(Bloomberg) — The world's best-performing ESG fund for 2023 was created by Ark Investment Management LLC and backed by a big bet on cryptocurrencies.

Most read from Bloomberg

The $2.4 billion Nikko AM Ark Positive Change Innovation Fund (ticker NIPCIPJ LX) returned 68% last year, more than double the gains of the S&P 500. Its largest holding was Coinbase Global Inc., which It makes up nearly a tenth of the fund. This is according to data collected by Bloomberg. The Nikko-Ark fund is registered as “promoting” environmental, social and governance standards under European rules.

This outperformance caps a year in which investing in funds with ESG themes faced significant headwinds. More traditional ESG cleantech assets, such as wind and solar, that were stored in capital-intensive projects in those sectors, have been upended by rising interest rates. But ESG funds that chose other areas of technology performed much better.

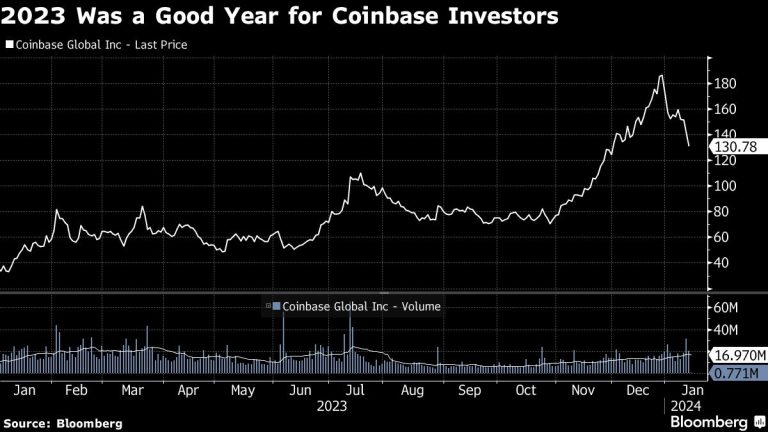

The S&P Global Clean Energy Index's 21% decline last year coincided with a nearly five-fold rise in the market capitalization of Coinbase, the largest cryptocurrency exchange in the United States. Cryptocurrency enthusiasts started 2024 on a high after the US Securities and Exchange Commission moved forward with its highly anticipated approval of a number of bitcoin exchange-traded funds. (Those Bitcoin gains have since evaporated in what some analysts say is a classic case of “buy the rumor, sell the truth.”)

Read More: Coinbase's Bitcoin ETF Position Sparks Envy and Risk

The SEC approval gives Coinbase shares “plenty of room to run,” thanks to its position as “the leading custodian of underlying Bitcoin assets,” said Thomas Hartmann-Boyce, portfolio manager at Arc.

Coinbase “is definitely the most convinced name we have that is within the digital asset category,” he said in an interview.

The fund obtains a model portfolio from Ark Investment Management, founded by Cathie Wood. It is then analyzed and implemented by Nikko Asset Management Co. The investments are in revolutionary technologies that align with the United Nations Sustainable Development Goals, according to Hartmann-Boyce. He acknowledges that Bitcoin consumes a lot of energy to mine, but says the fund's sustainability logic is about transparency around transactions, and providing financial services to the underbanked.

Overall, ESG funds that eschewed traditional green assets and instead turned to technology outperformed last year. Among the best-performing stocks was the JPMorgan US Technology Fund (JPMUSTC LX), which offered nearly 65% to its investors. The fund, like the Nikko Ark portfolio, is registered as “promoting” environmental, social and governance criteria, a category officially known as Article 8 under the EU’s Sustainable Finance Disclosure Regulation.

Ark is targeting a compound annual return rate of at least 15% over the next five years for its high-conviction common stocks, which include Coinbase, CRISPR Therapeutics AG and Block Inc., Hartman-Boyce said. and Pacific Biosciences of California Inc.

Investors in the fund are no strangers to volatility, with 2023's huge gains coming after a more than 50% decline in 2022, according to data compiled by Bloomberg. So far this year, Coinbase's value has declined by about 25%. Of the 28 Coinbase analysts monitored by Bloomberg, 10 of them recommended selling, while the average price target is about 7% lower than the actual trading price.

Peter Graf, Nikko's chief investment officer for the Americas, said the fund remains committed to its strategy and allocations, even against the backdrop of a volatile macroeconomic outlook and a rocky start for technology stocks. “I'm looking forward to making a long-term offering” for sustainability-related innovation, he said.

“We don't want to characterize this as just a pure growth portfolio,” Graf said. “There's also definitely a small-cap flavor; it's really a bottom-up portfolio that has a lot to do with growth. But on a company-by-company basis, the idea is that new technologies — regardless of the business cycle — will succeed.”

–With assistance from Suvashree Ghosh.

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P