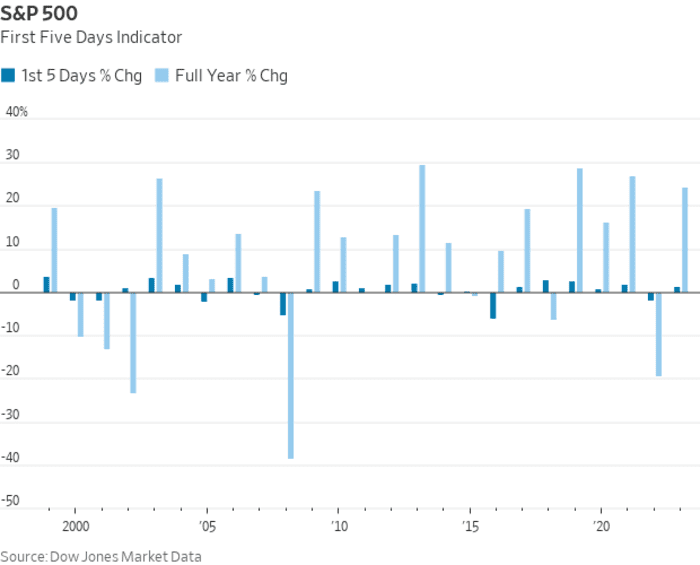

The movement of the S&P 500 during the first five days of a trading year often provides a good indication of how it will perform during the rest of the year, according to historical data. But if so, this does not bode well for stocks in 2024.

Historically, the US large-cap stock index SPX has seen its performance in the first five trading days and over the entire year correlate in the same direction 69% of the time, based on Dow Jones market data going back to 1950. In election years, this correlation has occurred 83% of the time. Of time. This trend has also been true in eight of the past twelve years, and in 14 of the last sixteen years that witnessed presidential elections.

This year, the S&P 500 is on track to post a 1.8% decline over its first four trading days, according to FactSet data. The last time the index fell 1% or more in the first five trading days of a year, in 2022, it lost 19.44% for the full year.

When the S&P 500 posted gains during the first five trading days of the year, it saw an average return of 14.2% over the entire year, according to market data dating back to 1950. When it fell during the first five trading days, it averaged The return is 0.3% for the whole year.

US stocks were mostly lower on Friday, with the Dow Jones Industrial Average down 0.1%. The S&P 500 fell less than 0.1%, and the Nasdaq Composite lost 0.2%.

—Ken Jimenez and Michael DeStefano contributed.