The Biden administration is withholding payments from three student loan servicers amid new evidence of the challenges borrowers faced after resuming payments after a more than three-year freeze.

The Department of Education announced Friday that it will withhold $2 million from Aidvantage, MMS,

$161,000 from EdFinancial and $13,000 from Nelnet NNI,

After it was discovered that the three service providers failed to send bill statements in a timely manner to 758,000 borrowers. Aidvantage's role in repayment was the subject of a recent MarketWatch story that noted the challenges borrowers faced in contacting the company and receiving accurate payment information.

The sanctions announced on Friday follow the department's announcement in October that it would withhold $7.2 million from MOHELA. Now, the department is deducting wages from all four major student loan servicers because of the way they handled the repayment process.

In addition to the sanctions, the Biden administration also provided details Friday about the challenges borrowers faced in the first month of repayment. The Consumer Financial Protection Bureau released a report describing long call wait times for borrowers contacting their servicers, a relatively high rate of calls that were dropped and requests for affordable payment plans that were put on hold for weeks.

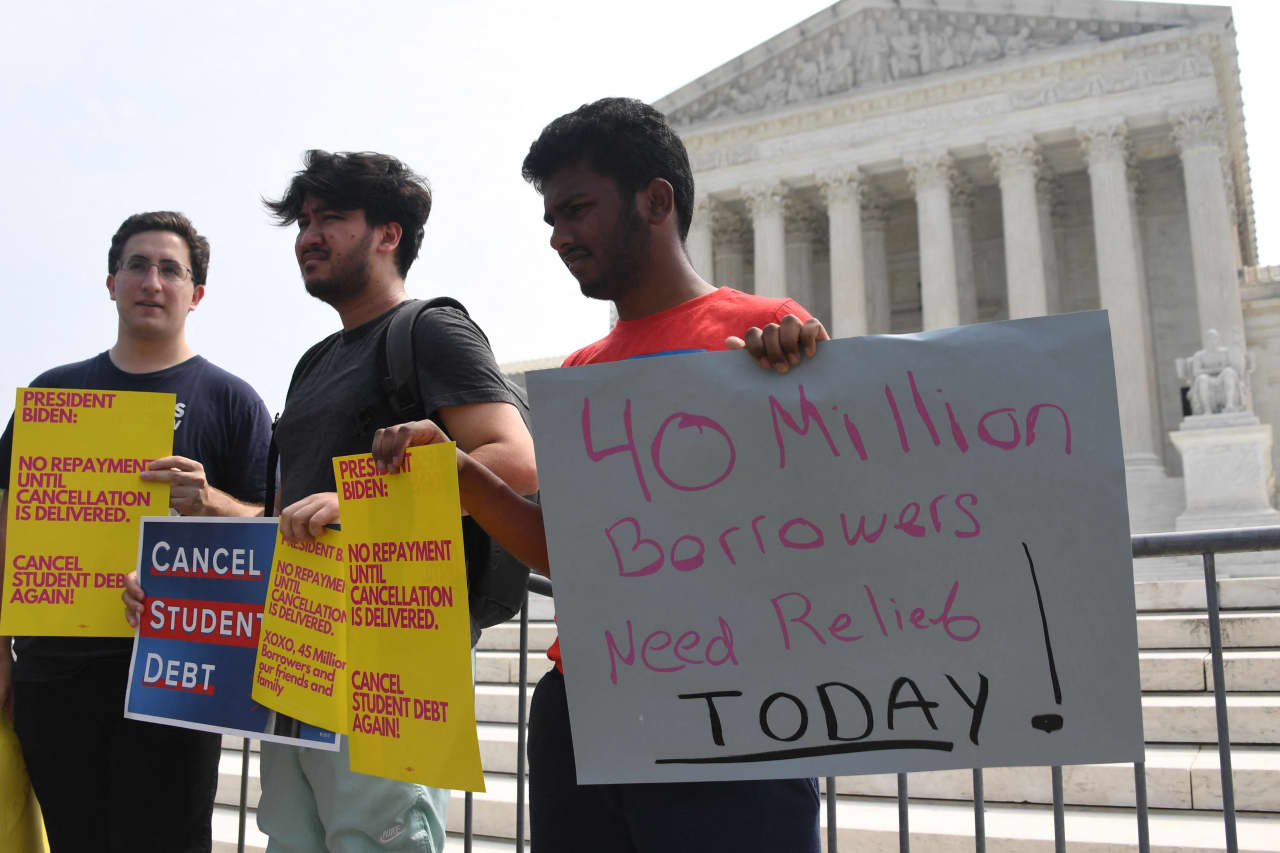

The two announcements provide the latest evidence of the hurdles borrowers faced in successfully making payments in October, as their first month's bills were due after the pandemic-era pause. Logistical hurdles, such as paperwork delays and struggles to communicate with servicers, may exacerbate the financial challenges borrowers face in repaying loans. The ministry said last month that nearly 40% of borrowers did not make their installments in October.

Both the department and student loan servicers have cited funding cuts as part of the reason borrowers are struggling to get help with their loans. Management pays servicers to manage the loan program on its behalf. Following a decision by Congress not to fully meet the department's funding request, providers reduced staffing and customer service hours.

Providers also said they were being asked to move 28 million borrowers into repayment at the same time the department launched other complex programs, a daunting task.

“It's a little difficult to finally respond to the issues that we've been warning about for months,” said Scott Buchanan, executive director of the Student Loan Servicing Alliance, a trade group. “I'm not excusing these issues, I'm saying that part of the challenge here is that structurally, if you ask a system that's not designed to do appeals all at once to have it all happen and cover that up with last-minute decisions by the government… you're going to get these kinds of issues.” “.

EdFinancial referred MarketWatch to the Department of Education for comment. Ben Keyser, a Nelnet spokesman, wrote in an email that 0.4% of Nelnet customers have missing or late billing statements. “We take seriously our responsibility to borrowers and regret any mistakes made during the exceptional circumstances of returning to repayment.”

Eileen Rivera, a spokeswoman for Maximus, Aidvantage's parent company, wrote in an email that the company takes all of its contractual obligations seriously.

“Our goal in serving the Department of Education and its nearly nine million borrowers is to provide excellent service that respects and protects the rights of borrowers,” she wrote. “When we identified this issue, we took immediate action to correct the error and prevent any future risk.”

But for borrower advocates, the chaos of the first months of repayment was predictable. They have said for years that servicers often do not provide borrowers with sufficient or correct information to successfully manage their loans.

This dynamic may be at play during the return to repayment, CFPB Director Rohit Chopra noted in a statement. “If student loan companies are cutting corners or skirting the law, it could pose serious risks to individuals and the economy,” he said.

Most borrowers experienced a wait of at least 45 minutes

The bureau found that in the last two weeks of October, borrowers waited an average of 73 minutes to speak to a representative at their service center. No matter when they called, most borrowers experienced a wait of at least 45 minutes, the CFPB said. One borrower waited 565 minutes, or more than nine hours, to speak with someone, according to the bureau's report. The long wait time means nearly 30% of calls are canceled, the CFPB said.

Borrowers are also waiting weeks for their applications for an affordable repayment plan to be approved, according to the CFPB. As part of a suite of protections to make it easier to get back into repayment, the Biden administration launched a new version of income-based repayment, a program that allows borrowers to pay off their debts as a percentage of their income for decades and then get the rest forgiven.

This new plan, called SAVE, is the most generous in history, but the CFPB report notes that a backlog of paperwork at servicers may delay borrowers' ability to sign up. By the end of October, more than 450,000 income-based repayment requests remained pending with borrower servicers for more than 30 days.

As of the end of that month, more than 1.25 income-based reimbursement requests were still pending, the office said. Across providers, the average employee working on income-driven reimbursement claims had 1,335 outstanding claims, the office said.

In addition, borrowers who were eligible to have their student loans repaid because they were defrauded by their schools received billing statements, according to the CFPB.

The Biden administration has taken steps to protect borrowers from some of the worst consequences of not paying their student loans. As part of the ramp, borrowers who default on their debts will not be reported to credit bureaus or collections for a year after the payment pause begins. In addition, Richard Cordray, chief operating officer of Federal Student Aid, wrote to credit bureaus in December warning them that borrowers' scores would be canceled for missing a payment.

The agency also directed servicers to place borrowers affected by billing errors into an administrative forbearance period — a temporary moratorium during which interest will not accrue and months count toward forgiveness under certain payment programs.

“We will not allow providers to cause harm to borrowers when they resume making their monthly payments,” Cordray said in a statement.