While stocks are volatile into the new year, there has been a significant rally in one corner of the commodity market, which industry watchers expect to continue.

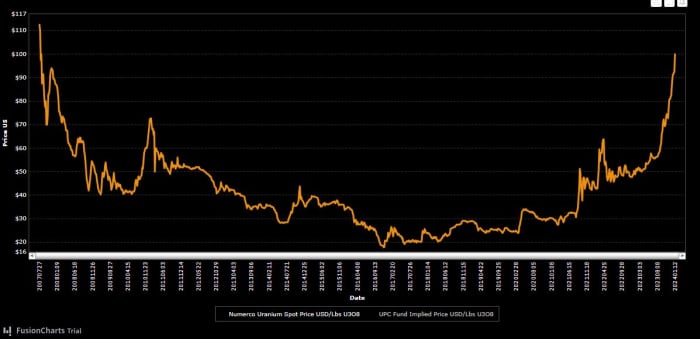

The spot price of uranium, which is vital to fuel nuclear reactors, rose to just over $103 a pound on Monday, a level not seen since 2007, according to a chart from Numerco, a U.K.-based uranium spot price company. This comes after a nearly 90% increase in metal prices in 2023 in a market struggling to keep up with new demand.

“The uranium market is experiencing a major speculative rush as physical shares held by ETFs continue to absorb shares, adding to the distress caused by the prospect of higher demand in the coming years, and a rush to buy from utilities that have… At Saxo Bank: “Investors are getting lazy with hedging after years of falling prices.”

The spot price for uranium ore concentrate, commonly referred to as U3O8.

Numerco

Uranium prices initially rose above $100 a pound last Friday after Kazakhstan's state uranium company said it may not meet production targets. NAC Kazatomprom, the world's largest producer, said it was having difficulties obtaining sulfuric acid used to extract the mineral and was experiencing construction delays at new deposit discovery sites. It was targeting 2024 production volume at 90% of what permits allow.

This adds to production cuts in 2023 from Canadian uranium miner Cameco CCO,

French mining company Orano's operations in Niger, equity analysts Chris Drew and Christopher LaFemina said in a note on Monday.

In their view, uranium prices are on track to collapse after their June 2007 all-time high of $136 per pound. “Furthermore, with term contract volumes barely at replacement levels while spot pricing exceeds $100 per pound, the term pricing setup remains bullish,” the analysts said. “Major producers are still short of pounds.”

This tight market has been amplified by “continuous” buying from Sprott Physical Uranium Trust SRUUF or SPUT, the world's largest physical uranium fund, and Yellow Cake YCA,

An investment vehicle betting on uranium, said Jefferies analysts, who added: “The pressure is on.”

Australian miners Paladin Energy PDN,

boss Energy Bank Of England,

Deep Yellow Limited DYL,

They remain their preferred exposures, even as Jefferies analysts admit that valuations remain “high.” Shares of these mining companies jumped about 7%, 9% and 11%, respectively, on Monday, and each has gained 30% during the year so far.

Yellow Cake shares have risen 15% so far this year, and were up 2.6% in London on Monday.

is reading: Why may the rise in uranium prices, which has pushed prices to their highest levels in 15 years, never end?

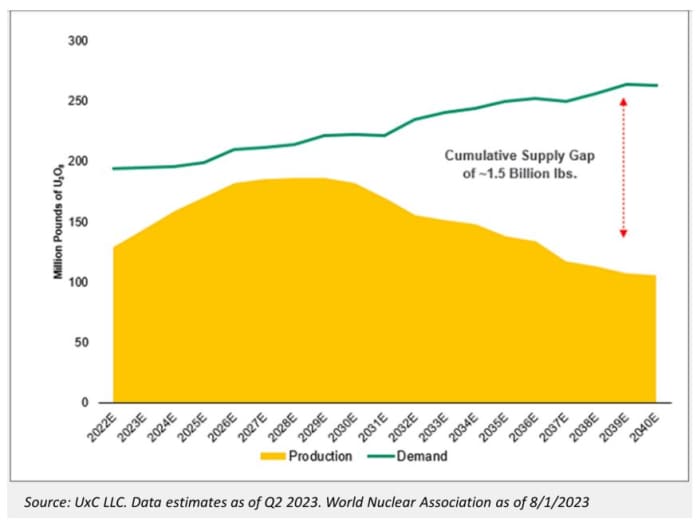

In an interview published last week with Macro Voices, Justin Hohn, founder of Uranium Insider and editor of the newsletter, laid out the basic investment case for uranium via the chart below:

It shows the actual pounds expected to be extracted from the ground on an annual basis compared to the actual burn rate of the global nuclear reactor fleet. “You can see that we are still in deficit even with the peak production expected towards the end of the decade,” Hoehn said.

Since the glut of supply in the 1980s, uranium has been in short supply, with two bull markets in that period and the mid-2000s. “The difference now is that there is very little secondary supply to offset this lack of production,” he said.

Secondary supply refers to the stock held by governments and utilities, which amounted to about £30 million even during the “tumultuous bull market” of the mid-2000s, he said.

Fast forward, he said, there is only 15 million pounds of secondary supply today, with no one who could sell that stock doing so, while the past 18 months have seen China buy aggressively.

So, regardless of the price of uranium, “almost any mine in the world can make a profit,” yet supply shortages will persist, and it will be many years before large new mines are put into operation, Hoon said.

Another pressure on the market is the looming ban on Russian fuel services by the United States, with the Senate voting to move forward with this ban. Ultimately, Russia could retaliate with an export ban rather than accepting a phase-out by 2028 in this legislation. “An immediate ban would have more serious consequences, potentially putting pressure on prices throughout the nuclear fuel chain,” Drew and LaFemina said.

is reading: Hedge fund manager Harris Cooperman who called last year's tech bust bets on Florida, oil rigs and this commodity