After rising costs and fragile consumer demand hit U.S. companies last year, Wall Street now expects corporate profit margins to rebound during the first half of 2024, as more companies resort to layoffs, technology or other cutbacks in an attempt to protect their bottom line and ward off investor anxiety. .

This rebound will come after a broader downward drift in margins — or the share of a company's sales that ultimately ends up profitable — since 2021, when many companies were unable to cope with the booming and newly reopened economy. But after the fourth quarter of 2023, when margins are expected to reach their lowest level since the pandemic lockdown, they could rise again, analysts forecast, to break the 12% mark again by the summer, according to FactSet.

“It is interesting to note that analysts believe S&P 500 net profit margins will improve in the first half of 2024,” John Butters, senior earnings analyst at FactSet, said in the report.

But that rise in profit margins will come as companies like Xerox Holdings Corp. XRX,

wayfair w company,

And Messi M,

Laying off employees. Nike Inc.,

It said last month that it plans to cut up to $2 billion in expenses over the next three years.

Discounts come in other forms, too. Macy's closes its stores. health cv health cv,

It is closing some of its Target Corp. pharmacies. TGT,

Locations. Even Walmart — which investors have been kinder to as more customers seek cheaper groceries — is said to be closing its startup incubator.

FactSet, in a report on Friday, said it currently expects fourth-quarter earnings margins for S&P 500 companies combined to reach 10.7%. This number will be lower than the previous quarter and the same period last year. It will also be the lowest margin number since the second quarter of 2020.

Many companies have not yet announced their fourth-quarter earnings, and analyst expectations typically decline as markets digest more results. Currently, analysts see profit margins rising to 11.7% in the first quarter of this year and 12.1% in the second quarter, according to a FactSet report.

This would return margins to levels reached in 2022. At the time, many companies were looking to offset higher employee wages and used supply shocks caused by the Russian invasion of Ukraine to push higher prices, for things like gas and groceries, onto customers and retain With it. Those prices went up.

Since then, price shocks have forced many shoppers to abandon excessive spending on clothing, furniture and electronics in favor of basics. Some economists have said that corporate profit hoarding is the main reason prices are rising and remaining high compared to pre-pandemic levels. However, others say companies maxed out their pricing power last year, after exhausting consumers with profit margins.

But even when companies try to shore up margins, higher margins may not necessarily be good for stock prices in the long run.

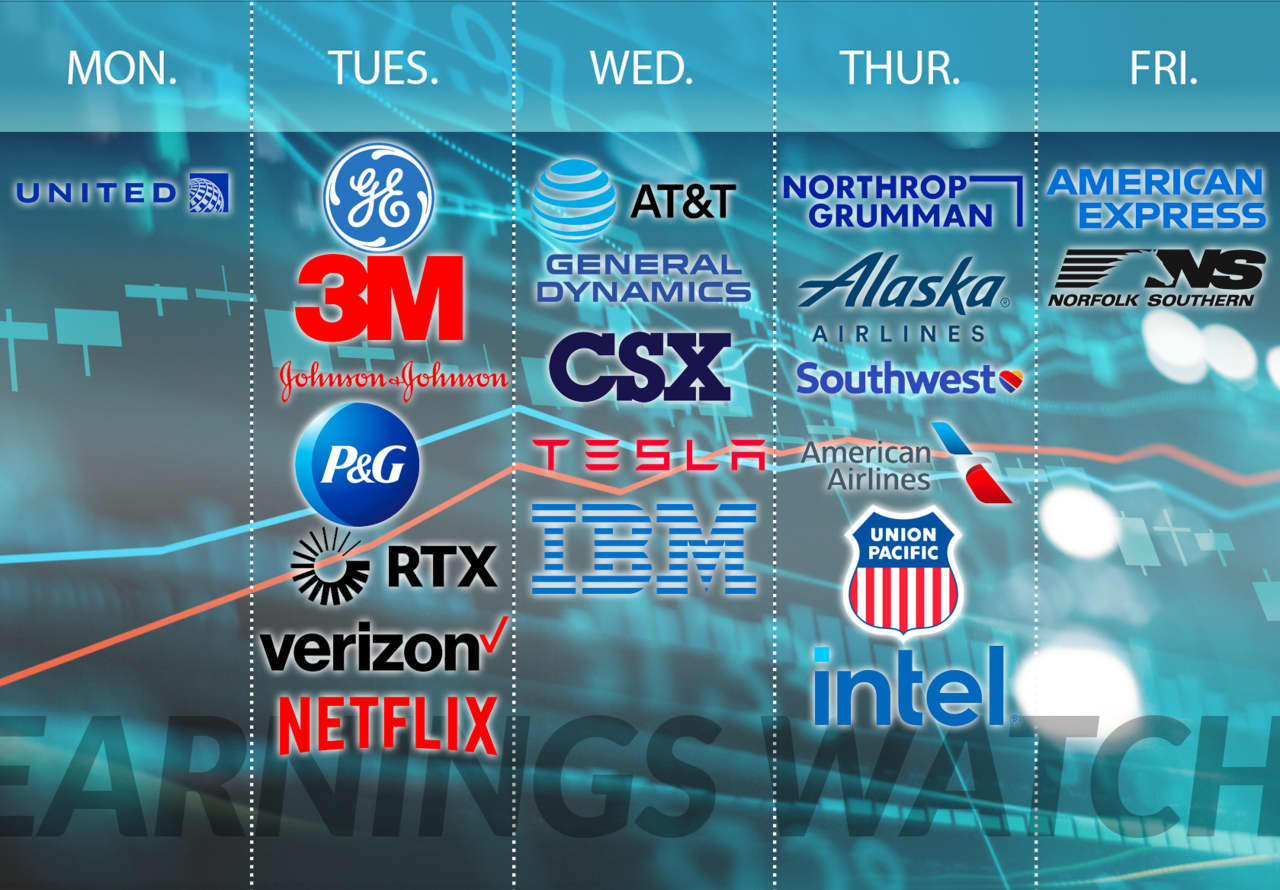

This week in earnings

Meanwhile, two well-known names – streaming giant Netflix Inc. And electric car maker Tesla Inc. – About their results during the week.

When Netflix NFLX,

According to reports on Tuesday, it will all be about the ads, analysts suggest, as the platform's cheaper but ad-packed viewing options show signs of paying off. Bank of America analysts said last week that Netflix had won the “streaming wars,” as rivals consolidated, leaned on their ad-tiered services, cut spending on new shows and movies, or rethought their approach to streaming after last year's strikes. In Hollywood .

“These changes (e.g., reduced content spending/production, increased third-party licensing) were a tacit acknowledgment that not all media companies will be able to achieve Netflix's global reach and streaming scale,” said Jessica Reeve Ehrlich, analyst at Bank of America. . he said in a research note on Wednesday.

However, Benchmark Research analyst Matthew Harrigan remained skeptical about potential stock gains from here, saying that Netflix's “long-term business characteristics” [are] Closer to other major media companies.

tesla TSLA,

Meanwhile, the results will be announced on Wednesday. The automaker faces a lot of questions ahead of the results: specifically, the trajectory of its earnings, after cutting prices for its cars to stimulate demand; rising interest rates and concerns about slowing electric vehicle adoption; Whatever happens in China's economy; Whatever happens with plans to make a cheaper car currently referred to as the “Model 2”; The degree of control over the company that Elon Musk would be happy to have.

Either way, over the coming months, we're bracing for “growing pains,” said Wells Fargo analyst Colin Langan.

Tesla also temporarily halted production at a factory in Germany, according to reports, citing disruptions to shipping routes due to attacks on ships in the Red Sea carried out by Houthi militants, a group in Yemen supported by Iran. This topic could come up more on earnings calls in the coming weeks.

More broadly, 75 S&P 500 companies are scheduled to report next week, including 10 Dow Jones companies, according to FactSet. They include General Electric Company GE,

3M MMM,

ibm International Business Machines Corporation,

Intel Corporation, INTC.

Results are also due from rail operators CSX Corp. CSX,

union Pacific Corp UNP,

As retailers navigate an uncertain economy, they try to remain cautious about the products they order, which impacts what is shipped via rail and truck. Norfolk Southern Corp NSC,

Also, reports say, after one of its trains derailed in Ohio last year and led to larger questions about its safety protocols. And a number of defense contractors – Lockheed Martin LMT,

rtx corp rtx,

General Dynamics GD, Inc.

Northrop Grumman Corp. (NOC)

– A report amid the escalating conflicts in Ukraine and the Middle East.

Calls to put on your calendar

Airlines: The airline industry was upended this month by new problems with Boeing's 737 MAX planes and efforts by JetBlue Airways Corp.

and Spirit Airlines Inc.

To fight a federal judge's ruling blocking a planned merger between the two companies. Airlines reporting results this week can talk about both issues, how they could affect air travel, competition, and what travelers pay to fly in an industry already controlled by just four airlines.

Alaska Air Group ALK,

— The airline whose Boeing 737 Max 9 plane suffered a window explosion this month, prompting the government to ground 171 Max 9 planes — announced results on Thursday. United Airlines UAL,

Reports earlier in the week, on Monday. Both companies operate dozens of Max 9 aircraft, and can provide more context on the impact on their airline networks and the bottom line.

These results, in addition to earnings reports during the week from Southwest Airlines LUV,

And American Airlines AAL,

It will arrive as analysts speculate about Spirit Airlines' potentially bleak prospects as an independent airline, and what the court ruling means for other potential merger deals in the airline industry. Executives can offer their take on travel industry dynamics for the year ahead, as revenge travel fades and the courts decide how many airlines consumers can eventually choose from.

Numbers to watch

Visa, Capital One, American Express: In the fourth quarter, credit card provider Discover Financial Services DFS,

Allocate an additional $1 billion to prepare for the possibility of consumers defaulting on bills. WFC Wells Fargo & Co.,

Special provisions for credit losses jumped 34%, amid caution about the condition of credit card holders and the commercial real estate sector. When Visa Inc. V,

Capital One Financial Company COF,

Thursday's report results, followed by American Express AXP,

On Friday, the results will provide more color for the cautious consumer.