A drone attack that killed three US service members in northern Jordan, which the White House blamed on Iranian-backed militants, represents a major escalation of tensions in the Middle East and appears likely to provoke a reaction when financial and commodity markets open. this week. .

Analysts said oil prices are likely to rise when futures trading begins Sunday evening.

Much will ultimately depend on the US response and whether Iran takes measures aimed at closing the Strait of Hormuz, Tariq Zaher, managing member at Tyche Capital Advisors, told MarketWatch on Sunday afternoon.

He added: “We are on the cusp of this escalation, which may seriously affect the flow of crude oil.”

Three American soldiers were killed and more than two dozen others were wounded in a drone strike on a US base in northeastern Jordan, according to US Central Command. These were the first American deaths during months of attacks on American bases launched by Iranian-backed militias since the war between Israel and Hamas began in October.

President Joe Biden attributed Sunday's attack to an Iranian-backed militia, and said the United States “will hold all those responsible accountable at a time and in the manner of our choosing.” News reports said US officials were still working to conclusively identify the exact group responsible for the attack, but they estimated responsibility lay with one of several Iranian-backed groups.

Some Republicans in Congress called for direct retaliation against Iran.

We must respond to these repeated attacks by Iran and its proxies by directing direct strikes against Iranian targets and its leadership. The Biden administration's responses so far have only led to more attacks. “It is time to act quickly and decisively for the whole world to see.” Share on X.

Oil futures rose last week, but the gains were partly due to a production shutdown in the United States and more optimistic expectations about economic growth.

Oil prices have seen short-term spikes around developments in the Middle East since the beginning of the war between Israel and Hamas, but have failed to build a lasting geopolitical risk premium. West Texas Intermediate crude oil

every 00,

every.1,

The US benchmark is still about $15 below its 2023 peak in the mid-90s set in late September. Brent crude BRN00,

The global benchmark fell above $80 a barrel last week.

Attacks launched by the Iranian-backed Houthis on ships in the Red Sea led to a change in the course of tankers and cargo ships. For crude oil, this had impacts on the physical market but did not stop the flow of crude oil from the Middle East.

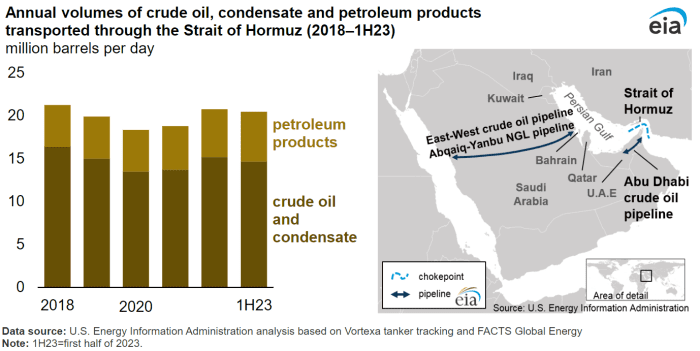

The step taken by Iran to close the Strait of Hormuz, the largest oil transport corridor in the world, remains a source of great concern.

The Strait is a narrow waterway connecting the Arabian Gulf to the Gulf of Oman and the Arabian Sea. The waterway is only 21 miles wide at its narrowest point, and the shipping lane is only two miles wide in both directions, separated by a two-mile buffer zone.

Energy Information Administration

About 21 million barrels per day of crude moved through the waterway in the first half of 2023, equivalent to about a fifth of daily global consumption, according to the US Energy Information Administration.

The US stock market has largely looked past the tensions in the Middle East, with the S&P 500 SPX returning to record levels this month, while the Dow Jones Industrial Average (DJIA) also posted a string of records.

is reading: The stock market rally faces the Fed, tech earnings and jobs data in a make-or-break week

Beyond oil, markets will be monitored for any knee-jerk spikes in assets and instruments that traditionally act as havens during periods of heightened geopolitical tension, including US Treasuries BX:TMUBMUSD10Y.,

US dollar DXY and gold GC00,

—The Associated Press contributed.