Even before Michael Saylor Projection With the now-immortalized phrase “there is no second best,” bitcoin maximization has been a staple of the cryptocurrency space. So much so that “crypto” itself has become an unworthy title to describe the weight and importance of Bitcoin.

For Bitcoin extremists, Bitcoin is Bitcoin and cryptocurrencies are altcoins, if not evil currencies. Now that Bitcoin is trending higher, fueled by the fourth halving hype and Bitcoin ETF approvals, Saylor's MicroStrategy is already more than $1.2 billion into unrealized profit territory.

The Bitcoin meme creator himself wasted no time visualizing the payoff from his Bitcoin maximization strategy.

With results like these on the table, it's time to examine Bitcoin maximization more closely. Is just holding BTC tokens more complicated than all the altcoin derivatives trading in the world?

Basic Beliefs of Bitcoin Maximization

In essence, Bitcoin maximization is an extension of first mover advantage. After launching the Bitcoin mainnet in January 2009, the pseudonymous Satoshi Nakamoto provided a revolutionary proof of concept. Is it possible to create peer-to-peer money in a secure way?

Can blockchain-based wealth transfers and storage resist network manipulation? Satoshi achieved this by cleverly combining cryptography with economic incentives. At its foundation lies Bitcoin's proof-of-work algorithm. It makes network participants (miners) expend computational resources when adding new transaction data blocks.

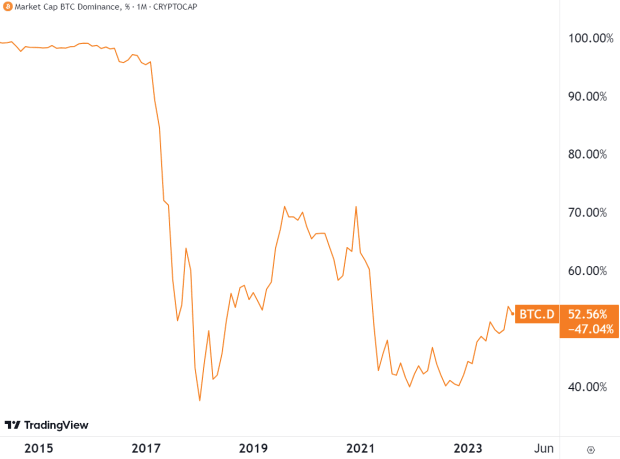

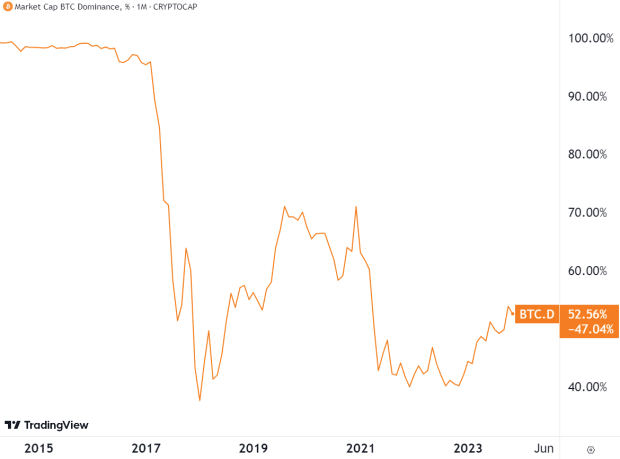

In return, miners are rewarded with BTC tokens, up to a maximum of 21 million. Because the state of the record must be agreed upon by all miners, there is no single point of failure in exploitation. It took until February 2017 for this pioneering concept to start producing altcoins, eroding Bitcoin's market cap dominance.

With eight years under its belt to get people more comfortable with the new concept, the rise of initial coin offerings (ICOs) has diversified the cryptocurrency landscape. As one of the beneficiaries of this wave, Vitalik Buterin, co-founder of Ethereum, equated the maximum dominance of Bitcoin with the maximum dominance of Bitcoin.

“It's an attitude that building something on Bitcoin is the only right way to do things, and that doing anything else is unethical.”

From this perspective, the development and consolidation of Bitcoin's maximum can be predicted:

- First mover advantage legitimizes wealth powered by blockchain technology.

- From this process comes the dominance of Bitcoin's market value.

- The dominance of Bitcoin's market cap leads to a more secure network.

- A more secure P2P money network leads to increased public trust.

- Increased public trust leads to increased mass adoption.

- Greater mass adoption leads to a rise in the price of Bitcoin, which reinforces all the previous steps.

It is then easy to see how a flood of altcoins could have the potential to disrupt any of those steps. In fact, the ICO craze of 2017 confirmed the idea that Bitcoin maximization is correct.

Specifically, Satis Group conducted a study that found that 78% of ICO projects are fraudulent. They were just an exit from liquidity scams where the project targets served as bait. This was on top of 4% of failed ICOs and 3% of dead ICOs.

However, this result was moderate compared to the catastrophic peak of cryptocurrency failure in 2022. From Terra (LUNA), Celsius, and Three Arrows Capital (3AC) to FTX, BlockFi, and others, crypto enthusiasts suffered a hit worth at least $60 billion.

Not only have altcoins become suspicious, but so has the entire corporate edifice associated with blockchain networks. In turn, these blows feed into each other, causing the price of Bitcoin to fall to $16.5 thousand, a price last seen in November 2020.

With public confidence in cryptography shaken, and an entire cycle effectively cancelled, Bitcoin purists have become more eager to point out Bitcoin's founding virtues – decentralization and self-custody.

However, even with these lessons behind us, does it make sense to prioritize Bitcoin over altcoins?

The economic rationale behind the preference for Bitcoin

Bitcoin hardliners face a difficult dilemma. There is only so much money that can be pumped into assets, including Bitcoin. This is market liquidity by reaping the first mover advantage. Bitcoin was the target of this influx for at least a decade before this wave of thousands of altcoins was born.

Now, with a market weight of $735 billion, it is very difficult to gain more weight, i.e. a higher price. When Bitcoin's price was over $50,000, Bank of America calculated that it would take net inflows of $93 million to move its price by 1%.

This translates into significantly lower percentage gains for new investors even if they fully understand Bitcoin's position as a hedge against monetary deterioration. for example:

- If someone bought 100 Sol in July 2021, they would have paid around $2,500.

- By November 2021, its value had risen to approximately $25,000.

- These 9x gains were only possible in Bitcoin's early days when its market cap was low.

Even in the most recent rally, without the Fed's money supply component, Solana investors would have received a three-fold gain in the October-November period. The same dynamic applies to a large number of other altcoins and even memecoins.

With this in mind, Bitcoin purists are taking a distinct approach, viewing Bitcoin as a major player in monetary development and not just an asset for short-term gains. An integral part of this approach is aligning technical pattern analysis with long-term strategies for navigating Bitcoin market dynamics.

The philosophical foundations of extremism

Even for people who have never purchased a single cryptocurrency token of any kind, the rapidly evolving blockchain space has provided valuable lessons in the public spotlight.

Concepts that were previously confined to the fringes of specialized economic theory have suddenly entered blockchain life: money supply, inflation rate, token economy, token allocation, vesting, burning, utility, and governance.

After that, it became easy to extrapolate these mental models to the dollar itself. Applying tokens to the US dollar, some Bitcoin lovers He even called the dollar the “ultimate currency.”

- 1 knot

- $2.3 trillion in circulation

- $33.75 trillion total supply (as owed to creditors)

- 1% of shareholders own 53% of shares (worth $19.16 trillion)

- It has lost 94% of its value over the past 100 years.

- Arbitrary adjustments in supply, leading to inflation and recession.

This is a new mental modeling made possible by Bitcoin, which was not available to the masses before. For Bitcoin purists, the pioneering cryptocurrency represents the first viable alternative to the single-node (centralized banking) system. After all, Satoshi Nakamoto launched Bitcoin as a response to central banks bailing out commercial banks with taxpayer money.

To store or transfer wealth, people no longer need to ask anyone for permission. Most importantly, there is no central entity that can weigh in on the Bitcoin network and alter its money supply. In turn, money can finally become truly private and serve as a means of saving.

In the long run, the Bitcoin cap is about not needing any stop/start ramps for Bitcoin. Instead, the Bitcoin standard will constitute a new decentralized monetary system. They envision an auditable, transparent, and defined system that eliminates the government's tendency toward corruption and war.

Meanwhile, as is currently the case in the debt-based monetary model, all fiat currencies incentivize risky investments to outpace inflation. While the Fed's desired inflation rate is 2%, Bitcoin is headed for an inflation rate of less than 1% after the fourth halving in April 2024.

At this point, altcoin proponents might say: “But hundreds of altcoins have negligible inflation rates and altcoin supplies are limited.” Bitcoin extremists have a simple response. Relying on a proof-of-work algorithm, Bitcoin is based on physicality, or as Michael Saylor put it, “digital energy.”

Practically speaking, anyone can clone altcoins, which are then subject to the influence of the capital network (stake), which accumulates with further staking. Likewise, one can clone the open source Bitcoin code. However, this is completely irrelevant because Bitcoin is secured by network power, not capital. One leads to centralization, the other does not.

Conclusion

Bitcoin is unique in that it is not tied to any organization or person. The same cannot be said for its opposing army of altcoins, starting with Ethereum. The cost of this decentralized flexibility is paid in energy rather than equity. This has been the controversial source of countless articles and statements by politicians attacking Bitcoin's energy use.

However, even these environmentally oriented pressures appear to have lost their strength. Can anyone really say what the fair price for financial sovereignty is? Given this horizon, Bitcoin hardliners are more focused on escaping the central banking system than on short-term altcoin gains.

Although some extremists view all altcoins as a wasteful distraction on this path, Bitcoin will certainly be integrated into the altcoin ecosystem. Ultimately, incentives create the blockchain landscape on their own regardless of opinions.

This is a guest post by Shane Nagle. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.