This week, our top cryptocurrencies – XRP (XRP), Dogecoin (DOGE), and Injective (INJ) – take center stage, in the wake of Bitcoin's (BTC) decline and the global cryptocurrency market cap losing around $100 billion due to rising prices and dumps. .

Bitcoin reached a two-year high of $49,000 on January 11, when Bitcoin ETFs began trading in the US since then. The asset fell and is now trading at $41,807.60, up just 0.34% on Sunday, January 21.

XRP is competing for $0.55

The recent market crash affected most mainstream assets, and XRP did not escape the attack.

Recall that XRP fell to a low of $0.50 on January 3 amid a mixed start to the year.

The asset eventually recovered from this slump, regaining the pivotal price threshold of $0.55.

However, this week saw bears attempt to push XRP below the price level. The downtrend from the previous week extended into this week, resulting in a bearish consolidation between the low of $0.5216 and high of $0.5895.

XRP reached this high level on January 15, at the beginning of the week. However, the bears beat it below the price threshold, and it has continued to make lower lows since then, falling to the $0.55 region. XRP strongly defended the $0.55 support, but eventually abandoned it on January 18.

As downward pressure increased, the asset collapsed to a low of $0.5216 on January 19. XRP made a comeback, rising 1.67% the day after reclaiming the $0.55 area. The token is currently trading at $0.5525, and he is seeking to close his position above this price point.

Failure to do so will trigger support at $0.5487, which is XRP's last defense against further declines. The asset should record a calculated move to the January 9 high at $0.5780, currently located at the Fibonacci level. 0.382. Closing above this resistance level may indicate an imminent price reversal.

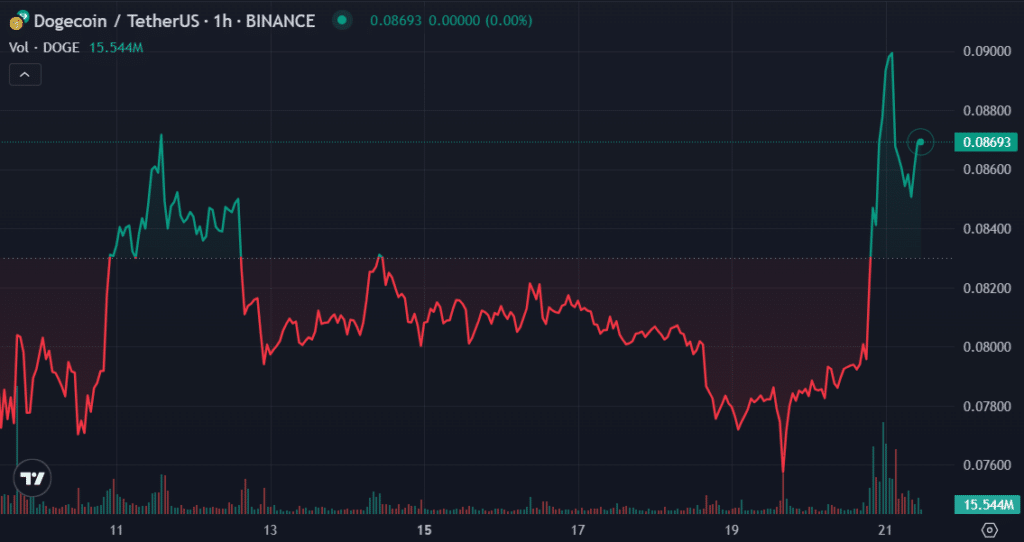

Dogecoin bucks trend with 7% gain

Dogecoin showed exemplary resilience amid fears of downward pressure this week.

While Bitcoin and other assets faced largely bearish consolidation throughout the week, DOGE posted impressive gains, looking to close out the week with a 7% surprise gain.

While other assets fell, DOGE started the week on a positive note, rising to a high of $0.08258 on January 16. However, the dog-themed memecoin eventually fell to a low of $0.07484 on January 19, breaking down below crucial support levels. At $0.08 and $0.075.

The Dogecoin breakout came on January 20, when the cryptocurrency asset rose to a high of $0.09058, breaking through the pivotal $0.09 resistance point in an attempt to grab $0.1. Despite the barrier at the $0.09 level, DOGE showed resilience, closing the day with a massive gain of 11.71%.

Dogecoin began a renewed uptrend on January 21, rising to $0.09046. However, the bears took over the scene, leading to a decline to $0.08468. Despite recent resistance, DOGE stock rose 7.6% this week, securing a spot among the week's top 10 gainers.

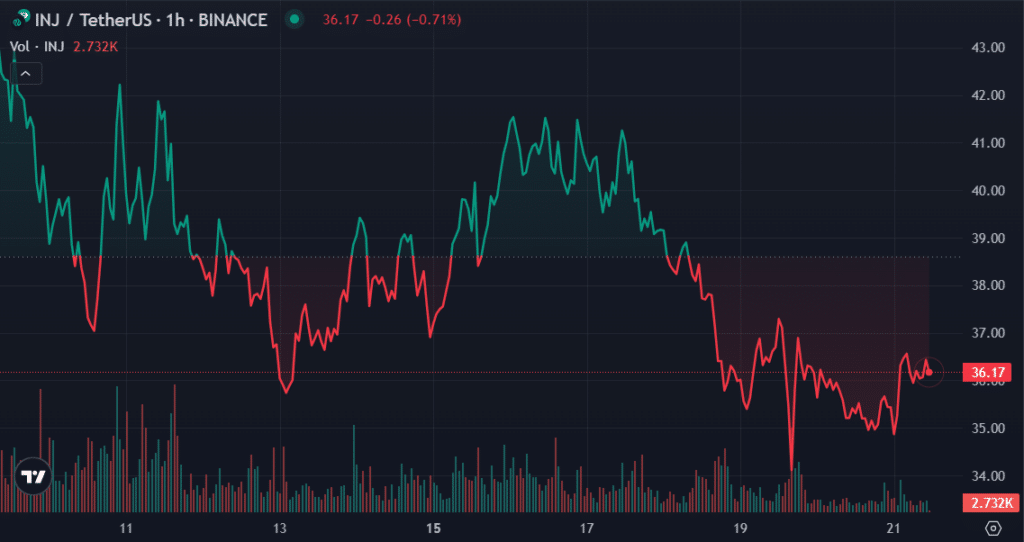

Injection forms a bullish flag

Injective succumbed to the bearish pressure prevailing in the cryptocurrency scene this week. The asset reached a high of $41.9 on January 16 after an 11% gain over the previous day. However, this upward movement was negated by the correction that followed.

INJ posted three consecutive intraday losses from January 16-18, facing an 8.18% decline on January 18, its biggest collapse since January 7.

The continued decline took the asset below $37. Injective is currently looking to recover some of those losses, trading at $36.2 with a 2.25% upside today.

Zooming out, INJ appears to have formed a bullish pennant structure amid ongoing consolidation. It is worth noting that the flagpole was formed from December 6 to 24.

The asset rose 161% from $17.19 on December 6 to a high of $44.89 on December 28, forming a tall flagpole.

However, after peaking at $44.89, Injective hit a roadblock, resulting in a slight bounce and subsequent consolidation.

This consolidation extended into this week, resulting in the formation of the pennant. This structure usually indicates that an uptrend has paused and a continuation is on the horizon.