The Pew Charitable Trusts recently reported that retirement assets in active IRAs have reached $1 billion.

Automatic IRAs, which began in 2017 when Oregon launched its OregonSaves program, are now in operation in six other states: Illinois Secure Choice (2018), CalSavers (2019), MyCT Savings (2022), Maryland Saves (2022) , Colorado SecureSavings (2023) and RetirePath Virginia (2023).

Automatic retirement accounts are a response to the problem that only about half of private-sector workers in the United States are covered by an employer-sponsored retirement plan at any given time, and only a small number of workers save without a plan.

Under the new programs, employers that do not offer a retirement plan must facilitate payroll deductions from their employees' paychecks into state-sponsored IRAs. While employee payroll deductions occur by default, employees have the option to opt out.

Many financial services companies have not been big supporters of automatic IRAs – perhaps because they fear that state-sponsored initiatives will erode their business. This concern didn't seem entirely valid. Most undisclosed workers work for small employers and are at the lower end of the earnings scale. This is not really the target market for the financial services industry. It does not seem likely that many companies with plans will abandon these plans in favor of automatically enrolling their employees in a government program that does not match employers.

More importantly, an argument can be made that even the relatively small administrative costs and hassles associated with participating in state auto-IRA programs can encourage companies—particularly those close to the line between offering a plan and not offering it—to set up their own plans. And all the controversy surrounding the creation of these government retirement programs could make retirement saving more prominent. In fact, the results of two recent studies, as well as previous research, support the idea that this trend may be prevailing.

The first piece of evidence comes from a recent survey we conducted to determine the reasons why small employers don't offer retirement plans, which included a direct question about how small employers react to automatic IRAs.

is reading: What's stopping more small businesses from offering retirement plans?

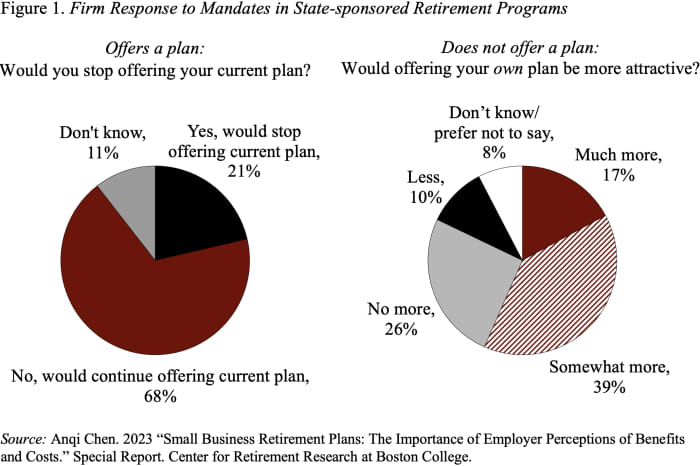

The responses show that the presence of state-sponsored programs does not appear to make companies less likely to offer their own retirement plan (see Figure 1). Of the companies that already offer a plan, about 70% say they would continue to offer their own plans if their state introduced a mandate. Among companies that did not submit a plan, nearly 60% said the mandate would make their offer effective king A more attractive retirement plan. These findings are consistent with a 2017 Pew poll.

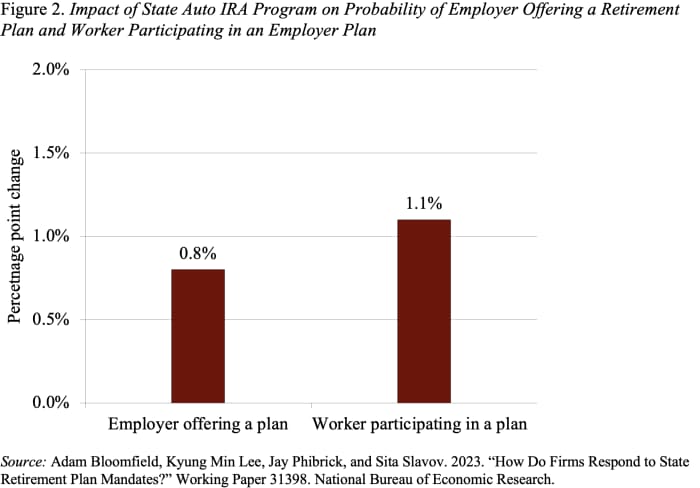

In addition to survey responses, a recent study, based on Form 5500 data and individual-level Census data, found that automatic IRA mandates increase the likelihood of companies offering a retirement plan by 0.8 percentage points and the likelihood of a worker participating in a retirement plan. Employer plan by 1.1 percentage points (see Figure 2).

These statistically significant results confirm previous studies that government automatic retirement accounts complement—rather than crowd out—the private market for retirement plans.

It would be great if the financial services industry could support these automatic IRA initiatives.