Image source: Getty Images

I do not have unlimited reserves of capital that I can use to invest. But here are two great dividend stocks – one of which is a very high-priced little stock – that I would buy for my portfolio if I had cash to spare.

I think they can provide a healthy second income for years to come.

Central Asian Minerals

Investing in mining stocks can be a wild ride. Even the best producers of raw materials can withstand a collapse in profits when commodity prices fall. the Central Asian Minerals (LSE:CAML) for example, (LSE:CAML) share price fell last summer as industrial metals prices came under pressure.

But I still buy this mining company for my stock portfolio today. This work – it is listed in London alternative investment market (Goal) – produces copper from Kazakhstan. It also has lead and zinc producing assets in North Macedonia.

I love this particular work because of its impressive track record of production. The mining giant beat production estimates again in 2022 at its Conrad copper project after another record year. Central Asian Minerals also produces minerals at a very low cost.

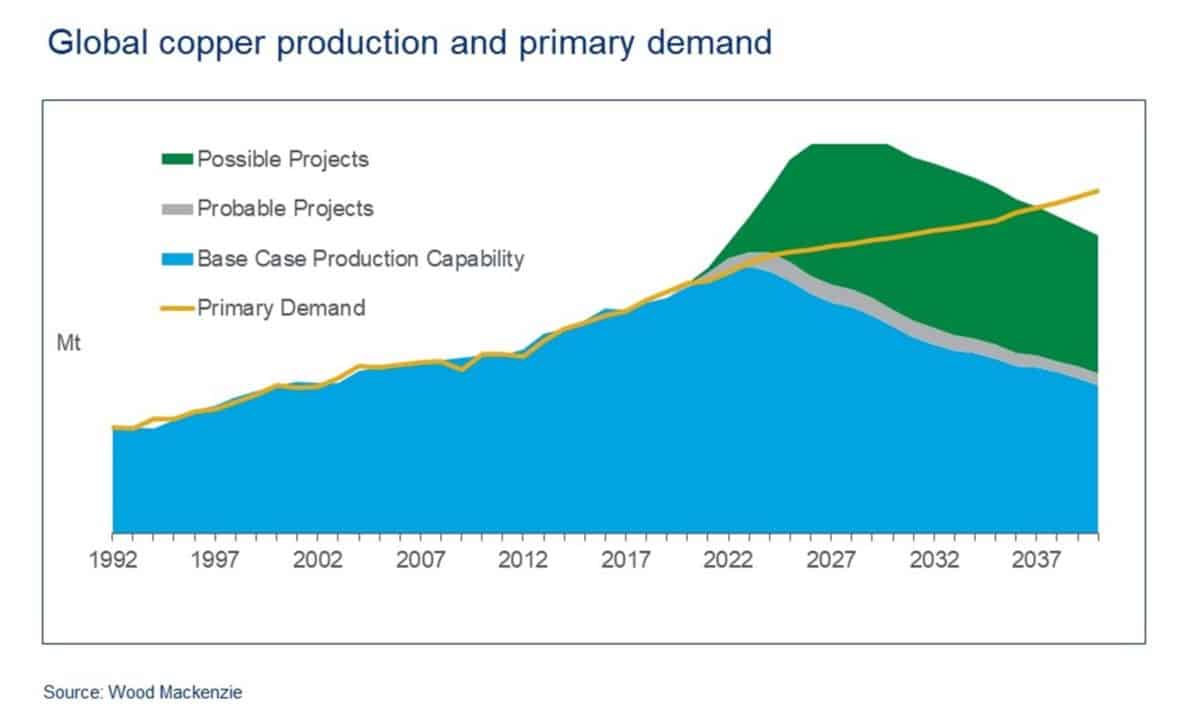

I think earnings here could pick up later in the decade if a potential supply shortage arises and base metals prices rise. The chart below from Wood Mackenzie shows how demand for copper, for example, could be on track to outpace future production. Trends such as increasing urbanization and energy transition will increase demand for the red metal.

I also think Central Asia Metals is the highest dividend income stock. Today it carries a dividend yield of 7%. I think this is too big to ignore.

Brickability group

Investing in penny stocks can be a great idea for growth-hungry investors. But many of the smaller British stocks can also be great passive income investments. This is where the product manufacturer builds Brickability group (LSE: BRCK) is coming.

As the name suggests, this AIM stock makes its money mostly selling bricks. Sales volumes for these vital components tend to rise as the home building activity picks up in Britain (the government has a target of 300,000 new homes being built each year).

In fact, trading in Brickability is already quite impressive. announced last week that itIt continued to deliver strong performance across all divisions of its businesss” and raised its profit forecast for the year. This is even as the housing market is experiencing near-term softness due to rising mortgage costs.

I also expect a strong repair, maintenance, and improvement (RMI) market to support strong earnings growth in the company. The United Kingdom has one of the oldest housing companies in the world. This means that constant modernization is required to stop the country’s homes from collapsing into dust.

Now let’s look at Brickability’s earnings forecast. For the fiscal years ending March 2023 and 2024, the dividend yield was high, at 4.5% and 4.7%, respectively.

Making bricks is an energy-intensive process. So buildability earnings could suffer if oil and gas prices rise again. But overall, I think this small stake can be a great way to make an excellent dividend income.