(Bloomberg) — FTX is offloading crypto assets and hoarding cash as bankruptcy advisors look for a way to repay clients whose accounts have been frozen since the platform collapsed in 2022.

Most read from Bloomberg

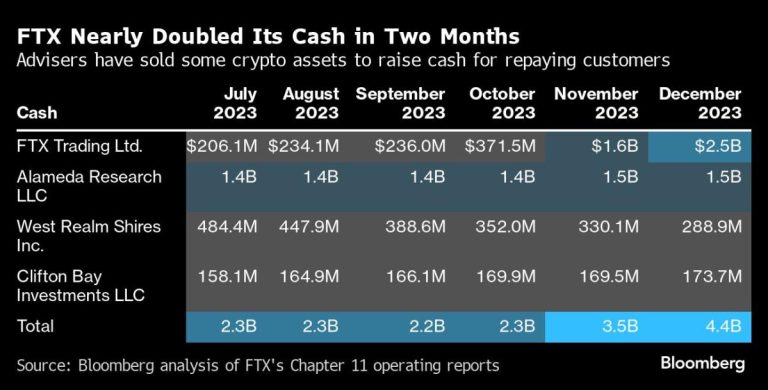

The four largest subsidiaries of the tainted cryptocurrency company committed fraud – including FTX Trading Ltd. and Alameda Research LLC — combined to nearly double the group's cash pile to $4.4 billion at the end of 2023 from about $2.3 billion in late October, according to its Chapter 11 monthly operating reports. The company's total cash is likely to be higher including the rest of its subsidiaries.

A representative for FTX declined to comment.

FTX had raised $1.8 billion as of December 8 through the sale of some of the company's digital assets, the company said in a lawsuit last month. FTX also said it is conducting bitcoin derivatives trades to hedge exposure to the currency and generate additional yield on its digital holdings — and is exploring options to restart the exchange.

The increase in FTX's cash inventory coincided with an increase in the value of clients' accounts. Since the breakup of FTX in November 2022, bankruptcy advisors have been tracking assets and striking deals aimed at benefiting clients with smaller accounts on the platform. The company has also filed major lawsuits against former partners of Sam Bankman-Fried and cryptocurrency companies such as Bybit Fintech Ltd. That withdrew funds from FTX before filing Chapter 11.

Client claims worth more than $1 million were trading at about 73 cents on the dollar as of Friday, up from about 38 cents on the dollar in October, according to investment firm and bankruptcy claims broker Cherokee Acquisition. Actual trading prices depend on the value of a specific claim and other factors, Cherokee Acquisition said.

However, FTX said it does not expect customers to be reimbursed in full – and that FTX.com customers will bear a larger proportion of the losses. Dozens of FTX clients are challenging a company proposal that would tie up the value of their digital assets at a time when the company has declared bankruptcy, meaning they would miss out on Bitcoin's year-long rally and the rebound of other tokens.

The case is filed before FTX Trading Ltd., No. 22-11068, U.S. Bankruptcy Court for the District of Delaware.

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P