decrease, regular transactions actually look great. Bitcoin trading volume is higher than it has been since late 2022, and shows no signs of stopping. There will certainly be a lot of demand for new Bitcoin mints.

Bitcoin traffic has been increasing for months as the possibility of a legal Bitcoin ETF becoming more and more common, and now that this battle is over, trading volume has increased at an even greater rate. While halving can present opportunities and challenges for miners, no one can claim that it is an unexpected event. Companies have been preparing for this, of course, with about $1 billion of increased trading volume coming from miners themselves. Bitcoin reserves held by miners are at their lowest levels since before the 2021 rally, and miners are using capital from these sales to upgrade equipment and equip themselves.

In other words, regardless of any government action, market conditions appear likely to change due to these factors. The bottom may fall out for some small businesses operating on thin margins, but the overall growth in Bitcoin trading volume means there will always be opportunities for revenue. Since only well-capitalized companies can make the most comprehensive preparations for halving, it may happen that some of the less efficient mining companies will not be able to survive. From a regulatory point of view, this may be a desirable outcome.

The federal government seems mostly interested in perpetuating the idea that the mining industry is a tax on society as a whole, consuming vast amounts of electricity for an unclear benefit. However, only the most efficient operations will be ensured to survive the halving and its economic fallout. As less efficient companies close their doors, the survivors will be left with a much larger slice of the smaller overall pie. Moreover, if open letters from several leading companies are anything to go by, these companies are quite prepared to put up a vocal fight against any attempt to suppress the industry. Given that the survey itself is still in its first week of data collection, it is difficult to say what conclusions it will draw, or how the EIA will be empowered to act next. The most important thing to consider, then, is that these new trends are occurring with or without the influence of EIA.

The survey has just begun, and the halving is just months away. There are many reasons to be concerned about the impact of EIA on the mining industry, but this is not the only factor. From where we sit, it looks like the entire ecosystem may change dramatically by the time regulators are ready for any action, even if the action is harsh. The people left to confront them will become more resilient, survivors and innovators of a chaotic market. Bitcoin's great strength is its ability to change quickly, giving new enthusiasts the opportunity to take advantage of one set of rules, and then rise or fall as the rules change. It is this spirit that has propelled Bitcoin to its global highs over more than a decade of growth. Compared to that, what chance do its opponents have?