The SEC has been busy, meeting with all potential issuers of spot bitcoin ETFs with active orders in December. These meetings have resulted in the global adoption of cash creation methodology by these issuers rather than “in-kind” transfers, as is the case for other ETFs. Much has been said about this change, ranging from the silly to the serious. However, the overall impact of a TLDR would be minimal to investors, relatively meaningful to issuers and reflects poorly on the SEC overall.

In order to provide context, it is important to describe the basic structure of exchange-traded funds. All ETF issuers deal with a group of Authorized Participants (APs) who have the ability to exchange either a pre-determined amount of fund assets (stocks, bonds, commodities, etc.), a specified amount of cash, or a combination of both, for a fixed amount of shares. ETF for a pre-determined fee. In this case, if “in-kind” creation is allowed, a fairly typical unit of creation would be 100 BTC for 100,000 shares of the ETF. However, when creating cash, the issuer will be required to deploy the amount of cash, in real time as the price of Bitcoin changes, to obtain, in this example, 100 Bitcoin. (They must also publish the amount of cash for which 100,000 ETF shares can be exchanged in real time.) The issuer is then responsible for purchasing 100 bitcoins until the fund is in compliance with its covenants or selling 100 bitcoins in the event of a redemption.

This mechanism applies to all ETFs and, as is obvious, means that claims that cash creation means the fund will not be 100% supported by holding Bitcoin are false. There may be a very short delay, after creation, as the issuer has not yet purchased the Bitcoin they need to obtain, but the longer this delay, the greater the risk the issuer may take. If they need to pay more than the quoted price, the fund will have a negative cash balance, which will reduce the fund's net asset value. This will of course impact their performance, which is likely to hurt issuers' ability to grow their assets, given the number of competing issuers. On the other hand, if the issuer is able to purchase Bitcoin for less than the cash deposited by the APs, the fund will have a positive cash balance, which may improve the fund's performance.

Thus, one would expect that issuers would have an incentive to price the cash price much higher than the actual trading price of Bitcoin (and the redemption price lower for the same reason). The problem with this is that the wider the spread between the cash amounts for creation and redemption, the wider the spread that access points in the market are likely to quote to buy and sell shares of the same ETFs. Most ETFs trade on very tight spreads, but this mechanism may mean that some versions of Bitcoin ETFs have wider spreads than others and wider overall spreads than when created “in-kind”.

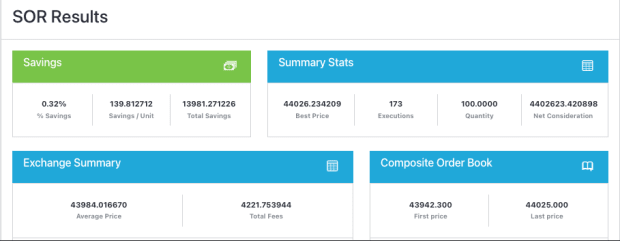

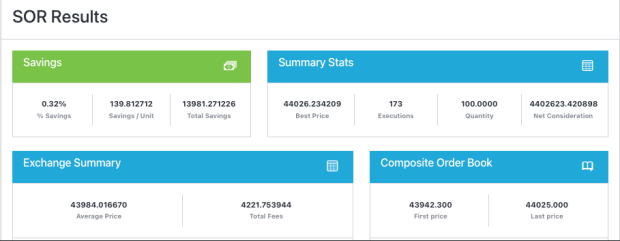

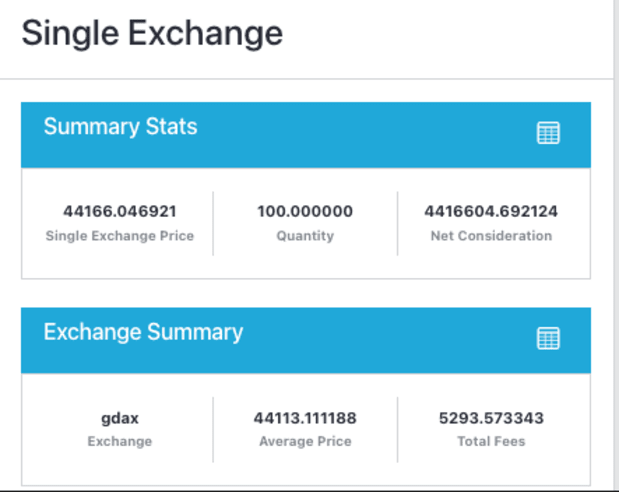

Therefore, issuers must balance the goal of setting a tight margin between origination and redemption cash amounts with their ability to trade at or better than quoted amounts. But this requires access to cutting-edge technology to achieve. As an example of why this is true, consider the difference between pricing 100 Bitcoin based on liquidity on Coinbase alone, versus a strategy using 4 exchanges regulated in the US (Coinbase, Kraken, Bitstamp, and Paxos). This example used the CoinRoutes cost calculator (provided by the API) which displays both the cost of an individual exchange or any custom group of exchanges to trade based on the full order book data held in memory.

In this example, we see that the total purchase price on Coinbase alone would have been $4,380,683.51, but the purchase price across those four exchanges would have been $4,373,568.58, which is $7,114.93 more expensive. This equates to a 0.16% increase in expenses to purchase the same 100,000 shares in this example. This example also illustrates the technological hurdle faced by issuers, as the calculation requires traversing 206 individual combinations of market/price levels. Most traditional financial systems don't need to look beyond a set of price levels, as Bitcoin's hashrate is much larger.

It is worth noting that major issuers are unlikely to choose to trade on a single exchange, but it is possible that some will do so or choose to trade over-the-counter with market makers who will charge them additional spreads. Some will choose to use algorithmic trading providers such as CoinRoutes or our competitors, who are able to trade at a lower price than the quoted spreads on average. Whatever they choose, we do not expect all issuers to do the same, which means there will be potentially significant variation in prices and costs between issuers.

Those who have access to superior trading technology will be able to offer lower spreads and superior performance.

So, given all the difficulty issuers will endure, why has the SEC effectively mandated the use of cash creation/redemption. The answer, unfortunately, is simple: Access points, by rule, are broker-dealers regulated by the SEC and SROs like FINRA. However, to date, the SEC has not approved regulated broker-dealers to trade spot bitcoin directly, which they would have to do if the operation were “in-kind.” This reasoning is a much simpler explanation than various conspiracy theories I've heard, and it's not worth repeating.

In conclusion, spot ETFs would be a huge step forward for the Bitcoin industry, but the devil is in the details. Investors should research the mechanisms each issuer chooses to quote and trade in the creation and redemption process in order to predict which ones may perform best. There are other concerns, including custodial trades and fees, but ignoring the way they plan to trade could be a costly decision.

This is a guest post by David Weisberger. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.