The Washington Post/The Washington Post via Getty Images

Authority without wisdom is like an infinitely heavy axe, better suited to being broken than polished– Anne Bradstreet.

It's been a little over a year since we last took them look In the name of a beanie called Wrap Technologies Inc. (Nasdaq: wrap). When we last highlighted this company, its non-lethal product offerings had gained favor with police agencies across the country. However, at the time of writing the last article, this had not led to meaningful sales and, therefore, we labeled the stock an “avoid” at the time. After stagnating for quarters, the stock made a big move higher with the overall market rally that began in late October.

Seeking alpha

Earlier this month, the company It has been terminated Its financial director as well specific New CEO. Knowing that it was more than 12 Months after our recent peak at Wrap Technologies, today we provide an updated analysis of the company.

Company overview:

Company presentation for August

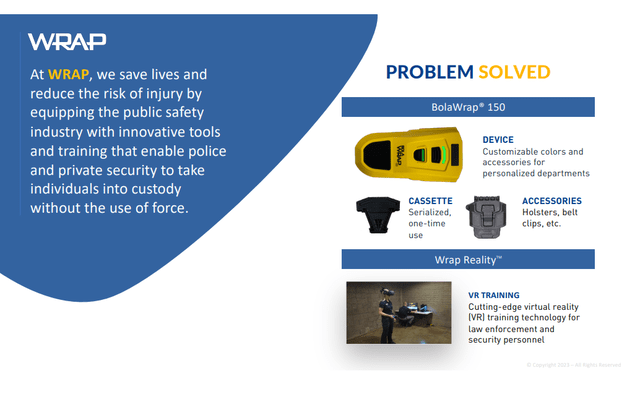

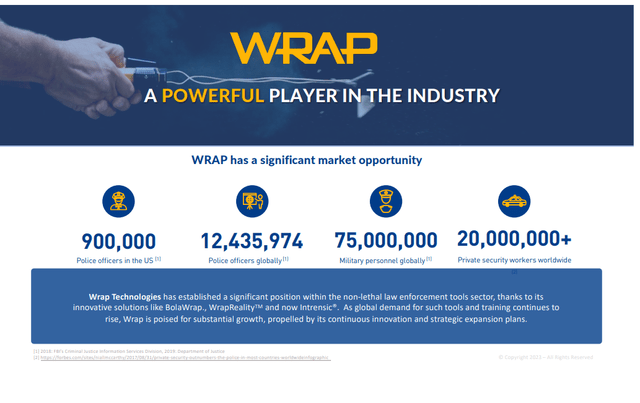

The company is headquartered in Tempe, Arizona, in the same city as Arizona State University, my alma mater. The company focuses on developing non-lethal police product solutions for law enforcement and security personnel. Wrap's flagship product is the BolaWrap 150. It is a hand-held remote restraint device that unloads seven-and-a-half feet of Kevlar rope. The purpose is to entangle an individual from a distance of 10-25 feet. The company also provides virtual reality training system offers using 3D technology. The stock is trading at just under $3.50 per share and has an approximate market cap of $140 million.

Company presentation for August

Third quarter results:

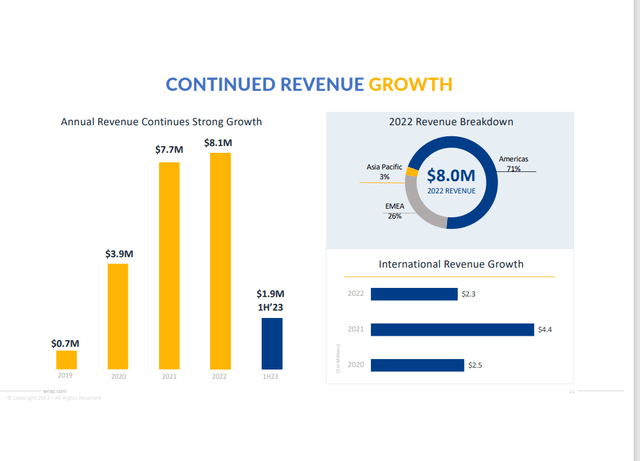

The company announced the third quarter Preparation On November 9th. Wrap Technologies reported a GAAP loss of seven cents per share. The net loss for the quarter was $2.78 million, down from a net loss of $3.87 in the prior period last year. Revenue rose more than 110% year over year to $3.63 million. Sales growth was driven by international buyers. Sales there were $2.29 million for the quarter, compared to just $220,000 in the same period of the year. Sales from the Americas decreased to $1.34 million from $1.48 million in the third quarter of 2022.

The number of trained law enforcement agencies that can use BolaWrap increased 14% to 1,400, and the number of certified officer trainers increased to 5,200. At the end of the quarter, the backlog of orders reached just $385,000. Then the company will end 2023 on a good note Receive The largest order ($4.9 million) in its history. Since that news, the stock is up nearly 20%.

Analysts' comments and balance sheet:

There haven't been any analyst firm ratings for Wrap Technologies over the past year, at least included on TipRanks. Just over 12% of the shares on sale are currently outstanding. There were some very small insider purchases in the second quarter of last year by several insiders when the stock was trading at just over a dollar per share. However, there has been no insider activity in the stock since that time. The company did file A prospectus for a proposed resale of just over 910,000 common shares by the selling shareholders was issued in mid-November. I don't see that listed as inside sales yet.

Wrap Technologies ended the third quarter with just over $14 million in cash and marketable securities on its balance sheet. The company burned through $4.5 million worth of cash in the first nine months of fiscal 2023. The company has no long-term debt.

Verdict:

There are no current earnings for the analyst firm Estimates on packaging technologies for fiscal year 2023 or fiscal year 2024. In fiscal year 2022, the company had sales of just over $8 million.

Company presentation for August

I still find the company's technology interesting. Especially in light of the growing need for non-lethal force to deal with rising mental health issues, homelessness, and the challenges of opioid addiction. However, there are several issues with recommending a WRAP for investment. First, Wrap Technologies, Inc. stock saw… It has been rising significantly recently and appears vulnerable to some profit taking. Second, there is no analyst coverage or sales/earnings estimates across the company. Wrap Technologies orders also seem few.”Massy, and it is difficult to impossible to predict when a company might become profitable. Finally, given current cash balances, a capital raise could be on the horizon sometime this year. Therefore, I have no investment recommendation for WRAP, although I will monitor this developing story.

Company presentation for August

Trying to achieve good by force is like trying to provide a person with a picture gallery at the expense of gouging out his eyes“―Ayn Rand.