The following is an excerpt from the latest issue of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these and other online Bitcoin market insights directly into your inbox, subscribe now.

The first 5 days

The launch of the Bitcoin Spot ETF was one for the history books. By all accounts, this was the largest ETF product launch in history, surpassing the previous record set by the launch of the Proshares Bitcoin Strategy ETF (BITO) in October 2021. The first day's trading volume was a whopping $4.6 billion, and it was a huge success. It remained relatively strong compared to the typical declines seen by other products after launch. We can be confident in volume numbers, unlike inflows. After the first two days of trading, the market was left wondering about the flows because the data provided by TradFi was late and incomplete. Experts, like Eric Balchunas BloombergHe said it was normal for there to be a delay in reporting flows of up to T+3 (after three days). Bitcoin has never been used to such poor transparency.

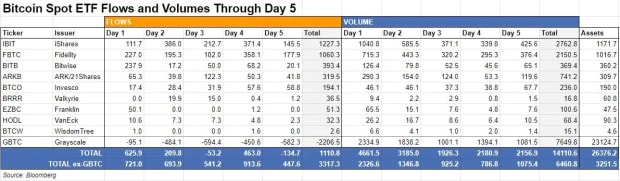

In the table below, you can see that GBTC outflows have now exceeded $2 billion, with the largest day being day 3. However, it is very likely that most of the Day 3 flows are due to Day 2 trading, as well as Day 2 trading. On the first day, and so on. We also cannot know if all issuers have their data up to date. Is that all their flows or have they not finished counting? We simply don't know.

Bitcoin users supplement TradFi's slow data, which can take days, by tracking on-chain flows. Wednesday morning, James Van Straten Cryptocellite It reported that 18,400 BTC were sent from Grayscale to Coinbase's Prime OTC desk right at market open, following a pattern of outflows in the previous two trading days of 9,000 BTC on January 16 and 4,000 BTC on January 12. Arkham is trustworthy, the problem is that it doesn't match the reported outflows. Those three days of on-chain data add up to $1.3 billion in Bitcoin, and the reported outflows were just $1.1 billion. It is also interesting that there were no transactions on the morning of January 18, but they resumed this morning.

Source: Arkham via @DylanLeClair_

Coinbase already holds Grayscale's Bitcoin, so it transfers from their custodial account to the OTC desk, where other ETF market makers can receive it, limiting the impact on the spot price.

The GBTC sell-off may be coming to an end

The Grayscale sale was expected but we still don't know the final amount it will eventually sell for by the time the dust settles. Will 100% of their coins slowly come out, or maybe just 10%? People expect that the expense ratio of 1.5% versus other ETFs averaging 0.25% might prompt people to swap ETFs. If this were the case, it would not translate into any net sale. GBTC has reduced its transfer fees, from 2% to a new 1.5%. If GBTC holders are holding large unrealized gains, they may choose not to sell until the next rally. Remember that there are tax implications to the swap as well.

Many early sellers of GBTC do so for ideological reasons. The opposition formed in February 2021 caught them by surprise and they felt stuck. The question is how many bitcoins? GBTC still has over 550,000 BTC as of January 19, how many of those are still outstanding? Why didn't they switch them out already in the first few trading days? I think it's less than people think. Yes, all the Bitcoin will eventually come out if they keep the expense ratio high, but not in one sustainable move. I think the dumping will spread over several large rallies in a bull market. GBTC selling may actually slow down with the discount to NAV falling from 150 basis points on day one to 47 basis points on January 17.

Bitcoin price

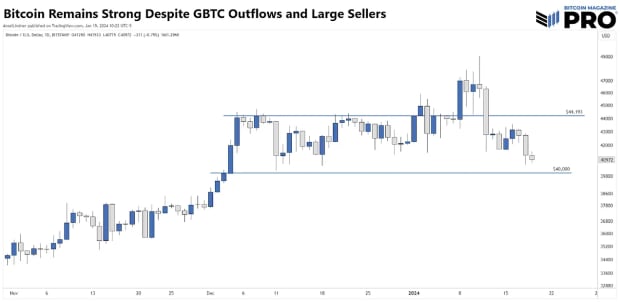

Talking about the price, Bitcoin managed to maintain the support at $40,000 even with massive outflows from GBTC and selling whales. Once again, James Van Straaten reports on a whale who bought for $48,000 in the 2021 bull market, held out through the massive drawdown and FTX debacle, and may have unloaded 100,000 BTC with a $49,000 ask. For context, all ETFs except GBTC are still below that at 79,000 BTC. This was not a news selling event, it could have simply been a whale sell after breaking even. This means that the sustained buying pressure for ETFs is only delayed by a week or so.

We are still in the range dating back to the beginning of December, but we are threatening to drop below it now. My interest remains on the $40,000 level and the $44,193 line that we have been watching all along, which was established from the daily closing high on December 8th.

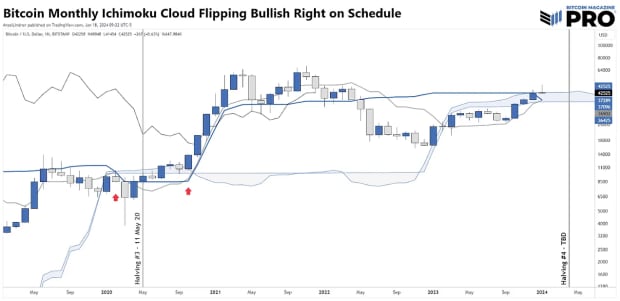

For those readers who prefer a nice low time, the monthly Ichimoku cloud is fluctuating upward. This is a very bullish signal that only occurs at the beginning of Bitcoin's bullish rallies. It last happened in October 2020 after it roughly flipped pre-coronavirus in February 2020. Interestingly, if it had flipped in February, it would have been in roughly the same relationship with the halving we are in today. Before 2020, the only other time this happened was in June 2016, at the beginning of that huge bull market, and one month before the halving in July 2016.

Massive buying pressure in context

Using the incomplete flow data above, we can say that the average daily buying pressure, including GBTC selling, was over $200 million per day. Interestingly, the fourth day was the second highest, adding some evidence to the theory that buying pressure could reach a level of $250-$300 million. To put that amount into context, Microstrategy just began a 4-month process of selling $216 million in new shares to buy more Bitcoin. ETFs do it in a day. Tether is also constantly purchasing Bitcoin for its reserves. Most recently, they reported adding another $380 million worth of Bitcoin at the end of 2023. Two of the ETFs' first five days were more than that.

Taking all of these sources of massive demand into account, look again at the monthly chart above, again. There is only one way for this market to go. are you ready?

If you liked this post Please give it a like and share On social media so we can spread our message! Thank you!