Money has flowed into bonds issued by the money center's six big banks, led by Bank of America Corp. and Citigroup Inc., in the past two weeks in a bullish signal from investors ahead of the fourth-quarter earnings season.

Net buying of selected bonds was greater than selling, as spreads against 10-year Treasuries were compressed.

bank of America PAC,

The bonds attracted $461 million in net buying, followed by $441.7 million for Citigroup SE,

$278.3 million to Morgan Stanley MS,

$236.5 million to Goldman Sachs Group Inc. GS,

$138.5 million to JPMorgan Chase & Co. JPM,

and $109.5 million for Wells Fargo & Co. WFC,

According to data from BondCliQ.

JP Morgan attracted the largest volume of the group (see chart below).

Bonds issued by the six largest US banks have attracted more money from investors in the past six weeks.

Bond Click Media Services

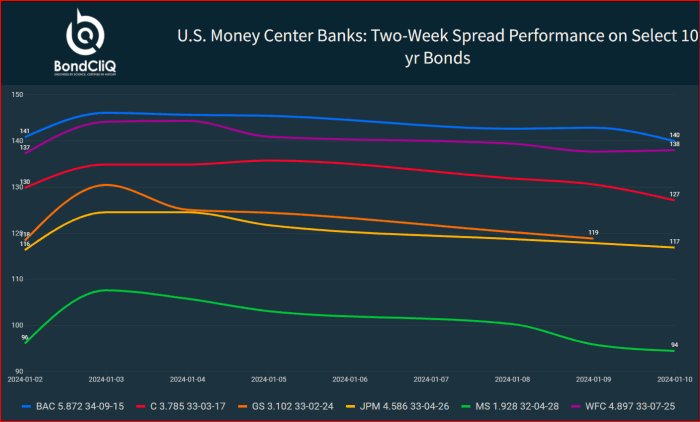

In another bullish sign, basis point Spreads between the six banks' select bonds and the 10-year Treasuries BX:TMUBMUSD10Y have tightened over the past two weeks.

The minimum spread, or difference, between the basis points paid to bondholders and the yield offered on a 10-year Treasury bond is equivalent to investors betting that the debt they are purchasing is less risky.

A higher spread indicates that investors view bonds as more risky compared to Treasuries.

In the case of bank bonds, investors have been betting in recent weeks that the debt is becoming safer (see chart below).

Spreads between bank bond yields and 10-year Treasuries have narrowed, a sign that investors see the debt of big banks in money centers as becoming safer.

Bond Click Media Services

Meanwhile, even as stocks in big banks rose in the fourth quarter, stock prices have cooled in recent days.

The six banks' fourth-quarter earnings season begins Friday, with updates from JPMorgan Chase, Wells Fargo, Bank of America and Citigroup.

Morgan Stanley and Goldman Sachs will announce their results on Tuesday.

During the fourth quarter, earnings estimates from analysts declined as dealmaking stalled and economic headwinds persisted.

Read also: JPMorgan and Bank of America lead the earnings presentation of the largest US banks to end a difficult year