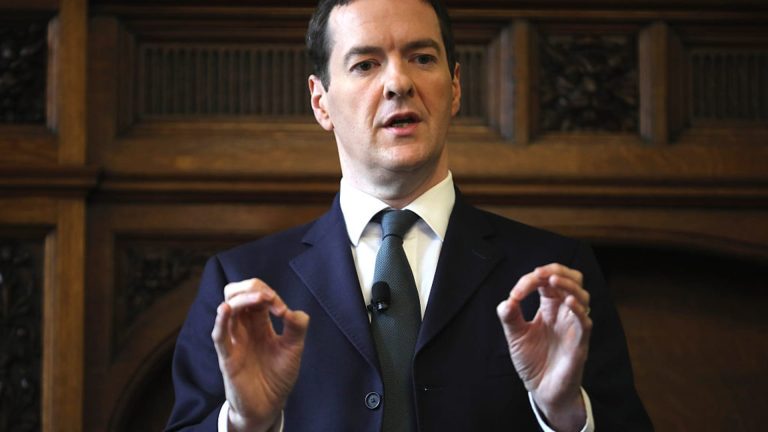

Former British Chancellor George Osborne addresses guests during a visit to the Manchester Chamber of Commerce on July 1, 2016 in Manchester, England.

Christopher Furlong | Getty Images

LONDON — A former British finance minister on Wednesday joined cryptocurrency exchange Coinbase as a global adviser, bolstering the company's regulatory bargaining power at a time when it faces intense scrutiny from the United States.

Coinbase announced that George Osborne, who served as British Chancellor of the Exchequer from 2010 to 2016, will join the company on its global advisory board.

He will join the likes of Mark Esper, former US Secretary of Defense, and Patrick Toomey (R-Pa.) on the council, which was created to “advise Coinbase on our global strategy as we work to expand our reach around the world.”

Faryar Shirzad, chief policy officer at Coinbase, said the company was “thrilled to have George join our board at an exciting time for us in the UK and globally.”

“George brings with him a wealth of experience in business, journalism, and government. We look forward to drawing on his vision and expertise as we grow Coinbase around the world,” Scherzard added.

Osborne will serve in an advisory capacity at Coinbase, helping connect the company with politicians and regulators to help advance the case for forming cryptocurrency-friendly regulations.

While Chancellor of the Exchequer, Osborne launched a series of austerity policies aimed at reducing the budget deficit, including freezing child benefits, cutting housing benefits, and implementing a two-year freeze on public sector wages. He also tried to stimulate business activity by lowering corporate taxes.

Osborne was interim editor of the London Evening Standard after his term as British Finance Minister ended. He is currently a partner at Robey Warshaw LLP, a boutique investment bank.

“There is a tremendous amount of exciting innovation in finance right now,” Osborne said. “Blockchains are transforming financial markets and online transactions.”

“Coinbase is at the forefront of these developments,” Osborne continued. “I look forward to working with the team there as they build a new future in financial services.”

Osborne's ties to Coinbase are not new

Suggestions of a growing relationship between Osborne and Coinbase first surfaced last year, when Brian Armstrong, CEO of Coinbase, spoke on stage at a ceremony Osborne moderated at a fintech event in London.

Osborne then spoke with Coinbase CFO Alicia Haas in a fireside chat at the Belvedere Hotel during the World Economic Forum in Davos, Switzerland.

This comes as Coinbase has been grabbing territory across Europe, expanding into multiple countries over the past few months with new licenses in place. The company obtained a virtual asset service provider license in France last month, paving the way for expanding its services there. It also recently obtained licenses in Spain, Singapore and Bermuda.

Coinbase is currently facing a harsh regulatory crackdown in the US as the Securities and Exchange Commission has accused the company of violating securities laws. Coinbase denies these allegations.

Last year, Armstrong, the president of Coinbase, appeared on stage with Osborne at the Innovate Finance Global Summit in London. At the event, Armstrong said he was open to investing more abroad, including moving from the US to the UK or elsewhere if regulatory pressure on cryptocurrency companies continues.

“I think if we go several years without seeing regulatory clarity around us… we may have to consider investing more elsewhere in the world. Anything including, you know, relocation,” Armstrong told Osborne.

He told CNBC's Arjun Kharpal at the time that Coinbase was “looking at other markets” as it considered its position from a regulatory standpoint.

Armstrong later clarified in an interview with CNBC's Dan Murphy that Coinbase has no formal plans to move from its US headquarters in San Francisco. “Coinbase will not move offshore,” Armstrong said. “We will always have an American presence… but the United States is a little bit behind at the moment.”