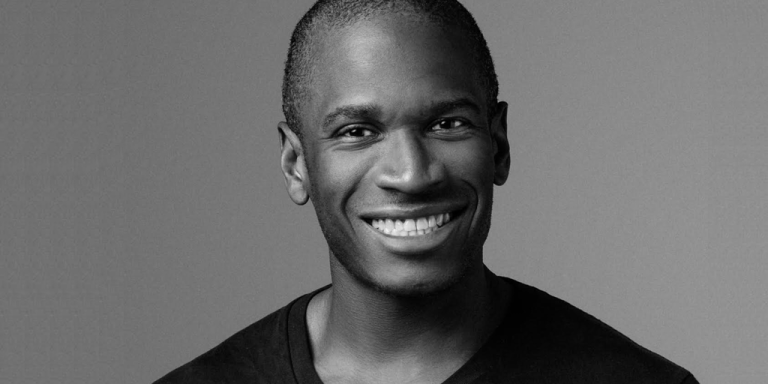

“I think Bitcoin will find a local bottom between $30,000 and $35,000,” said Arthur Hayes, famous cryptocurrency trader and founder of 100X Group. In a published article entitled “Relenting or talking?” – referring to US Treasury Secretary Janet Yellen – explains how several geopolitical factors could affect the future of cryptocurrencies.

Hayes appears to be bearish in the short term and bullish in the long term, so brace yourself.

He criticized the financial strategies of US Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell, highlighting their impact on the market with his typical colorful comments.

“US Treasury Secretary Bad Gurl Janet Yellen and her easygoing friend US Federal Reserve Chair Jerome Powell vacillate between decisive action and ambiguous talking points,” Hayes wrote.

One of Hayes' main predictions concerns the trajectory of Bitcoin's price, and for day traders and its Bitcoin brethren, things are not looking very good. Its expected bottom of $30,000 to $35,000 depends on current market dynamics and impending decisions from key financial authorities. Hayes believes that the market misinterpreted the actions and speeches of Yellen and Powell, which led to unjustified optimism.

Hayes said traders failed to distinguish between their prepared rhetoric and their real actions, which helped prices rise, and now markets are correcting as they slow and there is more room to understand the true impact of US monetary policy.

However, as a true cryptocurrency dean, Hayes said that once Bitcoin hits bottom, he will buy a bunch of altcoins.

“I'm going to start bottom fishing. I'm going to load up on Solana and $WIF,” he wrote. He's also interested in Punk – which he described as “the comic money of the last cycle” – so there will be some of that in his portfolio as well.

Bitcoin and geopolitics

Hayes also links Bitcoin's performance to broader financial trends. He notes a difference between Bitcoin and traditional financial indicators, for example, and suggests that Bitcoin is a more accurate harbinger of financial reality.

“Bitcoin is telling the world that the Fed is trapped between inflation and a banking crisis,” he explains, indicating a cautious approach to the cryptocurrency’s immediate future. Once again he stressed the difference between talk and action: “The Fed's solution is to try to convince the market to believe that the banks are sound without providing the funds to turn that fantasy into reality.”

For Hayes, inflation will play a major role in the direction of Bitcoin's price as a hedge to store value. It is believed that the current geopolitical events may lead to inflation rising again, impacting the markets.

“There is no doubt that Powell is aware of these issues, and he will do everything he can to talk a big game about interest rate cuts without actually having to cut them,” he said, referring to the need to print money to cover all the wars the United States wages. “What may be a slight increase in inflation due to increased shipping costs could be supercharged by interest rate cuts and resumption [quantitative easing]”.

“The market does not appreciate this fact yet, but Bitcoin does,” he noted.

All of these events could lead to a situation that he believes could force the Fed's hand.

“Halting the BTFP will cause a mini-financial crisis and force the Fed to stop talking and start cutting interest rates,” Hayes predicts.

The Bank Term Financing Program (BTFP), launched by the Federal Reserve in March 2023, aims to enhance the stability of the financial system by providing guaranteed one-year loans to eligible depository institutions. This additional liquidity helps ensure that these institutions are able to meet the needs of depositors, and ultimately support American businesses and households by preventing potential financial crises and economic slowdowns. But the BTFP is set to expire in March.

Another point of view

Stefan Rost, CEO of economic data aggregator Truflation, has a more positive outlook on Bitcoin's current situation.

“Bitcoin has fallen below the psychologically important $40,000 mark, and everyone is talking about the failed ETF launch, but absolutely nothing has changed for Bitcoin,” Rost noted in a joint statement with Decryption. In the long term, Rost said he remains optimistic, anticipating significant growth for Bitcoin. “Bitcoin’s value has and always will be driven by scarcity, and a halving will only reinforce that narrative,” he said. “We could see Bitcoin reach the $150,000 mark before the year is out or shortly after.”

As with most regulators in the Bitcoin scene, Hayes isn't sure what politicians are doing to make the world better. He said he believes bitcoin becomes more attractive as countries become weaker. Some states and sectors may be showing positive signs, but he is not optimistic about fiat currencies.

“The rest of America is very broke and drowning in debt,” he concluded.

Edited by Ryan Ozawa.