Recap of January 19th

- Wheat futures rose at the end of the week amid technical buying supported by improving global demand for exports as seen in the export sales report which beat analysts' expectations. However, wheat recorded its third consecutive weekly loss. Soybean prices fell on Friday for the fifth week in a row under pressure from improving weather for Brazilian crops and concerns about demand for US exports. Corn futures fell for the sixth straight week despite recording a higher close on Friday supported by net US corn sales at a five-week high, including the first purchase of US corn from China in three weeks. the Corn March Future added 1½ cents to close at $4.45 per unit; The subsequent months were mixed. chicago March wheat 7¾¢ was added to close at $5.93 per unit. Kansas City March wheat 2¾¢ was added to close at $6.08 per unit. Minneapolis He walks wheat It rose 7½ cents to close at $6.95 per unit. March soybeans ¼™ fell to close at $12.13 per unit; Subsequent decades were mixed within a narrow range. March soybean meal It fell $4.80 to close at $356.50 per ton. August futures advanced. Soybean oil for March It fell 0.72 cents to close at 46.9 cents per pound.

- US stock markets closed higher again on Friday, with the S&P 500 hitting a new record high after more than 500 trading days without one happening. Technology stocks led the way after a positive earnings report earlier in the week from Taiwan Semiconductor Manufacturing Co., which led to a rebound in stocks like Nvidia, Advanced Micro Devices and Broadcom. the Dow Jones Industrial Average The stock increased 395.19 points, or 1.05%, to close at 37,863.8 points. the Standard & Poor's 500 It rose 58.87 points, or 1.23%, to close at 4839.81 points. the Nasdaq Composite The stock increased 255.32 points, or 1.7%, to close at 15,310.97 points.

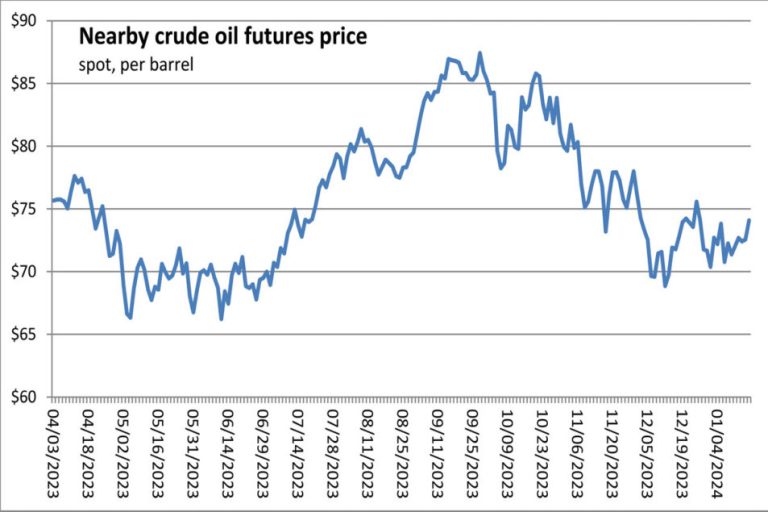

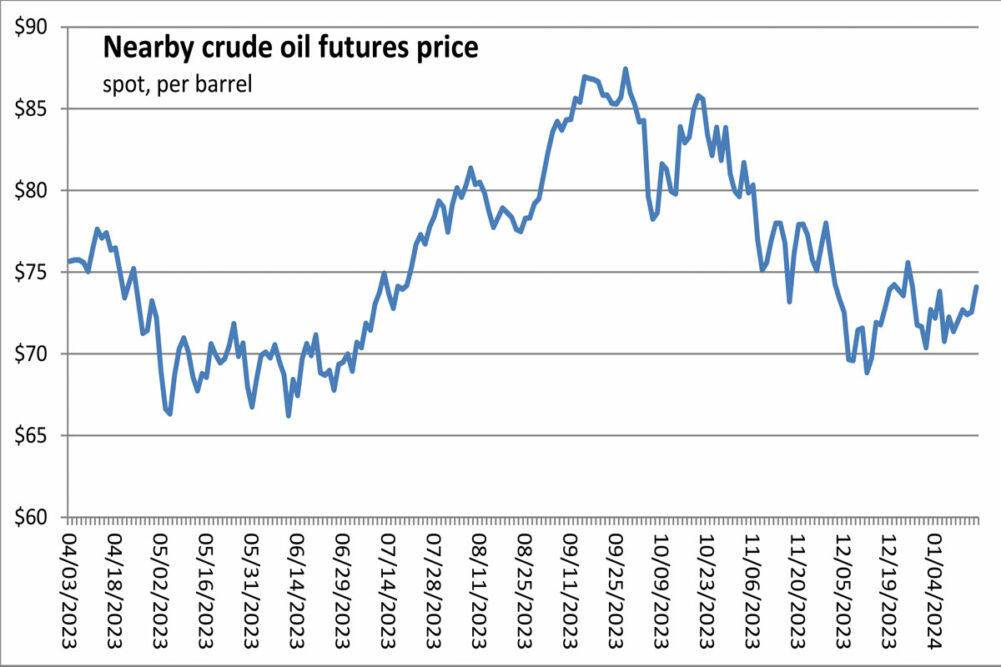

- US crude oil Prices were lower on Friday. February West Texas Intermediate Light crude fell 67 cents to close at $73.41 a barrel.

- the US dollar index He went down on Friday, ending a four-session winning streak.

- American gold Futures It closed higher on Friday. The February contract added $7.70 to close at $2,029.30 an ounce.

Recap of January 18th

- U.S. wheat futures rose on Thursday along with Euronext wheat, rebounding from declines seen the previous day that sent some contracts down to seven-week lows. Support for wheat also came from the World Trade Organization, which reported wheat shipments through the Suez Canal fell by almost 40% in the first half of January to 500,000 tons due to terrorist attacks launched by Houthi rebels in the Red Sea and Gulf of Aden. US soybean futures also rebounded from two-year lows in short covering and technical buying. Corn futures rose from three-year lows on heavy global supplies in a round of short covering. the Corn March Future added 1¾¢ to close at $4.44 per unit. chicago March wheat 3 cents were added to close at $5.85 1/2 per unit. Kansas City March wheat 11¼¢ was added to close at $6.05 per unit. Minneapolis He walks wheat rose 7¾¢ to close at $6.88 per unit; March and May 2025 were lower. March soybeans rose 7¾¢ to close at $12.13 per unit; The subsequent months were mixed. March soybean meal It added $2.60 to close at $361.30 per ton. Soybean oil for March It fell by 0.08 cents to close at 47.62 cents per pound. The subsequent months were mixed.

- US stock markets closed higher on Thursday, supported by IT stocks such as Taiwan Semiconductor, Qualcomm and Apple. the Dow Jones Industrial Average The stock increased 201.94 points, or 0.54%, to close at 37,468.61 points. the Standard & Poor's 500 The stock increased 41.73 points, or 0.88%, to close at 4,780.94 points. the Nasdaq Composite It rose 200.03 points, or 1.35%, to close at 15,055.65 points.

- US crude oil Prices were higher on Thursday. The price of West Texas Intermediate Light crude for February rose by $1.52 to close at $74.08 per barrel.

- the US dollar index It closed higher again on Thursday for the fourth straight trading session.

- American gold Futures It closed higher on Thursday. The February contract added $15.10 to close at $2,021.60 an ounce.

Recap of January 17th

- Soybean futures fell on Wednesday due to improvement in South American growing areas and Brazilian soybean shipments to China, an indication that U.S. supplies face intense competition. Pressure from increased global supplies sent corn futures prices falling to a three-year low on Wednesday. Chicago wheat futures rose while all other contracts fell as the US dollar strengthened and neighboring markets exerted pressure. the Corn March The future fell 1¼ cents to close at $4.42 per unit. chicago March wheat It rose by ½™ to close at $5.82 ½ per unit, but all subsequent months were lower. Kansas City March wheat It fell 7½ cents to close at $5.94 per unit. Minneapolis He walks wheat It fell 10½ cents to close at $6.80 per unit. March soybeans It fell 21½ cents to close at $12.05 per unit. March soybean meal It fell $12.5 to close at $358.70 per ton. Soybean oil for March It rose 0.45 cents to close at 47.70 cents per pound.

- US stock markets fell further on Wednesday, with a sell-off attributed to pessimism over the Federal Reserve's interest rate path that offset a Commerce Department report that showed US retail sales rose a seasonally adjusted 0.6% in December from the previous month, a larger-than-expected percentage. The gains followed a healthy 0.3% increase in November. the Dow Jones Industrial Average The stock fell 94.45 points, or 0.25%, to close at 37,266.67 points. the Standard & Poor's 500 The stock fell 26.77 points, or 0.56%, to close at 4,739.21 points. the Nasdaq Composite The stock fell 88.73 points, or 0.59%, to close at 14,855.62 points.

- US crude oil Prices were mixed on Wednesday. February West Texas Intermediate Light crude oil rose 16 cents to close at $72.56 per barrel, while the March contract fell 4 cents to close at $72.48 per barrel, and subsequent months were also lower.

- the US dollar index It closed higher again on Wednesday for the third straight trading session.

- American gold Futures It closed lower again on Wednesday. The February contract fell $23.70 to close at $2,006.50 an ounce.

Recap of January 16th

- Export inspections at the high end of trade expectations and a record soybean crush in December supported soybean futures on Tuesday in choppy trading that included mixed data on South American production. Corn futures continued to fall after one trading day after the USDA estimated a record high in 2023 U.S. corn production and larger-than-expected global supplies. Weak global demand and indirect pressures from corn kept wheat futures on a bearish trajectory after the long weekend. the Corn March Future fell 3½ cents to close at $4.43 per unit. chicago March wheat It fell 14 cents to close at $5.82 per unit. Kansas City March wheat It fell 13¾¢ to close at $6.01 per unit. Minneapolis He walks wheat It fell 8¾¢ to close at $6.90 per unit. March soybeans rose 3 cents to close at $12.27 per unit; Ease the contract for September onwards. March soybean meal It added $9 to close at $371.10 per ton. Soybean oil for March It fell 1 cent to close at 47.25 cents per pound.

- US stock markets closed lower on Tuesday and all three major indexes fell for 2024 as investor optimism about the Federal Reserve's interest rate path gave way to increased market scrutiny halting the recent bond rally. the Dow Jones Industrial Average The stock fell 231.86 points, or 0.62%, to close at 37,361.12 points. the Standard & Poor's 500 The stock fell 17.85 points, or 0.37%, to close at 4,765.98 points. the Nasdaq Composite The stock fell 28.41 points, or 0.19%, to close at 14,944.35 points.

- US crude oil Prices fell on Tuesday. February West Texas Intermediate Light crude fell 28 cents to close at $72.40 a barrel.

- the US dollar index Stocks closed higher on Tuesday, ending the weekend with stronger closes after weakness earlier last week.

- American gold Futures It closed lower on Tuesday. The February contract fell $21.40 to close at $2,030.20 an ounce.

Recap of January 11th

- Corn futures fell to their lowest levels in three years after the USDA said 2023 U.S. corn production was at a record high and December 1 corn inventories were at their highest levels since 2018. Corn market pressure weighed on the wheat complex, as USDA report indicating wheat stocks. It rose to 1.410 billion buses as of December 1, the largest since 2020. The ministry also increased global wheat stocks, although this forecast remained at an eight-year low. Soybean futures fell to 26-month lows as USDA's higher-than-expected assessment of the Brazilian crop offset US soybean inventories on Dec. 1 at 3 billion bus, down from 3.021 billion a year earlier and the lowest level since 2020. . Corn March The future fell 10¾ cents to close at $4.47 per unit. chicago March wheat It fell 7¾¢ to close at $5.96 per unit. Kansas City March wheat It retreated ¾™ to close at $6.15 per unit. Minneapolis He walks wheat It fell ½¢ to close at $6.99 per unit. March soybeans It fell 12¼ cents to close at $12.24 per unit. March soybean meal The price of crude fell by 10 cents to close at $362.10 per ton. Soybean oil for March It fell 0.47 cents to close at 48.25 cents per pound.

- US stock markets were mixed on Friday, with the Dow Jones Industrial Average falling during the day while the S&P 500 managed to near a record high despite big declines in airline stocks and companies that rely on discretionary spending. However, all three posted weekly gains after falling in the first week of 2024 Dow Jones Industrial Average The index fell 118.04 points, or 0.31%, to close at 37,592.98 points. the Standard & Poor's 500 It rose 3.59 points, or 0.08%, to close at 4783.83 points. the Nasdaq Composite It rose 2.57 points, or 0.02%, to close at 14,972.76 points.

- US crude oil Prices rose again to end the week amid tensions in the Middle East. February light sweet West Texas Intermediate crude added 66 cents to close at $72.68 a barrel.

- the US dollar index Stock markets ended a two-day losing streak on Friday, while the euro, yen, pound and franc closed lower.

- American gold Futures It closed higher on Friday. The February contract added $32.40 to close at $2,051.60 an ounce.

Component markets

| new ideas. Served daily. Sign up for Food Business News' free newsletters to stay up to date on the latest food and drink news. |

Participate |