In a new video update, famous cryptocurrency analyst Michael van der Poppe analyzes the current dynamics of the cryptocurrency market, focusing on the potential of selected altcoins. VVan der Poppe's analysis provides a strategic perspective for potential investors, focusing on the complex relationship between Bitcoin (BTC) price movements and the broader altcoin market.

Van der Poppe began by acknowledging the mixed performance among altcoins, with some consolidating, others correcting, and a few showing notable strength. The core of his analysis hinges on the complex relationship between Bitcoin market behavior and the resulting impact on altcoins.

He highlighted Bitcoin's current consolidation phase, noting that “Bitcoin is currently looking at a consolidation which means if Bitcoin were to bottom out…it could be the beginning of altcoins starting to take off.”

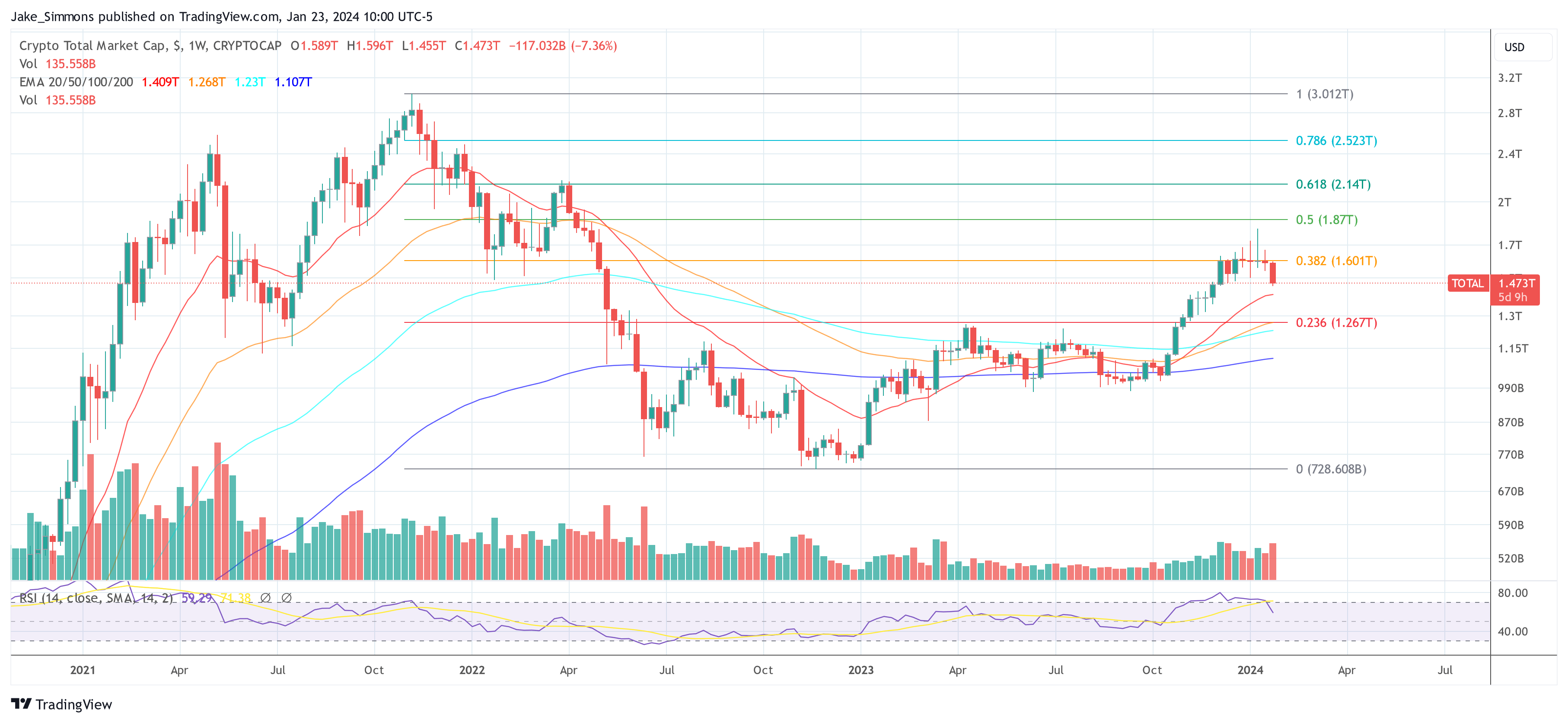

Furthermore, the cryptocurrency analyst delved into the market cap metrics, with a special focus on Total Market Cap 2 (excluding Bitcoin) and Total Market Cap 3 (excluding Bitcoin and Ethereum), to underscore the potential of altcoins. “We are at March 2022 levels… the total late market cap suggests we are looking at another case for cryptocurrencies to start trending outside of Bitcoin,” he noted.

The 3 best altcoins you can buy right now

The first altcoin chosen by Van der Poppe is Ethereum. He linked Ethereum's price movements to broader market events, including the Bitcoin halving and potential regulatory approvals, and suggested that “Ethereum will always rise at a pace dating back to Bitcoin's consolidation period.”

Regarding the SEC's final deadline for immediate US ETF approval, he added, “The actual date we need to focus on is May, which is likely to drive such momentum toward these rallies.”

Regarding a potential price target on this uptrend, the analyst revealed: “I think at this point ETH will continue to run towards the 8K area and we will find ourselves at a top at this specific level.”

Regarding the one-week ETH/BTC chart, van der Poppe said: “We are seeing a crucial level that we need to break at 0.06. If we do that, I think the high range at 0.0838 will be the target. In fact, you could say that 130 should be added.” $1 billion to Ethereum. That's about a 43% rise.

Van der Poppe's second pick is Chainlink. Highlighting LINK's technical patterns and correlation position against BTC on the weekly chart, Van der Poppe explained that LINK hit resistance at 0.000448, fell back towards 0.0002843 and is now consolidating.

Once this is done, Chainlink is expected to rally “towards resistance and begin to break out of this level towards the highs at 0.0009 to 0.0010.” “In terms of the value of Bitcoin, it is very likely that it will achieve double value,” he added, stressing the potential for significant growth.

In terms of USDT, this means LINK ranges from $17 to $18. “From $17 to $18, you have to do 2X, which is this high range, which is this level, where we can expect Chainlink to go to before we have a very big correction in the entire market,” he added.

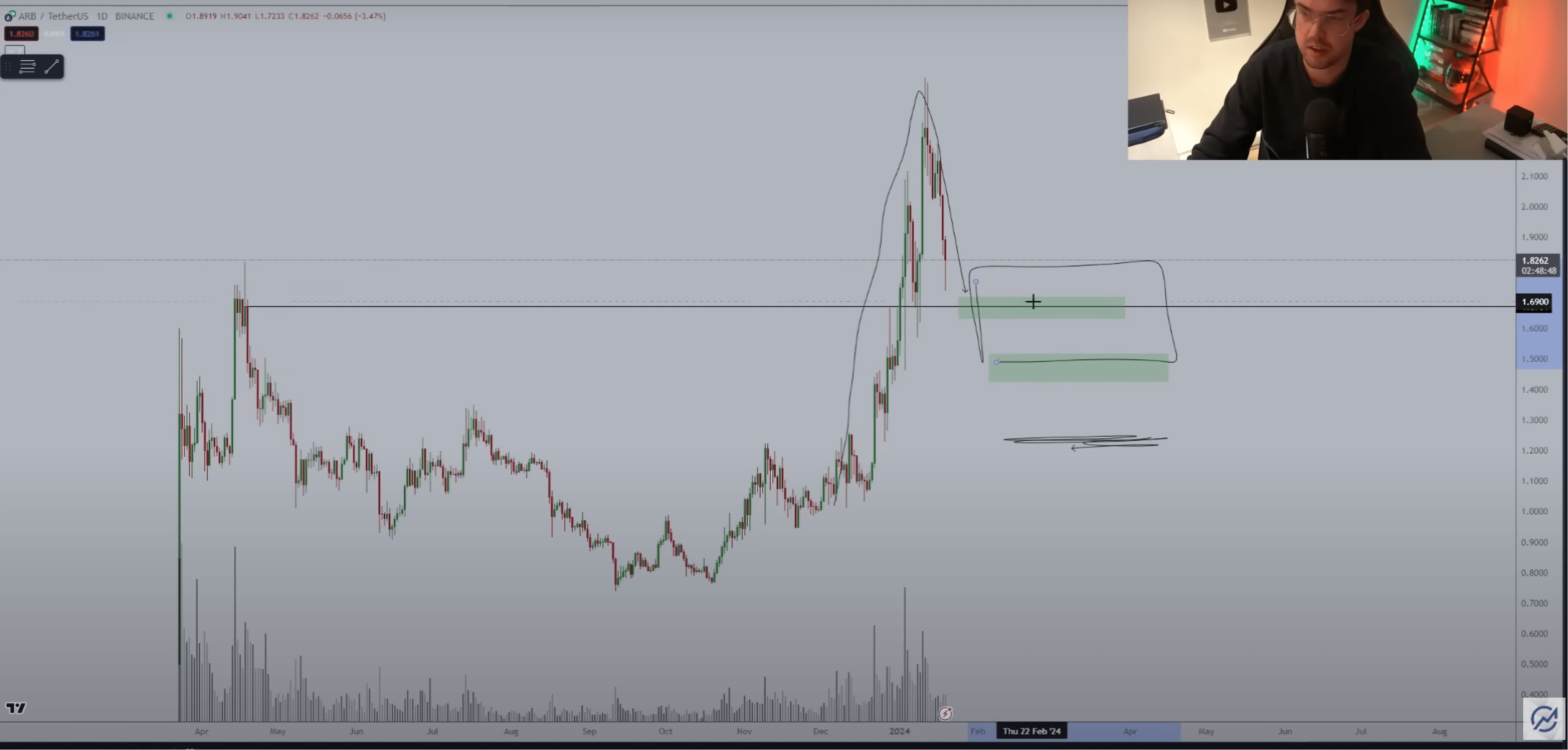

The third altcoin for the analyst is Arbitrum. Focusing on ARB's recent price action and the potential for a significant rally, Van der Poppe identified key entry points, saying: “Anywhere in that ballpark between $1.67 and $1.50 is where you want to make an entry point.” He stressed the potential growth, saying: “If there is another push that happens, it will go to $3.50 or $5.”

At press time, the total cryptocurrency market capitalization reached $1.473 trillion after being rejected at the 0.382 Fibonacci retracement level.

Featured image from iStock, chart from TradingView.com