Carrie Mathis was always an avid bowler, and her hometown of Pittsfield, Massachusetts, had a number of bowling alleys, including one with 50 lanes of traditional ten-pin bowling that ran games 24 hours a day. But after GE,

The city's plastics factory closed in the early 1990s, and local businesses — including bowling alleys — suffered.

In 2022, Mathis led her family's efforts to partner with Berkshire Hills Bancorp BHLB,

For an SBA guaranteed loan to purchase an old bowling alley and reopen it as K&M Bowling.

The Mathis family put together a business plan and contributed a lot of effort, and now K&M Bowling Company — named after Carrie and her husband, Mark Mathis — will celebrate its first anniversary in March.

The 14-lane bowling alley employs 11 people. And it's always packed.

“We turn people away,” Carey told MarketWatch.

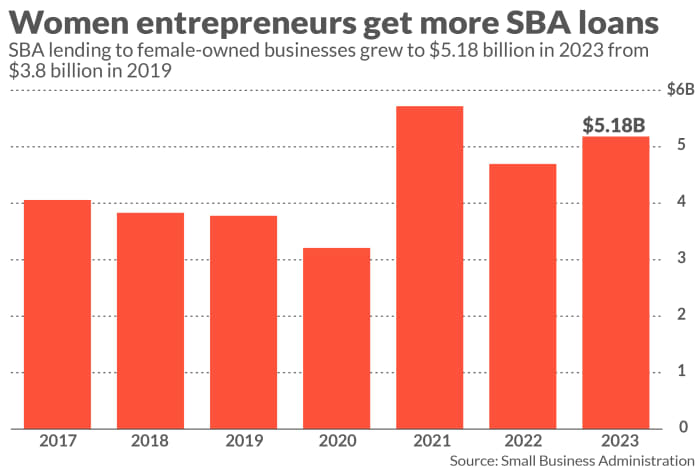

K&M Bowling's SBA loan is part of a trend: SBA loans to women-led businesses have soared in recent years as banks focus on ways to reach women borrowers, whom they see as an opportunity for growth.

Cary Mathis, co-owner of K&M Bowling Company in Pittsfield, Massachusetts, obtained an SBA loan to start the company.

Carrie Snyder and the Berkshire Eagle / Photo courtesy of Berkshire Hills Bank

The SBA provides a way for banks — especially smaller banks — to reach entry-level customers and use their experience and knowledge of local markets to compete with larger banks for customers.

The Small Business Authority said its lending to women-owned businesses through its two main lending programs — 7(a) loans and 504 loans — rose to $5.18 billion in 2023 from $4.7 billion in 2022 and from $3.21 billion in 2020. It reached $5.72 billion. This is partly due to government stimulus programs related to the pandemic.

Meanwhile, in 2023, financing through SBA-licensed small business investment firms for women, minority, and veteran-owned businesses increased 25% compared to the previous year.

Berkshire Hills Bancorp, whose 44 business capital units specialize in Small Business Administration loans, cites an award it won in 2023 for SBA lending to women-led businesses in Massachusetts. “Berkshire Bank recognizes the importance of women-owned small businesses to the nation's economic landscape,” said Greg Bohlman, senior vice president of 44 Business Capital.

In addition to its loan to M&K Bowling, 44 Business Capital has funded women-owned businesses including fitness and childcare companies, legal firms and construction supply companies.

More female entrepreneurs are opening their businesses as part of the so-called Great Quit, where people voluntarily leave their full-time jobs to strike out on their own, said Maggie Furness, SBA director at Columbus, Ohio-based Huntington Banc. ,

This trend has increased in the wake of the pandemic as more people wanted to work from home or simply work for themselves.

Huntington, the largest SBA lender in the United States, has a mission to improve access to capital for women, people of color, veterans, indigenous peoples and others who have historically faced challenges obtaining loans, Furness said.

“We have seen an increase in the amount of lending to women,” she said. “Women are saying, ‘I’m doing this for myself,’ and they are creating jobs. Since the emergence of the coronavirus, we have seen a reactivation of the entrepreneurial space.

The Huntington SBA program also fits with the bank's focus on helping small businesses and cultivating ongoing relationships with them. Many of the bank's SBA borrowers were able to transition to business loans and other products.

Since 2020, the bank's Lift Local SBA program has written $89 million in loans, including $28.9 million to women-owned businesses.

In 2003, Angela Sharpley and her daughter Stecia Rollins, owners of Bamba Tea/Pipe'n Hot Grill in Cleveland, received a $50,000 loan from Huntington's that allowed them to put their Bamba Tea line on the shelves of the Meijer supermarket chain.

Lan Hu, owner of Fat Milk, a Chicago-based beverage brand, took out a $150,000 loan to open a retail space. She told her story on the TV show Gordon Ramsay's Food Stars.

The ABCs of SBA Loans for Borrowers and Banks

When it comes to SBA loans, there are challenges as well as benefits for borrowers and banks.

For borrowers, the Small Business Administration (SBA) allows a 10% down payment, which is much lower than the typical 25% down payment for a traditional business loan. This allows the company to retain more of its working capital.

With SBA loans for real estate, borrowers typically have a 25-year repayment time frame with no overpayments or call provisions. In contrast, a conventional loan may have a 20-year repayment term with a five-year lump sum payment, which may require refinancing.

One thing entrepreneurs considering an SBA loan should consider is the personal guarantee aspect of the loan, Berkshire's Bohlman said. For anyone who owns 20% or more of a business, that involves using their home or other assets as collateral, he said.

This is different from a business loan, which is typically based on the company's assets rather than the assets of the company's founders or executives.

Borrowers must also provide cash flow projections and a business plan, as well as solid estimates of how much money they will need, how it will be repaid and how they plan to grow their business. Here small local banks can play a vital role.

“The big financial center banks don't have the advantage of having people on the floor,” Bohlman said. “Large banks can be slower in processing these loans.”

Poehlmann has seen many cases in which a borrower obtained a Small Business Administration (SBA) loan after being denied a loan by a banker. Then within three or four years, SBA loan sharks and commercial lenders can refinance the deal.

“The SBA acts as a bridge from where the borrower started to traditional financing,” he said.

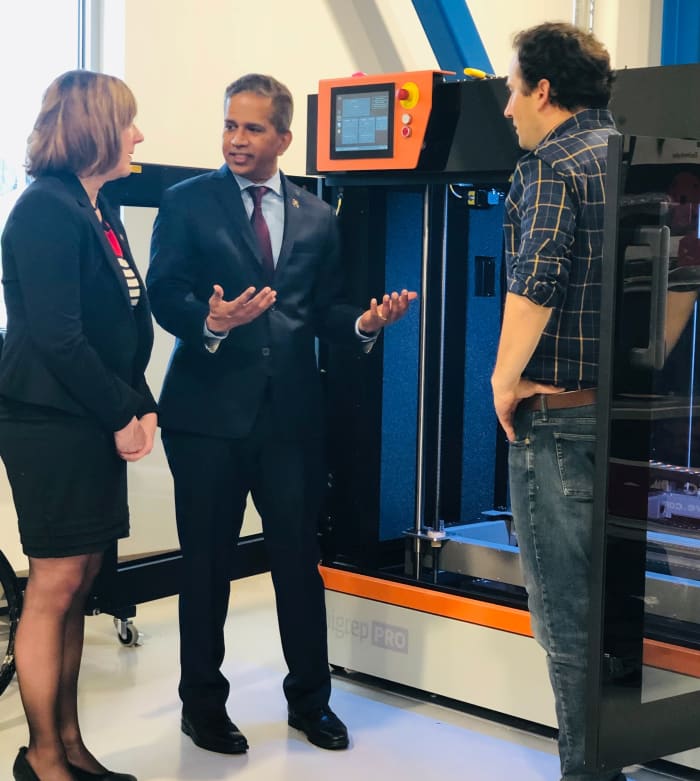

Nitin Mahatre, CEO of Berkshire Hills Bank, center, with Ben Sawsan, executive director of the Berkshire Innovation Center in Pittsfield, Massachusetts, right, and Lori Gazilo-Kelly, director of the Berkshire Bank Foundation.

Berkshire Hills Bank

Nitin Mahatre, CEO of Berkshire Hills Bank, said that while the bank is ranked 125th in the United States with $12.4 billion in assets, it has historically been ranked among the top 20 banks in Small Business Administration lending.

The loans expand the options the bank can offer customers as well as diversify its loan portfolio. He said the SBA loans are “incredibly consistent” with the bank's efforts to financially empower businesses, communities and individuals.

“It allows us to say ‘yes’ in situations where we couldn’t have done otherwise,” Mhatre said. “SBA gives us access to new clients and new relationships to build on.”

In many cases, the bank is able to see its loan interest close to home, as is the case with K&M Bowling.

“It's good to see how they were able to plant the seeds and see them grow,” Pohlman said.

After Carrie Mathis and her family heard about Berkshire Hills' Small Business Administration loans, they began thinking about applying for the federally guaranteed, taxpayer-funded loan program.

They also talked to two other banks, but those institutions did not show the same enthusiasm for the project as Berkshire Hills did. Because they thought an SBA loan seemed more suitable for their new business, they did not consider business loans.

Nowadays, K&M Bowling is full of bowlers, including serious league players and part-timers, Mathis said. Last summer, local bowler Andrew Robitaille placed second in the junior gold tournament in Indianapolis.

Mathis and her family are now considering adding a miniature golf course to the back of the property. For now, Carrie still works as a licensed mental health counselor and her husband, Mark, continues to work as a maintenance technician for a limestone company, but they hope to make the bowling alley their full-time job one day.

And their relationship with Berkshire Hills Bank continues: Managers of the bank's local branches chose K&M Bowling as their holiday gathering place last year.

“We were a family business, and Berkshire made us feel like we were part of their family,” Mark Mathis said.