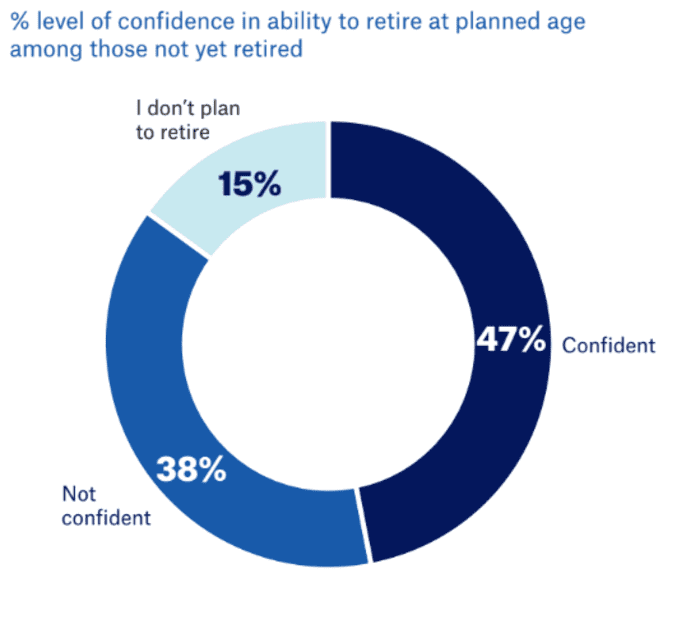

Not everyone thinks they'll one day retire: A new study found that 15% of Americans overall said they don't plan to retire at all, and young people as a group were less confident than their fellow workers.

More than one in five younger Americans have no plans for retirement, and 21% of Hispanic respondents said the same, according to TIAA's latest report, “The State of Financial Preparedness in a Diverse America.”

The biggest reason to skip retirement? Inability to save enough. Social reasons, such as a sense of purpose, avoiding boredom and enjoying professional life, were also reasons for not retiring, participants said.

“If most people are planning for retirement but cannot follow through on their plans, this is a call to action for employers, policymakers, financial advisors, retirement providers and others. We need to better define the steps we need to take,” Surya Kolluri, president of TIAA, said in a statement. To give people the resources they need.”

Source: TIA Institute

Less than half of the people still working were confident they would one day retire. Young Americans and Latinos were associated with the lowest level of trust, with more than a third in each demographic answering as such.

The survey included responses from 1,684 adults between the ages of 22 and 75, who represented a mix of demographics, including age, racial and ethnic groups.

TIAA also found that Americans have little investable liquid savings — 26% of black respondents, 26% of Native American respondents and a quarter of Hispanic Americans have no savings — and three in 10 respondents said they would not be able to pay $2,000 emergency fund. The survey found that people are more likely to have no investable liquid assets (15%) or less than $50,000 (29%) than those with more than $500,000 (19%).

is reading: Retirement Planning for Generation X and Millennials: To Make It Effective, Make It Small

For about three-quarters of current retirees, Social Security was their primary source of retirement, followed by more than half who cited employer pensions. But that may not be the case for younger workers, as nearly half of respondents between the ages of 22 and 34 said they don't expect to benefit from Social Security or pensions when they retire.

Two-thirds of people had a retirement account, such as a 401(k), but nearly a quarter of people didn't know how much they had saved, including 24% of those currently retired and 22% planning to retire.