The Bank of England on Thursday is expected to follow the European Central Bank last week and the Federal Reserve on Wednesday in leaving interest rates unchanged.

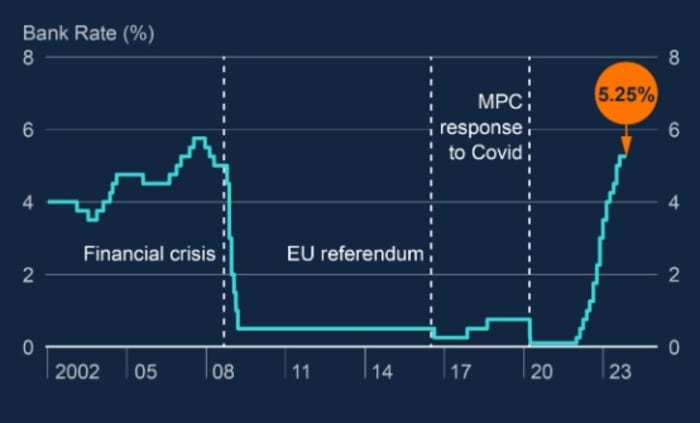

The interest rate will remain at 5.25%, the highest since March 2008, for the fourth meeting in a row, according to bets in futures markets.

Therefore, traders will focus on what the Bank of England's Monetary Policy Committee says in its accompanying statement and its economic forecasts as a guide on when interest rate cuts might begin.

Source: Bank of England

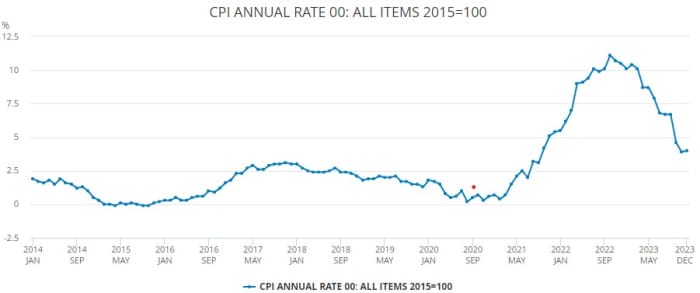

Like its counterparts in the US and the eurozone, the Old Lady of Threadneedle Street has been in a battle with inflation in recent years, raising interest rates 14 times in response to annual increases in consumer prices that topped 11% in October 2022, amid a rise in energy costs. and supply disruptions related to the Coronavirus.

Headline CPI inflation has fallen sharply since then, reaching 4% in December. But this was a slight rise from the 3.9% recorded in November, and still double the Bank of England's 2% target.

Source: Office for National Statistics

Such a scenario might encourage the central bank to maintain its hawkish bias were it not for the poor health of the UK economy.

In its November monetary policy report, the MPC said it expects GDP growth to be “broadly stable” in the fourth quarter of 2023, and over the coming quarters. She added that CPI inflation is likely to return to the 2% target by 2025.

But the latest data has been worse than the Bank of England had expected, notes Sanjay Raja, chief economist at Deutsche Bank.

“Since the November monetary policy report, the Bank of England has faced one downside surprise after another. Simply put, GDP, wage growth and inflation have all fallen short of the MPC's November forecasts,” says Raja.

However, this scenario has caused bond yields to fall and price in a faster pace of interest rate cuts in the coming years, which could then lift long-term growth by more than previously expected.

Therefore, the MPC is likely to maintain its weak rating for 2024 while increasing its forecasts for economic growth over the next few years, says Ibrahim Kadri, an analyst at Goldman Sachs.

“We expect growth forecasts in 2025 and 2026 to be revised upward, reflecting the updated adjustment path for the bank rate, which has fallen by about 85 basis points, on average, over the forecast horizon since the November monetary policy report,” Goldman said.

Importantly, Goldman also believes the Bank of England will revise its near-term inflation forecast due to weak consumption data and lower energy prices, with the CPI reaching 2% by the end of this year – and this could allow interest rates to be cut by the spring. .

“[W]We still expect a first cut of 25 basis points in May, followed by cuts of 25 basis points at each meeting until the interest rate reaches 3% in May 2025. An earlier cut in March cannot be completely ruled out, especially if the process of slowing inflation is accompanied by further Decline in interest rates. Growth,” Goldman says.

Sam Cartwright, an economist at Société Générale, agrees: “The size of the decline in both wage growth and inflation reinforces our view on a cut in May.”

However, he is concerned that because the impact of the National Living Wage increase on wage growth will not become clear until after the May meeting, it may encourage the Bank of England to wait a little longer.

However, unless there is another inflationary shock, markets should soon get the policy easing they are betting on.

According to ICE interest rate futures trading, the bank rate is expected to fall to 4.4% by December 2024 and 3.45% a year later. This has helped two-year British government bond yields (BX:TMBMKGB-02Y) fall from around 5.5% touched in July 2023 – the highest level since 2008 – to the current 4.34%, weakening GBP/USD.

In treatment.

“[H]“Having previously maintained a hawkish bias in its forward guidance, the MPC statement should certainly abandon its hike bias and acknowledge that if inflation follows the path assumed in its forecasts, the next move in interest rates is likely to be lower,” Daiwa said. . Money markets.