The Fear and Greed Index fell to 100-day lows as Bitcoin (BTC) fell below the $40,000 level for the second time in a week.

Against the backdrop of changes in BTC and market calm following the widely anticipated BTC spot exchange-traded funds (ETF), the fear and greed index has moved into neutral territory indicating a decline in potential investor interest in BTC. Cryptocurrency.

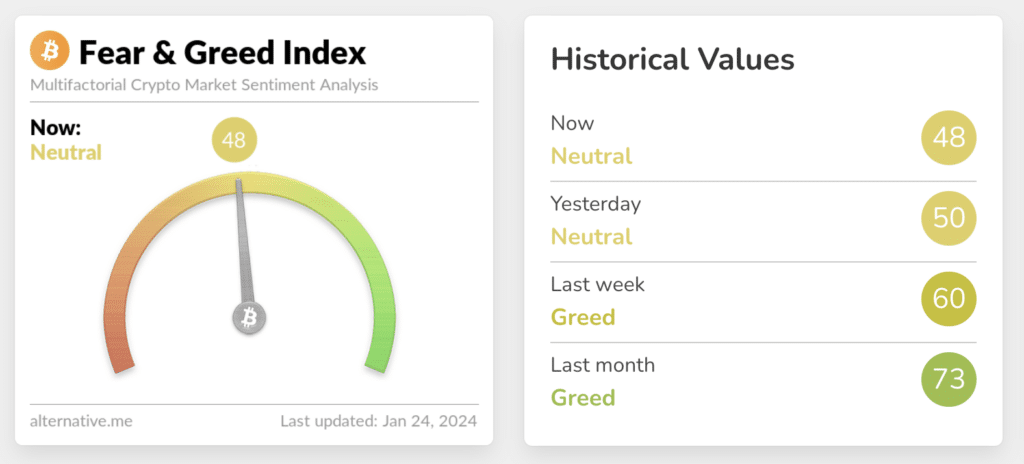

The Fear-Greed Index is a scale from 0 to 100, where 0 is most fearful and 100 is most greedy.

Currently the indicator is at 48 points corresponding to a neutral zone with fear prevailing. This is the lowest value since October 16, when the index was 47.

Since the beginning of November 2023, the Fear and Greed Index has been in the “greed” zone, indicating investors’ desire to buy digital currencies. Interest in buying digital assets was driven by anticipation of the imminent launch of a Bitcoin ETF.

Now, the index has fallen amid the launch of trading in Bitcoin ETFs in the US and BTC falling below the $40,000 level. Investor sentiment may indicate that the Bitcoin ETF craze has subsided.

Grayscale CEO Michael Sonnenshein also believes that most of the 11 SEC-approved spot Bitcoin ETFs are likely to fail. In his opinion, “only two or three ETFs are likely to achieve some critical mass.”