Goldman Sachs believes the US economy will grow by more than double the market consensus at the end of 2024, and it has a list of 10 reasons why it is more optimistic than most.

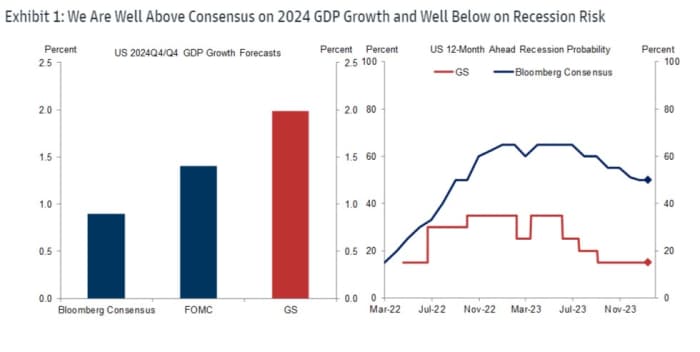

In a note published over the weekend, a Goldman economic team led by Jan Hatzius said it expects U.S. GDP to grow year-over-year by 2% in the fourth quarter of this year, compared to a consensus of about 0.9% in a Bloomberg survey. Economists.

Goldman also sees less than a 20% chance of a US recession in the next 12 months, while the Bloomberg consensus is around 50%.

This prompts Goldman to ask the question: “What are other forecasters worried about that we are not?” To answer, I looked at 10 risks for 2024 often highlighted by other forecasters and explained why they're less concerning than others.

Source: Goldman Sachs

The first risk that many consider is… Consumer slowdown If spending proves unsustainable, the saving rate rises from a low level, or households run out of surplus savings.

But Goldman Sachs says it expects consumption to grow 2% this year because real wage growth will remain positive with nominal wages rising but inflation falling, all while a strong jobs market encourages spending, and contrary to expectations, the exhaustion of excess savings will not the influence. Some fear.

“While spending by low-income households, whose incomes were significantly boosted by the pandemic stimulus, initially rose above trend, it has been returning to normal for some time,” Goldman says.

This links to the second concern of – High rates of consumer delinquency and default rates. “[These] The bank stresses that this mostly reflects normalization from very low levels in recent years, higher interest rates, and riskier lending, rather than the financial resources of poor households.

Next is fear And a sharp deterioration in the labor market. Goldman believes this is unlikely given that employment opportunities remain high and the rate of layoffs remains slow.

“Although some recent data points have been weaker, more statistically reliable signals, such as the salary growth trend and our composite job growth tracker, remain strong,” Hatzius and the team say.

Some observers have expressed concerns about Narrow scope for job growthwhich has recently been dominated by healthcare, entertainment, hospitality, and government.

But Goldman says there are several reasons why there was no such problem, including that these three sectors are not modest in size, accounting for 40% of employment, and the main reason they were attractive to workers is because they were understaffed and had high wages relative to workers. .

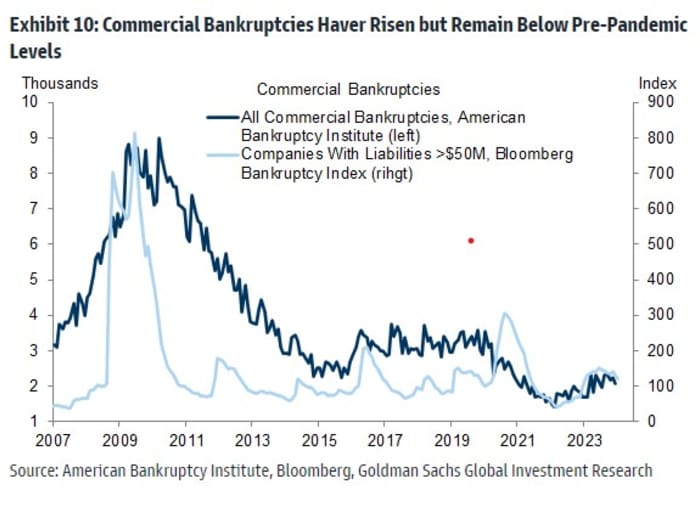

Fifth on the list is a prospect High incidence of corporate bankruptcies. Goldman stresses that companies large and small in general are on “strong financial footing” and that the current number of bankruptcies remains well below the pre-pandemic level. “Although large corporate bankruptcies are somewhat higher, they have only returned to 2019 levels,” Goldman says.

Source: Goldman Sachs

One reason some observers fear corporate pressure is what's on the horizon Debt maturity wall Companies have to refinance at higher interest rates. Goldman believes the impact will be modest, as higher corporate interest expenses will reduce capex growth by 0.1 percentage point in 2024 and 0.25 in 2025, and employment by 5,000 jobs per month in 2024 and 10,000 jobs per month in 2025.

“The effect is small partly because increases in interest expenses should be only moderate, and partly because increases in interest expenses have only modest effects on capital investment and employment,” Goldman says.

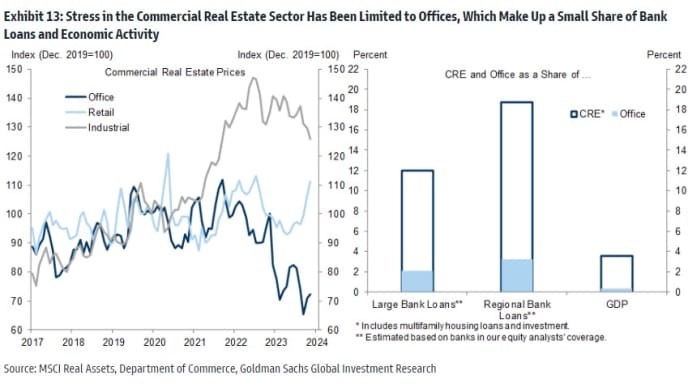

An area of serious concern Commercial real estateRemote work leaves many office buildings half-empty and financially unviable. There are concerns that some lenders will find it difficult to absorb losses in their commercial real estate portfolios.

But Goldman stresses that it is specifically offices, not broadly commercial real estate, that is in big trouble and that office loans represent only 2% or 3% of banks' loan portfolios.

“As a result, banks should be able to manage headwinds from falling office values. In fact, the Fed’s 2023 stress test found that banks subject to these tests will have enough capital to weather even an extreme scenario where [commercial real estate] “Prices fell by 40% and the unemployment rate rose to 10%,” says Goldman.

Source: Goldman Sachs

There are other factors that Goldman thinks are not as big of a problem: Something finally breaksBut the peak of the pain caused by rising interest rates has already passed; – The disappearance of financial support The drawdown will not be what observers fear; a Bank credit crisisbut small businesses did not report a severe lack of access to credit.