Editorial hapabapa/iStock via Getty Images

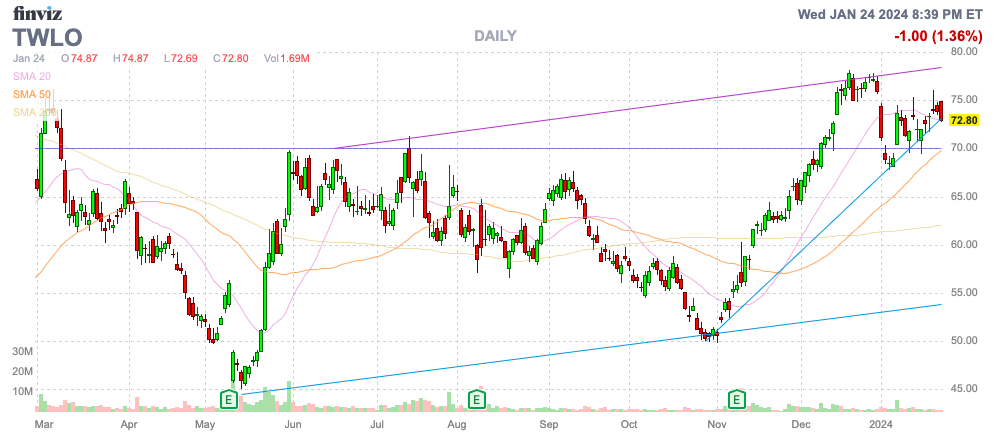

Twilio (New York Stock Exchange: TWLO) is trading at yearly highs despite the exit of the founding CEO from the business. The company has an interesting future for its AI communications software, although the actual financial outlook is limited. My investment thesis He became more neutral on the stock after the fourth quarter rally and the departure of Jeff Lawson.

Source: Finviz

Artificial intelligence software struggle

Twilio is not alone as a company with a promising future in the communications and software space thanks to artificial intelligence, yet the business is not growing yet. The company only headed for just over 5% organic growth in its upcoming 2013 Q4 earnings report.

Twilio's final product will use artificial intelligence to help customers connect with customers. In the future, software robots will communicate with end customers, eliminating the need for customer service representatives.

The company launched CustomerAI last August. Advertisement suggested The technology combines the powers of LLMs with client data from the Twilio platform.

Source: Twilio website

While the technology promises many benefits to customers with the ability to replace customer service representatives with technology that can interact with customers and includes predictive artificial intelligence capabilities to enhance those encounters. The issue is how Twilio will actually benefit from this technology with August still not flowing in financials similar to issues facing other AI software companies as companies look to save money with AI rather than spending more.

A co-founder CEO leaving the company at a time when artificial intelligence is providing a major catalyst for the business is a mixed picture for the stock. COO Shipchandler was announced as the new CEO in early January, and the upcoming earnings report will be the first under his leadership.

Given that Twilio has trended in the wrong direction over the past two years, investors have to worry about weak guidance around 2024 numbers. The company guided Q4 numbers above the previous range for revenue, though Twilio is offering no indication of how far the results will exceed Previous revenue estimates of $1.03 to $1.04 billion.

Jeff Lawson probably won't exit the company after getting strong results thanks to artificial intelligence. A long turnaround period is usually an ideal time for a leadership change and investors should keep this consideration in mind.

Ho hum

As with a lot of companies that saw telecom demand surge during the Covid crisis, Twilio's demand profile hasn't improved much since the peak. Analysts generally guide revenue growth in the 7% to 10% range going forward.

The stock won't gain much momentum without a catalyst, such as artificial intelligence. The stock is currently trading at 30x EPS targets for 2024. Twilio is only trading at 3x sales targets of $4.44 billion, but the company has lower gross margins due to telecommunications costs.

Twilio has done an excellent job of turning the business into a profitable enterprise with nearly $500 million in adjusted income targeted in 2023. One has to wonder if the company is spending aggressively enough on new growth opportunities, such as artificial intelligence.

The company spent $242 million on research and development last quarter, but the amount was down significantly from the $285 million spent during the previous third quarter. Once you exclude stock-based compensation of more than $90 million per quarter, Twilio is down to just $145 million in R&D expenses, or just 14% of revenue.

Source: Twilio Q3 2023 earnings release

The CFO attended the UBS Global Technology conference following its Q3 '23 earnings report, and much of the talk was about Twilio's new earnings and cash flow profile. Investors want to hear how AI will help drive sales growth into double digits and the level of investment needed to achieve those goals.

When asked about the CustomerAI product until the last question at the conference, the CFO gave a limited answer other than suggesting that the product would turn out to be a significant revenue contributor. Aidan Viggiano suggested that the industry hasn't even figured out a pricing and commercial packaging structure.

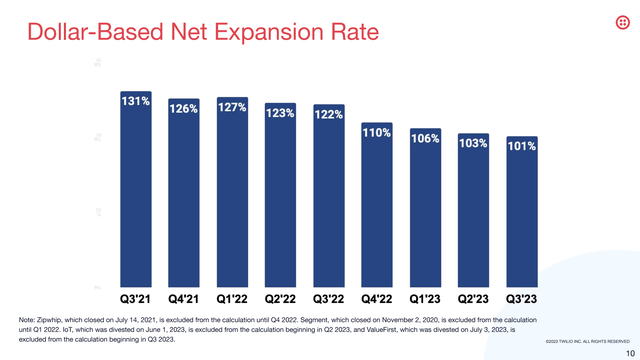

Meanwhile, net dollar-based expansion fell to a very low 101% last quarter. In essence, existing customers aren't extending services anymore, and a significant portion of the customer base will likely spend less with Twilio.

Source: Twilio Q3'23 presentation

The company has a net cash balance of $2.9 billion, so investing in profitable growth should be a goal. Additionally, Twilio has already generated $192 million of free cash flow for the first three quarters of 2023.

All the company lacks is real growth and Twilio must get back to growth with an AI catalyst.

He stays away

The investor's takeaway is that Twilio has some interesting opportunities by mirroring AI with communications tools, but the company actually needs to provide some data points that show the market shift is benefiting the company. After the big rally and considering a CEO change, our view is to move to the sidelines before the 4Q23 earnings report in mid-February. The AI catalyst appears to be a long way off at this point, and the first quarterly report from a new CEO leans toward conservative guidance.