rlsyk

Last October, I had you covered Canadian National Railway Company (New York Stock Exchange: CNI) in an article that was part of my Composite series (where I focus on the highest quality, wide moat stocks with reliable, predictable fundamental growth).

In this In this article, I highlighted my recent stock purchases and my belief that the value of the stock was attractive.

In the introduction to this original article I said:

“I'll explain why I believe CNI stock has the potential to generate a 20% compound annual total return from here over the next several years, ultimately making this stock one of the best opportunities on the market today for dividend growth investors.”

Well, looking at CNI's recent results, it looks like we're on our way to those impressive returns.

As you can see, the stock has performed great since then.

Seeking alpha

CNI shares were trading in the $108 area when this article was originally published on Seeking Alpha. Today, they trade for about $125 per share.

CNI has posted returns north of 15% since this article was published, beating the S&P 500, which is up roughly 12.9%.

Canadian National Railway this week published its 2023 fourth quarter/full year financial results.

Therefore, following the company's recent rise, and with the latest results in mind, I wanted to take some time to update my opinion on the stock's movement forward.

Canadian National Railways Q4/Full Year Results

2023 has been a difficult year for major railway companies.

Throughout the year, we witnessed labor disputes, wage pressures, a slowdown in economic activity, and severe challenges due to the pandemic.

With that in mind, my bullish thesis for CNI was not about Q4.

Instead, I'm looking for a nice bounce back in 2024 and continuing to move forward throughout the rest of the decade as efficiency numbers start to rise again.

Fortunately, CNI's fourth quarter kept this long-term thesis intact.

CNI's diluted EPS decreased by -2% during 2023.

This is not great. But looking at its peers, it looks like CNI's results will be at (or near) the top of its category.

Other Class I railroad companies have not yet reported fourth-quarter results. However, looking at analysts' consensus estimates for 2023, we see the following:

- Canadian Pacific (CP) is expected to post 0% EPS growth

- Union Pacific (UNP) is expected to post -9% EPS growth.

- Norfolk Southern (NSC) is expected to post 15% growth in earnings per share.

- CSX Corp (CSX) is expected to post 6% EPS growth.

During the fourth quarter, specifically, CNI reported adjusted EPS growth of -4%.

However, volumes started to rise across its network in Q4 (which is a good sign, pointing forward) and CNI's run ratio fell by 140 basis points (which is a good thing; run ratios are like golf scores, the lower the better).

It was great to see CNI's operating ratio return below the 60 threshold (it came in at 59.3% during the quarter. This result pushed its operating ratio for the full year to 60.8%. It has been above 60 for a few years now and it appears that increased productivity can To result in a full-year result below that threshold in 2024.

With efficiency in mind, management continues to focus on things like car train speed and residence times in an effort to improve results.

During the fourth quarter, CNI trains averaged 215 miles per year.

Derek Taylor, CNI's chief field operations officer, touched on the Velocity result during the fourth-quarter earnings conference call, saying it was “up 4% year-over-year in one of our best Q4s ever.”

Taylor continued:

“Importantly, we maintained this level of speed through the end of the year, even as volumes increased. With a 6.9-hour dwell time there was a 4% improvement over last year. This is even more impressive given that our traffic mix was lower in volume.” Multimodal this year, which we know doesn't usually stay at the station very long.

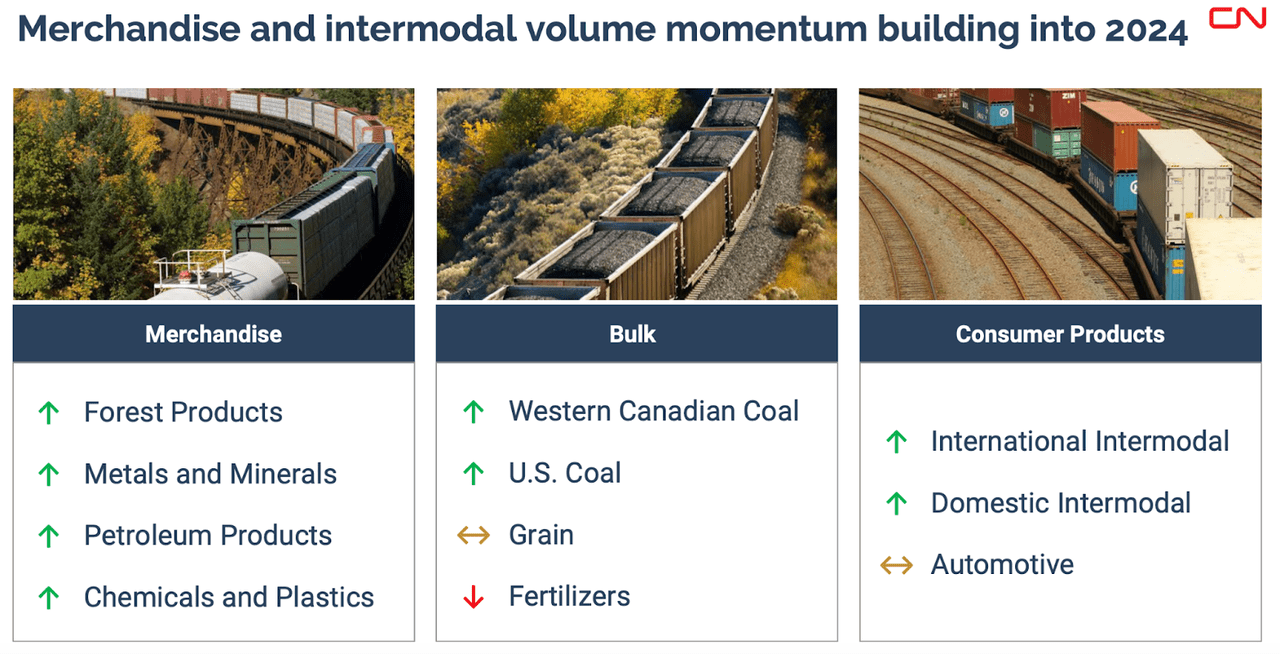

As you can see here, CNI has a positive outlook for shipment volumes across its portfolio:

View CNI Q4 ER

To me, the combination of increasing volumes and improving efficiency is a bullish sign for 2024.

Management agrees.

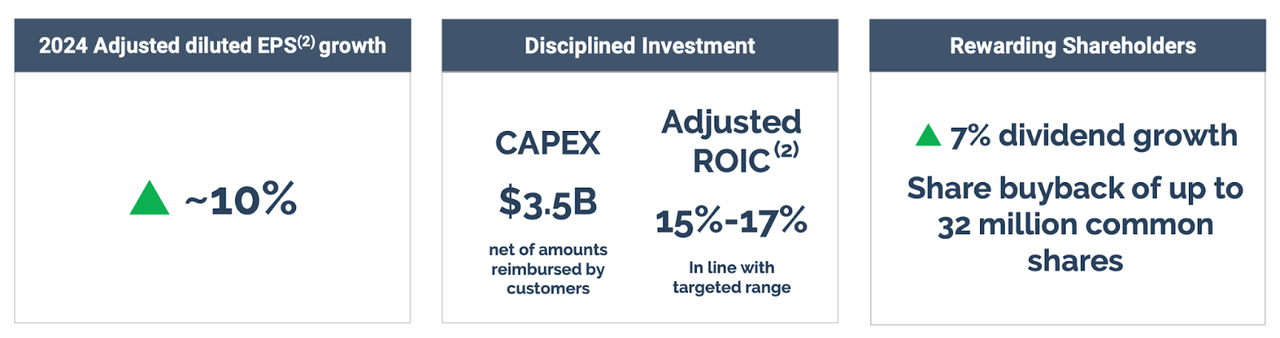

The company updated investors on its full-year 2024 EPS guidance during its fourth-quarter report. They are calling for 10% growth over the next 12 months.

View CNI Q4 ER

This growth forecast is in line with previous management's medium-term guidance, with CNI calling for EPS growth in the 10-15% range from 2024-2026.

This medium-term guidance is why I'm so bullish on CNI. The company's generous shareholder returns certainly help, too.

Canadian National Return

As you can see above, alongside Q4 earnings, CNI announced an increase to its 2024 dividend and a buyback mandate.

The company raised its dividend by 7%, which is in line with the low end of my upcoming estimates for the year.

CNI's 5- and 10-year dividend growth rates hover around 11%.

Anyone who read my article last week titled “25 Stocks with Double-Double Dividend Growth Potential” may have noticed that CNI was absent from the list.

I thought a high single-digit increase was likely this year due to the weak growth the company had in 2023. However, over the long term, I still think CNI can generate enough growth to sustainably double its earnings at a low level. – Double digit rate. This is very attractive to me when we're talking about a stock that yields almost 2%.

One problem that American investors have with a company like Canadian National will be foreign exchange rates.

CNI increased its annual forward dividend to $3.38 per share in its local currency; However, this is only equivalent to $2.50 at the moment due to the strength of the dollar.

A weaker dollar means better income from this Canadian property, but even taking current foreign currencies into account, the company's new dividend yield is around 2.00%.

I'll take a 2% yield with 10%+ long-term earnings growth potential any day.

CNI's latest increase marks the 29th consecutive year of increased dividends for the company

In terms of peace of mind, that's a great line to toe as well.

Furthermore, CNI generously returns its cash flows to shareholders in the form of regular buybacks as well.

Since 2010, CNI has reduced the number of its outstanding shares by more than 30%.

During 2023, CNI repurchased approximately $4.5 billion of its stock.

And it looks like the company will continue to continually eliminate its float through more buybacks in 2024.

This is good news for long-term investors because every stock divested is a boon to the company's EPS.

Moreover, it is a lower dividend payment that CNI has to pay.

Therefore, a lower number of shares reduces the burden of dividends on a company's cash flows, providing management with more flexibility to increase dividends in the future.

CNI stock valuation

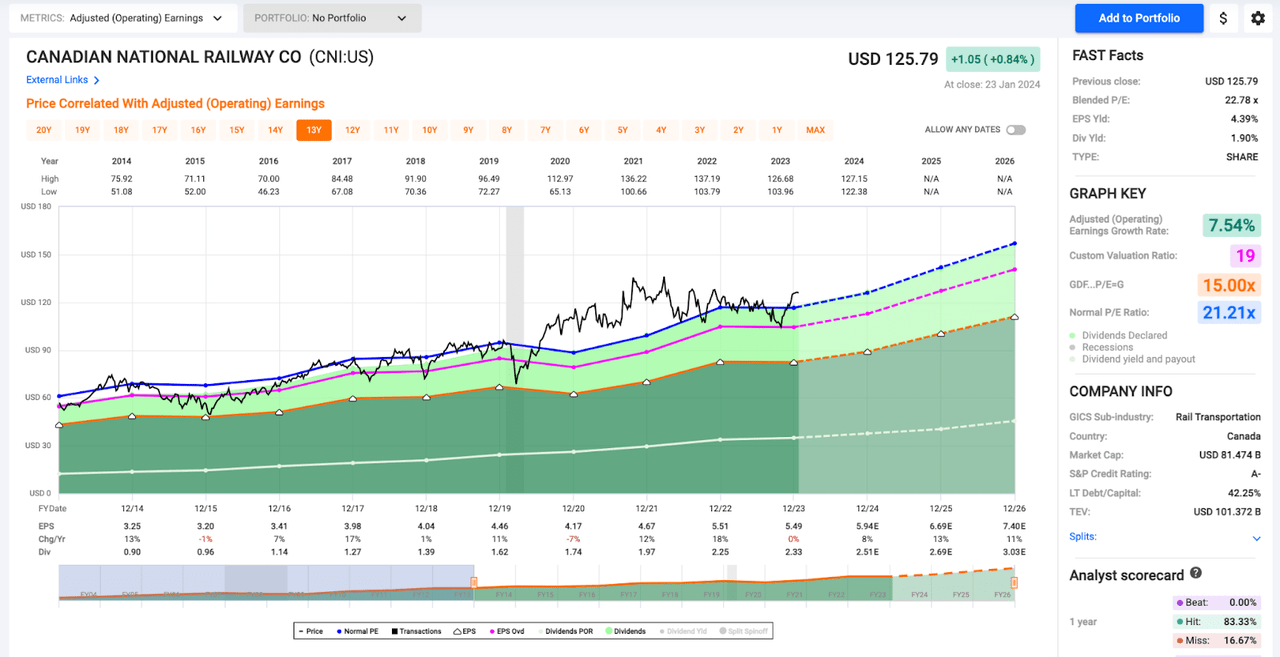

After the CNI rose 15%, stocks are no longer as cheap as they were in October when they were initially highlighted.

After looking at CNI's Q4/full year earnings and updated guidance, I believe the stock is worth $114 per share.

This is based on a forward multiple of 19x based on a 2024 EPS forecast of $6.00.

19x is a premium to the long-term (20-year) average P/E of 18.6x and a discount to the 5- and 10-year average P/E of 22.75x and 21.2x, respectively.

I'm concerned about macro headwinds in 2024 which could have a negative impact on CNI's business (at the end of the day, railways are economically sensitive). However, if we look back to 2014, CNI will note that outside of the March 2020 coronavirus crash, CNI's long-term average P/E in the 19x range (represented by the pink line on the chart below) served as a good value solid floor under the lows. Short term.

Quick charts

I admit I'm being conservative here, but with the market reaching all-time highs and more and more question marks looming on the macro front, I'm OK with that.

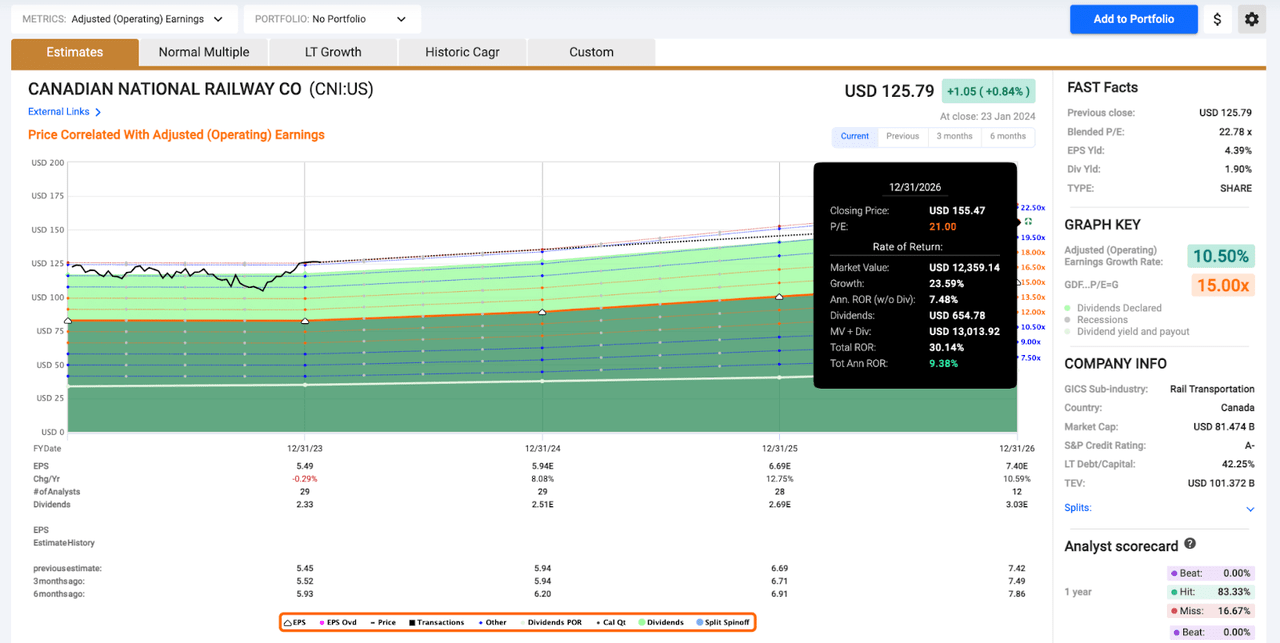

A 19x multiple of consensus earnings and 2026 dividend forecasts suggest a total CAGR of 6.5% over the next two years.

This is not bad. But I think there are better opportunities elsewhere in the market.

Now, I have to admit that I wouldn't be entirely surprised to see CNI maintain its 10-year average P/E in the 21x region going forward.

If this is the case, the upside from here is strong.

Assuming CNI meets analyst estimates between now and 2026 (which are more conservative than the company's medium-term guidance) and the P/E multiple returns to the stock's 10-year average, CNI's total potential return is approximately 9.4%.

Quick charts

If management is able to produce a CAGR of EPS growth near the high end of its guidance range (15%) over the next two years, we'll be looking at strong double-digit returns from here.

With all this in mind, although I no longer think the stock offers an attractive margin of safety, I'm happy to hold it.

I am not looking to add to my position at current valuation levels. But because of this company's strong moat, reliable growth, and high earnings, CNI will likely remain a staple in my portfolio for years (even decades) to come.

Now, I just have to be patient and wait for a pullback before adding to my personal stake (I'm happy to start adding more shares in the $110 area, becoming more aggressive if the stock drops below $100).

Conclusion

After all, it's very easy for me to own excellent railways like this because of their wide moat.

In my October CNI report, I touched on the CNI trenches, saying:

“Consolidation in the rail industry has resulted in a few big players (6 to be exact) dominating the space.

Things like environmental regulation and impending domain issues make it very difficult for new competition to build new paths and compete. Therefore, existing Class I railroads have a very strong market position in an industry with incredibly high barriers to entry. This strength indicates predictable growth over time.

Railways are still the most efficient way to move bulk goods across land, and technological disruption is unlikely to change that any time soon.

In this October article, I also highlighted my belief that US/North American manufacturing resurgence is a long-term upside for this company.

I wrote:

“The Covid pandemic has shown the world how fragile the global supply chain is.

This, combined with the fact that the United States and China have not been on better terms since the start of Trump's trade wars, has inspired huge investments in manufacturing across North America.

Mexico recently became America's largest trading partner (surpassing China), proving that the trend toward reshoring is real.

I suspect this trend will continue for a long time as nationalist/anti-globalization sentiment increases in the post-pandemic world.

The North American trading bloc is very strong.

I still think this is the case.

For this reason, during 2023 I built a full position in CNI and also started a stake in Canadian Pacific Railway.

When it comes to reliable long-term installation, it doesn't get much better than these two companies.

I sleep well at night with my rail stock.

CNI's Q4 report did nothing to change this.

Canadian National Railway's management has largely met my expectations, and I was pleased with its earnings increase and updated double-digit EPS guidance for 2024.

If sentiment turns negative for transportation again, I will happily continue to pile shares of these two stocks into doubles.

Until then, I will hold onto my shares in this A-rated company and watch the profits it produces pile higher and higher.