Nora Carroll Photography/Moment via Getty Images

2024 is off to a racing start, with the S&P 500 (SPY) hitting a new all-time high. After a brief decline at the beginning of the year, the index has risen approximately 1.5% year to date. Amazon (Nasdaq: AMZN) The stock followed a similar pattern and gained just over 2%. The company will report fourth-quarter earnings and full-year earnings on February 1 after the market closes. You will be able to listen to the conference call here.

Here are some things to watch for this year.

Will AWS growth accelerate?

Here are three reasons for optimism.

Artificial intelligence (AI) can be a massive growth driver for Amazon Web Services (AWS), and I'll cover it below. However, there is another reason I am optimistic that growth will accelerate in 2024: new budgets.

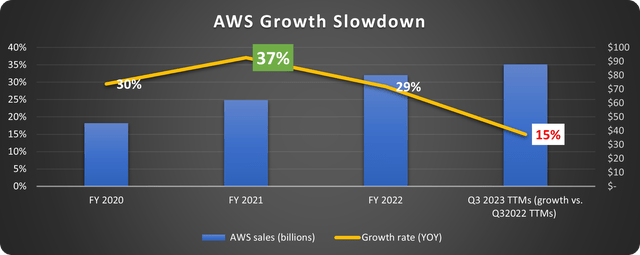

Many of us (perhaps the vast majority) expected a A recession in 2023 that never materialized. This includes companies that use cloud data. Much of AWS' revenue operates as a utility – users pay for the data they use. It's a wonderfully secular model as data usage is almost guaranteed to increase dramatically over time. But it hurts in 2023, as shown below.

Data source: Amazon. Chart by author.

Companies across industries have cut data usage budgets in the past year. This is what happens when an economic slowdown occurs or is widely expected.

The second thing that has happened is that many companies that are still operating on-premise have paused moving to the cloud in 2023. Companies will not plan to make costly changes before the recession hits. You might be thinking: “Okay, but many are predicting a recession this year as well.” Although this is true, I don't think companies will cling to the idea of ”maybe” for two years in a row.

Finally, the massive data needs of generative AI can have a catalytic effect. This third piece is also related to budget. We will see companies investing in new technologies and experimenting with them for years.

Much of the consternation over Amazon's performance has been the significant slowdown in AWS' growth. The stock could take off if AWS sales accelerate. Q1 2024 results will be a great indicator.

Can advertising maintain momentum?

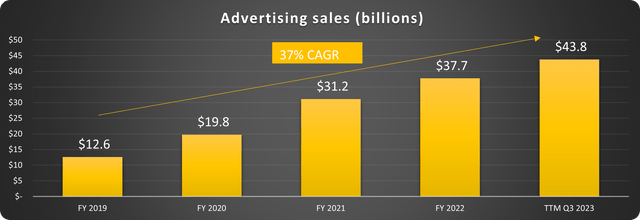

Digital advertising has been a revelation in the past year. The overall ad market has been flat, but Amazon's PPC, product placement and other advertising grew more than 20% year over year each quarter, including a 2023 high of 25% in the third quarter. Holiday announcements in the fourth quarter could push that number higher.

The segment has gone from an afterthought to a powerhouse by nearly quadrupling sales in four years, as shown below.

Data source: Amazon. Chart by author.

There are several reasons for this success. First, advertising is in a transition period. There are now many platforms that provide streaming TV, video, and social media platforms. Programmatic is taking hold, and advertisers are thinking beyond TV.

Amazon is an attractive place to move those budgets because these ads reach consumers who are actively looking to buy certain products. The company also uses artificial intelligence to improve advertiser performance. Here is an example:

In advertising, we just launched an AI image generator, where all brands have to do is upload a product image and description to quickly create unique lifestyle images that help customers discover products they love. – CEO Andy Jassy on Q3 2023 earnings call.

This type of value-add initiative will keep Amazon's advertising business growing faster than the industry as a whole.

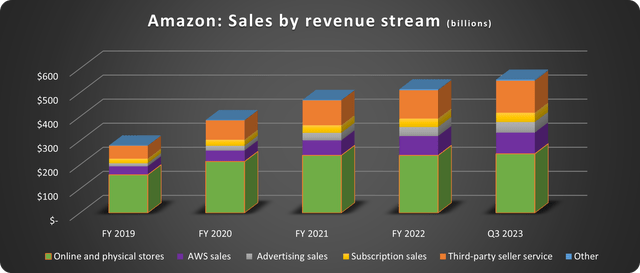

Progress in this sector creates another strong services revenue stream, increasing diversification into sectors with high margin potential, as shown below.

Data source: Amazon. Chart by author.

The difference between 2019 and now is astronomical and a testament to great management.

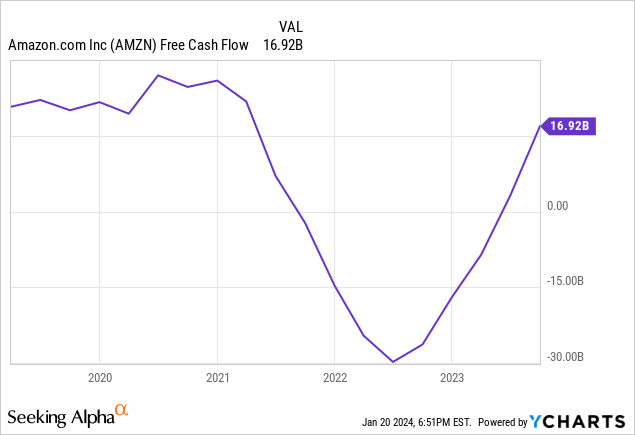

Will free cash flow remain strong?

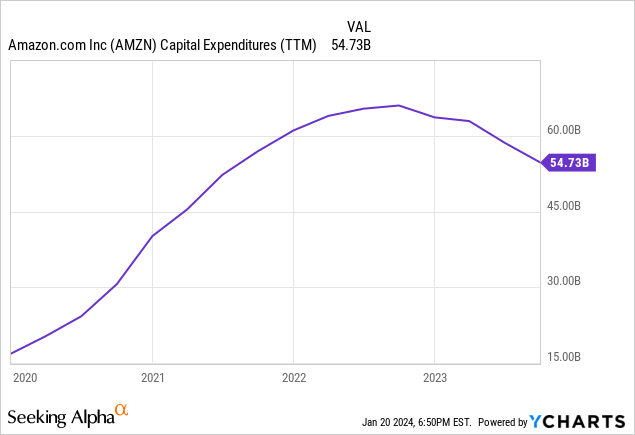

The cash is back! After bottoming out in 2022 due to a slew of rebound coronavirus impacts and heavy capital investment (CapEx). Now, CapEx has stabilized, as shown below.

Other issues such as labor and logistics were also resolved last year, and free cash flow returned significantly:

Tailwinds in Amazon Services revenue could push that number higher in 2024.

Is Amazon stock a buy?

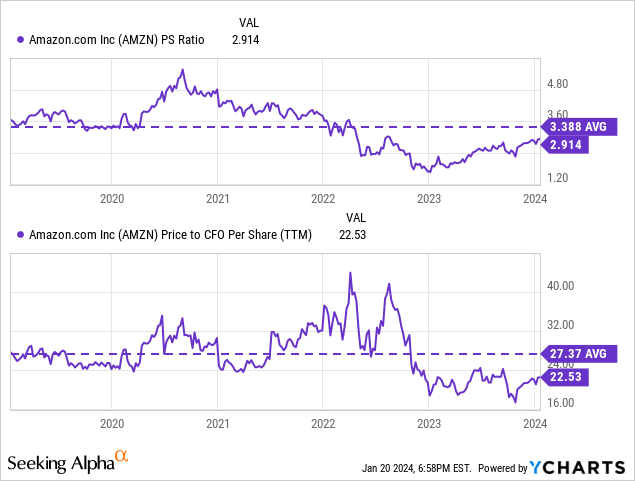

Despite the tremendous performance and fame given to Magnificent 7, Amazon is historically undervalued, 17% below its all-time high, and the price does not reflect the company's potential. There are many ways to value Amazon stock; I prefer to look at it in terms of sales and operating cash flow.

These metrics put the stock 16% to 21% below its 5-year averages. Amazon is a great long-term investment and 2024 will be excellent if AWS, advertising, and cash flow boom.