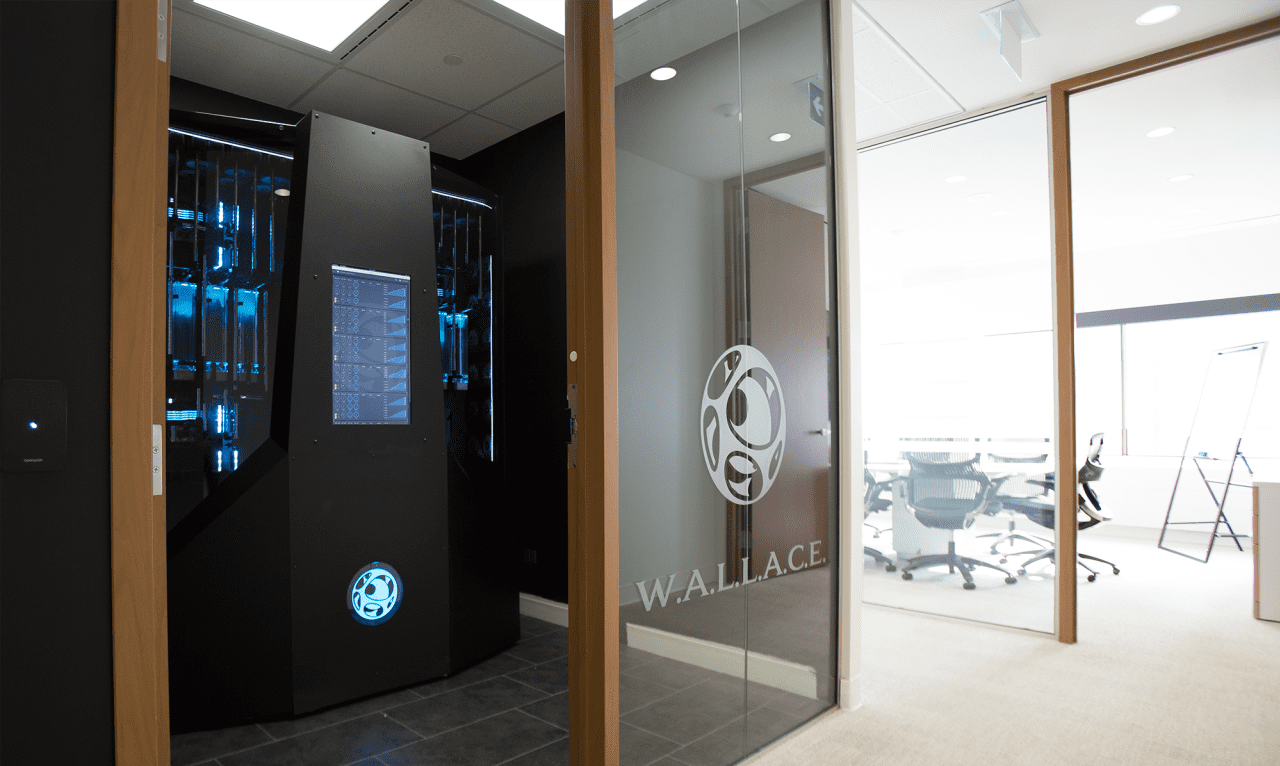

In a downtown Toronto skyscraper one block from the Hockey Hall of Fame, a small hedge fund hopes to find an edge in the financial markets. Castle Ridge Asset Management is betting on Wallace, the custom-designed supercomputer behind a hedge fund's AI-driven trading strategies.

For years, hedge fund players have wondered whether artificial intelligence could help them beat the market, but the AI trading efforts they launched often led to disappointment and were little more than marketing schemes to lure clients' money. With the launch of ChatGPT in November 2022, this new generation of AI hedge fund players has been re-energized.

Castle Ridge, founded by current CEO Adrian de Valois Franklin in 2015, is a relatively small player in the hedge fund world, with about $190 million in assets under management, and operating in a city not known for market production. Hedge funds hit. However, Valois-Franklin believes the investment fund's approach to predicting movements in financial markets using artificial intelligence could make it a serious player in the multi-trillion-dollar hedge fund industry.

Valois-Franklin, a former investment banker with little experience in quantitative trading, claimed that Wallace's main selling point over rival AI-powered hedge funds was his ability to continually improve his own models using evolutionary processes that have been likened to selective breeding.

Speaking to MarketWatch, Valois described Franklin Wallace as a multi-manager hedge fund, where virtual portfolio managers are constantly fighting to see who is best suited to this environment. But the hedge fund boss points out that unlike human portfolio managers, Wallace never needs sleep and never needs a pep talk.

In simple terms, Wallace's evolutionary process sees the machine create thousands of virtual investment portfolios of different weights every day, which are tested and ranked according to their suitability to current market conditions, Valois-Franklin said. In a recurring eight-hour cycle, Wallace selects his best-performing portfolios and prioritizes them for “multiplication.”

“On a daily basis, Wallace will make thousands of copies of himself, each a virtual portfolio manager with different characteristics. He will turn certain weights and patterns up and down, on or off, and then determine whether each portfolio manager is the best or worst fit for his environment.” The market we're in today…if it's better, it makes it more likely to proliferate,” Valois-Franklin said.

“Like a flock of birds”

Castle Ridge has had some success with investment returns. Since Wallace's creation in 2017, the investment fund has generated net annual returns of 12.4%, compared with the S&P 500's SPX returns of 12.1% over the same period, documents seen by MarketWatch show. It is up against deep-pocketed quantitative hedge funds, such as Two Sigma and DE Shaw, that are working on advances in machine learning and artificial intelligence.

Speaking to MarketWatch, Alex Bogdan, chief scientific officer at Castle Ridge, said Wallace's evolutionary approach allows for a deeper level of understanding than the neural networks used by systems like ChatGPT, which are modeled on the human brain.

In Bogdan's view, these evolutionary processes represent the future of artificial intelligence, by allowing machines to go beyond simple imitation. Neural networks, which feature prominently in the form of large language models (LLMs) such as OpenAI's ChatGPT, simply “mimic the responses a human would make when given the same input,” Bogdan explained.

In contrast, Wallace's “genetic algorithms” combine the individual pieces of knowledge they possess, to build on their own understanding and become “progressively smarter.” “What GPTs are are intelligent algorithms,” Bogdan said. “We have enough tradition. We need understanding, not intelligence.”

Early research into artificial intelligence first began in the mid-20th century, against the backdrop of developments in computer science during World War II. In one experiment conducted in 1961, British scientist Donald Michie succeeded in developing a machine made of matchboxes that was able to solve the game of “zeros and crosses” and play against human opponents.

Michie's machine, called the Matchbox Educable Naught and Crosses Engine (or Mence for short), used matchboxes to represent all 304 states of play in a game of tic-tac-toe, with each small box containing beads to determine the relative merits of each position.

The matchbox machine will in turn make moves based on the number of beads in each box, in a system that rewards it with beads for each winning move and punishes by removing beads for moves that result in losing, until it finally solves the problem. A simple game with pen and paper. The systems Wallace uses are based on a subfield of artificial intelligence called “evolutionary computing,” which seeks to solve complex problems using continuously adaptable algorithms.

Like a Michie machine, Wallace draws scenarios to select the most successful scenarios and then leverages those winning strategies. But unlike Michie's matchbox engine, Wallace operates in the complex world of financial markets, where standards are always changing.

Castle Ridge's success depends on its AI machine's ability to adapt to changing market conditions – meaning that unlike Michie's matchbox machine, which quickly solved the game it was designed to play, Wallace must constantly adapt his strategies.

“The system is not trying to determine what will happen in the market. It is trying to predict how players in the market will react to the news as it happens. From this perspective, the system is less interested in the fundamentals of the cards that are dealt in this game of poker, and more interested in the stories of the other players at the table.”

Castle Ridge says that as a byproduct of this strategy, Wallace has successfully predicted a series of market events ahead of formal announcements, based on signals contained in the data he analyses.

Valois-Franklin explains that Wallace looks at markets “like a flock of birds, constantly changing and shifting,” to pick up signs of early moves driven by insider knowledge.

““The system is not trying to determine what will happen in the market. It is trying to predict how market players will react to news in real time.“

These predictions include Wallace's bet on Gilead Sciences GILD,

Before the company sought to acquire New Jersey Biotech Immunomedics in September 2020, the cancer treatment company's shares rose more than 100% after the acquisition was announced.

“Once individual securities start flying away from the flock, that's one signal to Wallace saying: 'Stop it, why are these securities behaving more independently compared to their peers?'” Independence of behavior is often an indicator of the knowledge that is imprinted on the security. Often, when people don't really know anything, they tend to act in conformity with others.

Now hedge fund employees spend their time trying to “crack” Wallace’s system, by adding “unknown unknowns” and providing new data to the AI. In one case, the team provided Wallace with satellite images of Walmart WMT,

Parking lots, to see if the information can help the machine predict consumer behavior.

In Valois-Franklin's view, this type of work may soon occupy the majority of the workday for those who work at the world's largest hedge funds. “It will replace some types of jobs but it will open up capabilities in certain areas. We are not sitting idly by reading research reports but doing other things to help increase the productivity of the system.”